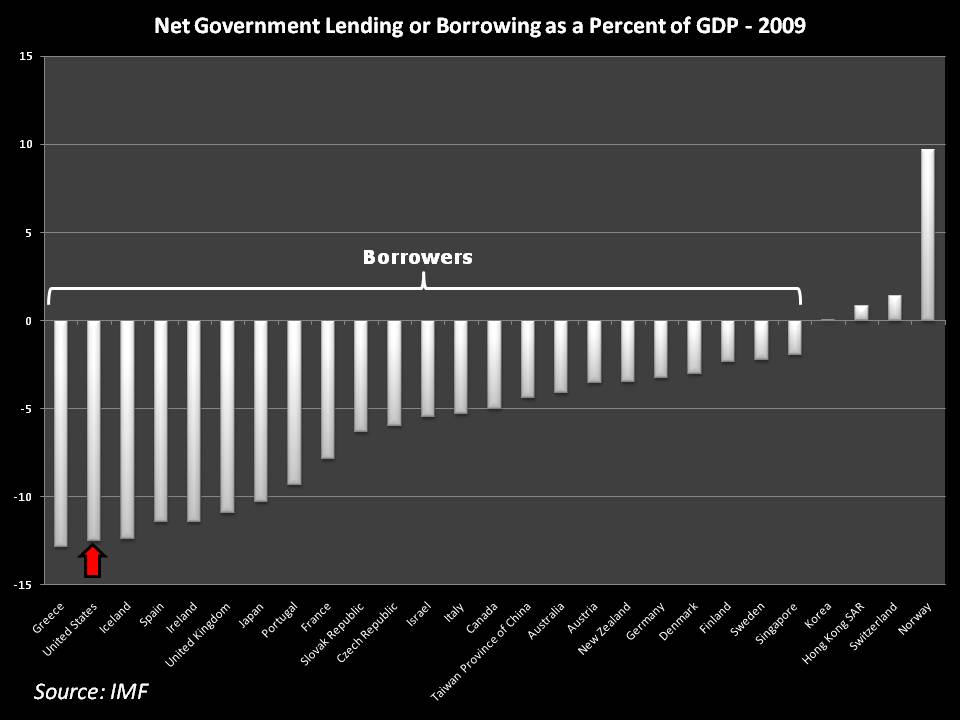

Take a look at this chart. It’s a chart of the net lending or borrowing (borrowing in the case of the United States) that an assortment of countries did during 2009. Look at where the U.S. is on the graph (highlighted with a red arrow): second-highest borrowing, after Greece.

Unless you’ve had your head under a rock for the past year, you’ve heard that Greece can’t pay its debts without firing its nurses, teachers, dog catchers, and mailmen. Even mobsters with no-show jobs are getting laid off in Greece. It’s bad.

Sandwiching the U.S. to the right on the graph is Iceland. Again, you’ve probably heard that Iceland’s debts destroyed its economy, government, and real-estate market. To add insult to injury, they now have a volcano spewing ash all over their country.

The next five countries on the list are Spain, Ireland, the United Kingdom, Japan, and Portugal. That’s a rogues’ gallery of economically depressed nations with near-zero hope of recovery in the near future.

So the U.S. borrows almost as much as Greece, and borrows even more than the debt-ridden crew just mentioned. The current administration, and the previous one, have done nothing to stop this slow-motion train wreck from happening. More debt, two wars (which are still being fought—where are the anti-war protesters now?), Obamacare, TARP, a stimulus package that didn’t stimulate anything but more government spending, Fannie Mae and Freddie Mac bailouts, GM and Chrysler bailouts, an AIG bailout, and enough pork to make you sick have all been piled on U.S. citizens. The situation is simply unsustainable. When are America’s leaders going to face the facts? How much time does America have before it ends up like Greece, or worse yet, Iceland?