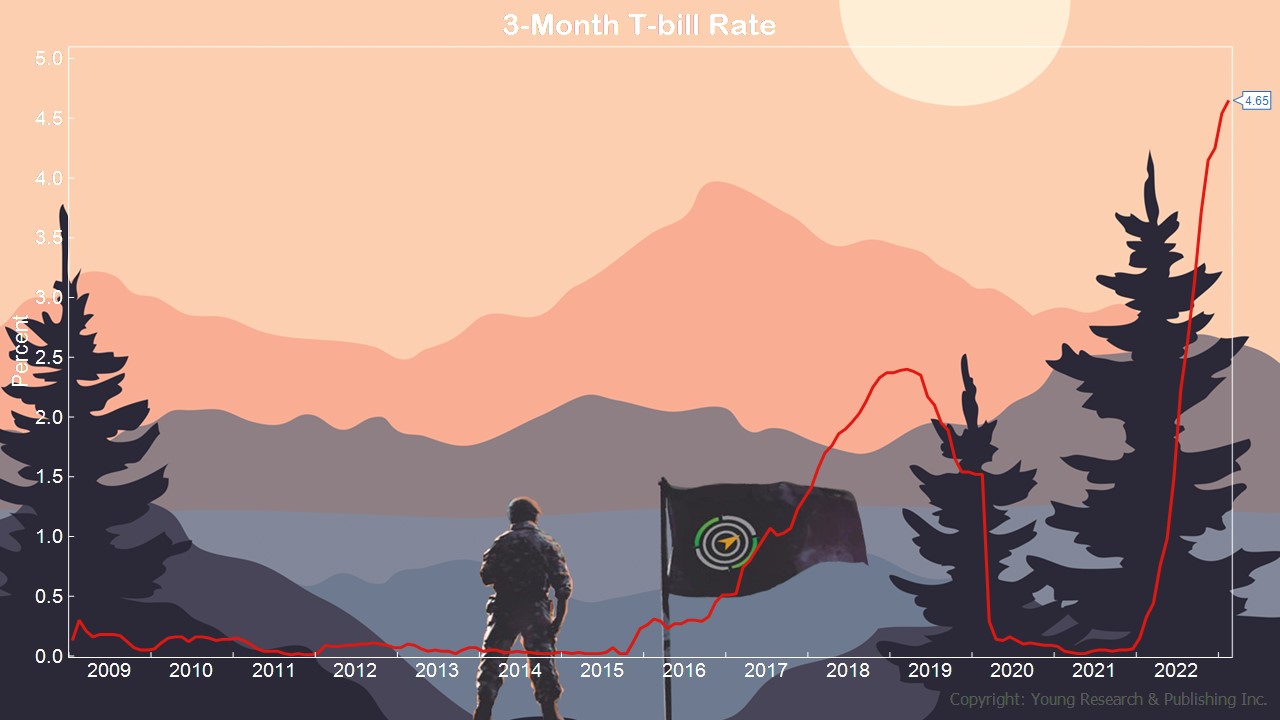

Happy Monday. A perfect day for some tough love. Your Survival Guy read an article over the weekend showing the savings and investments of some retirees. Here are their annual spend rates based on my back-of-a-napkin math: 12.6%, 15.8%, 10.5%, and 2.5%. The first three are terrifying. The fourth one’s OK. When Dick Young’s North Star (the 3-month T-bill rate) is at 4.652%, where do they think the returns are coming from?

If you’re a highly successful person, you’ve developed Your Survival Guy’s favorite habit: Saving. Right there, in one word. You’ve learned to do without, to save ‘til it hurts, and do something that’s hard and not much fun. Not much fun, that is, until you have a huge pile of money. Then it’s a lot of fun. Yes, money can buy you happiness.

A quick detour. Investment manager Steve Leuthold passed away last week at the age of 85. As the WSJ notes, he was known among friends as a tireless party animal who owned a bar near Minneapolis, invested in a brewery, and married three times, including once in a saloon. At his summer home on Bailey Island in Maine, he grew potatoes.

“In early 2009,” explains the WSJ, “Mr. Leuthold correctly forecast that the U.S. stock market was nearing a recovery from its wipeout during the financial crisis. The S&P 500 index soared about 65% from March 9, 2009, to the end of that year.”

Your Survival Guy comment: Note the value in not missing the boat and having a plan you can stick with through thick and thin.

“You don’t have to be right all the time. You just have to be willing to move defensively when you think the risks are high,” he told MarketWatch in 2011. “But most investment organizations don’t allow it—they force managers to be fully invested all the time—and most investors can’t do it because they are afraid of missing out while things still look good.”

Your Survival Guy comment: Start defensively. Begin by seeking return of assets (not return on assets). It’s my belief that if investors focused on downside protection first, they wouldn’t have to “move defensively” to begin with.

Action Line: If you’re fairly wealthy, chances are you’ve figured out the savings side of the equation. But keeping your wealth is another game. Don’t learn the hard way that you’re spending too much or that you weren’t defensive enough. I’m here if you need me.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.