“How much should I invest in stocks?” It’s a good question. One you might be thinking about.

Sure, when you’re working, it’s easy to invest in stocks because you have a paycheck to lean on like a crutch.

But what if you’re retired with no paycheck, living on a fixed income? Investing in stocks can be downright scary. The good news is stocks have historically been good inflation fighters.

But how much to invest? You’ve seen the brutal corrections so far this century. And chances are there will be more. “So, Survival Guy, how much do we invest in stocks?”

When speaking with prospective clients, we talk about a back-of-the-napkin allocation. You don’t need some fancy report that an algorithm spits out in seconds yet charges you by the hour. What this needs to be is an exercise in understanding. In other words, understanding Y-O-U.

You are the key to asset allocation. It is one of the most impactful investment decisions you’ll ever make. Period. And too often, not enough time is spent actually understanding it.

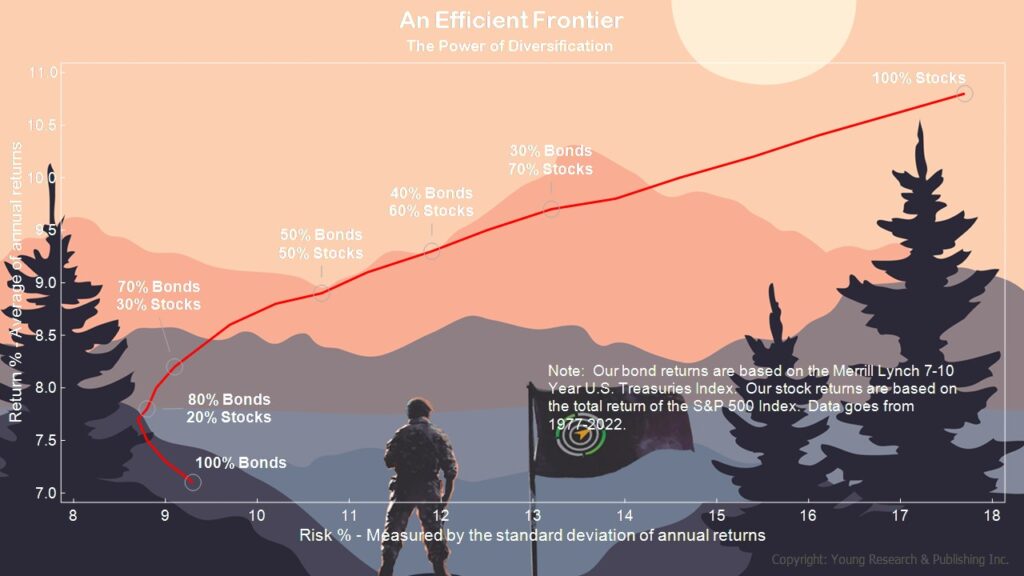

And this is not a one-size-fits-all endeavor. Your needs are specific to you. As the great Ben Graham pointed out, a mix of stocks and bonds between 70-30 or 30-70—somewhere along the efficient frontier (Your Survival Guy’s words)—is where you want to be.

A place where you can live with the peace of mind and comfort you deserve.

Action Line: When you’re ready to talk about your efficient frontier, let’s talk.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.