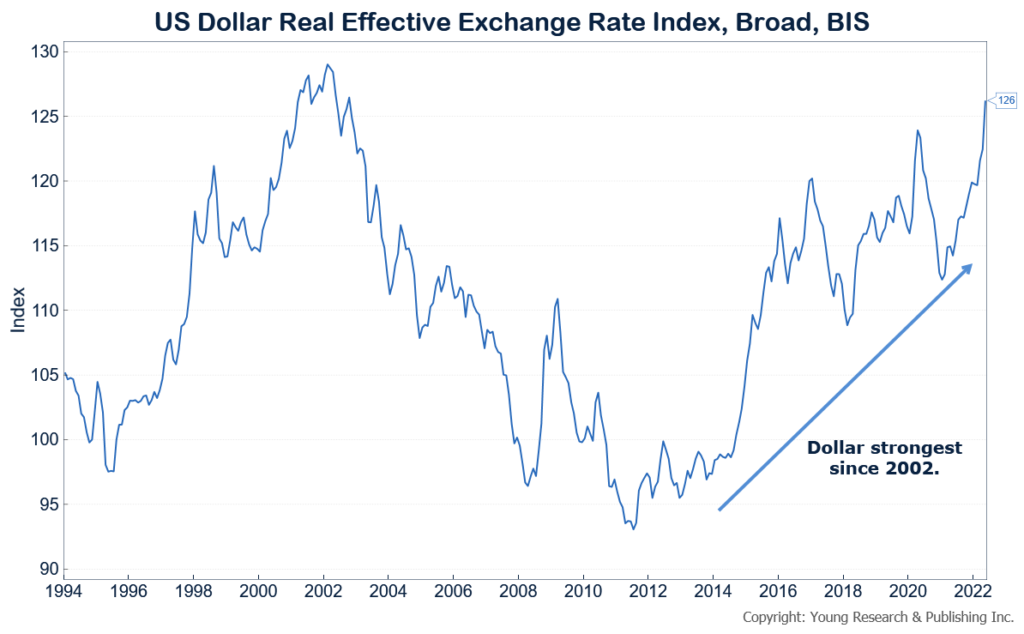

The dollar’s current status as the “least bad” currency continues to push its value higher relative to others. The euro and yen are both suffering from central bank policies that have kept rates low despite inflationary pressures. The Wall Street Journal’s Julia-Ambra Verlaine reports (abridged):

After the U.S. currency’s strongest first half in over a decade, investors sheltering from falling stocks and betting on U.S. economic resilience have helped power a continued rapid ascent. The WSJ Dollar Index, which measures the dollar against a basket of 16 currencies, hit a new 20-year high last week and is up nearly 2.5% this month. The euro traded below parity with the dollar for the first time since 2002, and the Japanese yen is depreciating to lows unseen since the end of the 20th century.

Asset managers have been betting the Federal Reserve will do whatever it takes to stop rising consumer prices. Following another hot inflation reading last week, the Fed is likely to raise rates by another 0.75 percentage point later this month. Although not as bold as a full percentage-point move as some feared, the gap will continue to widen between U.S. rates and those in Europe or Japan. This could attract more yield-seeking investors to the currency.

The dollar’s strength is a double-edged sword for U.S. consumers and businesses. It boosts purchasing domestically but weighs on multinational firms’ revenue. Microsoft Corp. cut earnings guidance in June, after saying in April that the strong dollar had reduced its revenue by around $300 million in the first three months of the year.

…

The ECB and the Bank of Japan have kept easy-money policies in place, lagging behind the Fed and other countries that are rapidly tightening borrowing conditions to tamp down inflation. The Bank of Canada surprised investors Wednesday by raising its policy rate by a full percentage point.

Hedge funds are betting against the euro, which has dropped nearly 15% against the dollar over the past year due in part to Russia’s war in Ukraine and related energy and inflation problems. Depository Trust & Clearing Corp. data show rising volume in options that pay out when euro declines accelerate.

“The foreign-exchange market is in the process of discounting a severe European recession,” said Stephen Gallo, European head of foreign-exchange strategy for BMO Capital Markets.

The yen has continued its decline, falling around 20% against the dollar over the past year. The Bank of Japan has pledged to continue its low-interest-rate policies, including control over the difference between short- and longer-term bond yields, known as the yield curve, despite signs of inflation.

“With the Bank of Japan not expected to act on rates or its yield curve target soon, the yen’s performance will depend on moves in U.S. yields,” said Shaun Osborne, a currency strategist at Scotiabank.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.