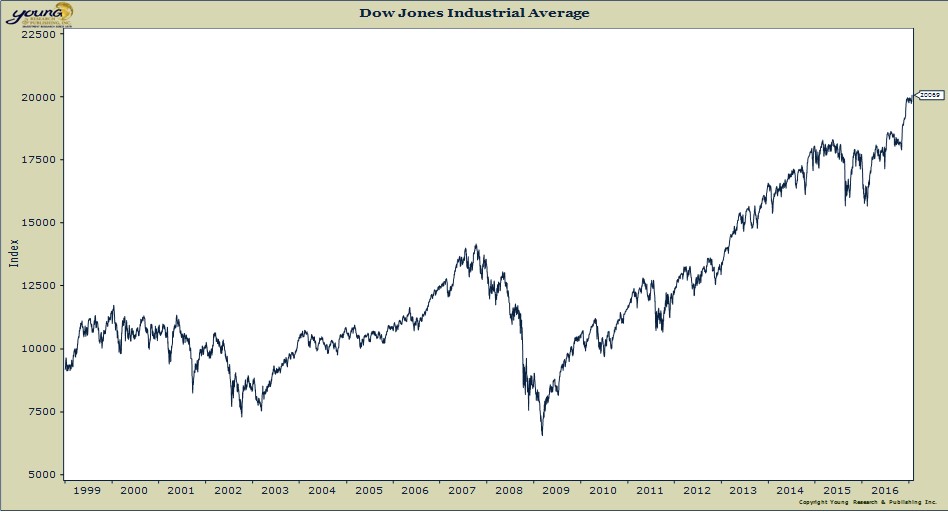

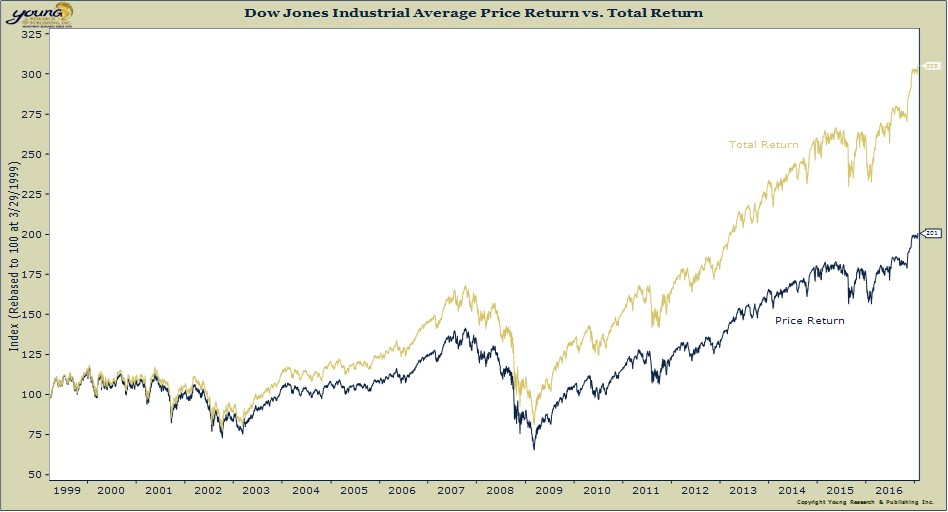

Yesterday, the Dow hit 20,000 for the first time. I remember vividly when the index hit 10,000 back in 1999 (Chart 1 below). Dow 20,000 took 17 1/2 years—a 4.2% compounded annual return, not including dividends. And that’s the key—not including dividends. Because for those of us that have been dividend-centric investors, the road from 10,000 to 20,000 has been a whole lot smoother. In fact, while the index has returned 101% from March 29, 1999 when it first hit 10,000 in price terms, when dividends are included, the total return becomes 205% (Chart 2 below). In other words, more than half of the return for investors during that time was delivered by dividends.

When the market is expensive, much like it is today, dividends should be your focus. Not only dividends, but consistent and reliable dividend increases. Both are the bedrock of Young Research’s Retirement Compounders common stock portfolio.

If stocks are expensive today, do you sell? No. It simply means you hope for the best but prepare for the worst. Dividends are for your long-term survival. Will Dow 30,000 be next? Or, will we revisit Dow 15,000? I don’t know the answer, but what I do know is that I want you to get paid to be invested in this market in the form of dividends and dividend increases. Your survival may depend on them.