At Mcleod Finance, Alasdair Macleod discusses the risks of high rates on fiat currencies. He writes:

It is gradually dawning on markets that lower dollar interest rates are a fantasy. But higher rates will destabilise fiat currencies.

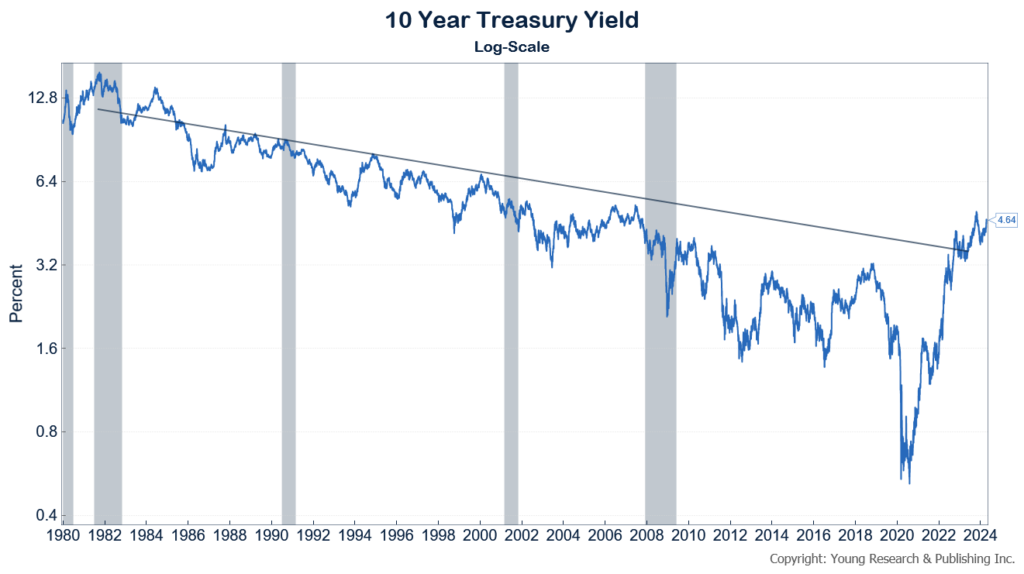

If a chart speaks a thousand words, this is it:

From its peak at about 15% in the early eighties, the trend for US bond yields was down for forty years. When the yield soared through 2.8% in April 2022 (yes, only 2.8%) alarm bells should have been ringing. When it turned down from 5% last October, investors heaved a sigh of relief and then expected interest rates and bond yields to decline: inflation was over.

However, between October and February the monthly inflation rate continually increased (it paused in March at the February rate). Importantly, last month Larry Summers headlined a join report between Harvard and the IMF which came out with a CPI recalculation to include financing costs, stating that in 2022 CPI inflation hit 18%. Those financing costs are still there, so the current official estimates of 3.4% understate it massively.

Of course, if the Fed cut its funds rate and the banking system followed, the inflation rate based on Summers’ calculation would fall. But that’s not what the Fed is watching. It sees commodity and energy prices rising again. Gasoline, a significant CPI component is rising particularly strongly up 14% this year. But as a mutual friend in the IMF who knows Summers well observed to me, it is amazing how he is ahead of the curve when a change in policy is about to happen. And he is saying that inflation is still a problem, contradicting markets.

So yes, the chart above of a thousand words is not to be ignored, and we are seeing that the super-tanker determining global interest rates is on the turn towards higher rates. Expectations of lower rates are being continually deferred and might not even happen. And Summers has been ramming the message home that the Fed should not reduce interest rates in a series of Bloomberg interviews.

Read more here.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.