Investors have a short-term memory. They forget about the disasters. Because they read, and read, and read in search of the next big thing. And they think they have found it. And then, poof, the black swan swoops in, and those gains are washed away with the tide.

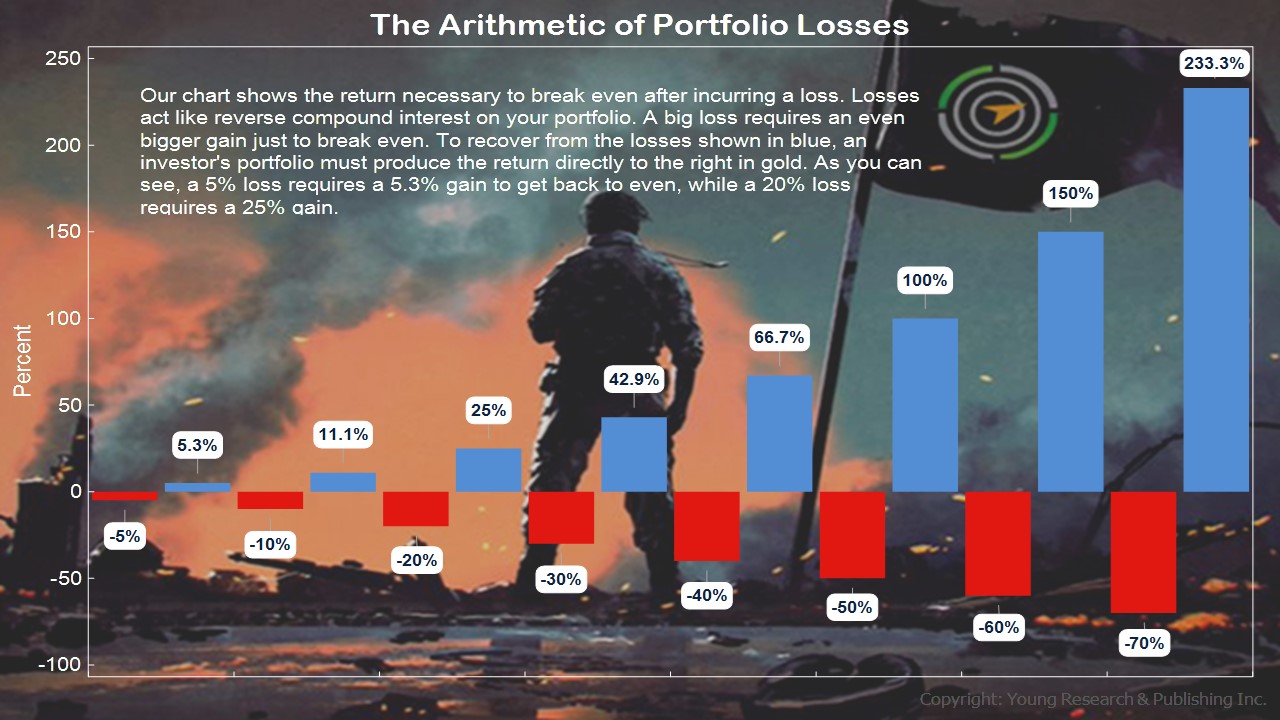

Luckily for you, you have Your Survival Guy to remind you of how brutal markets can be. Take last year, for example. Everyone’s talking stocks again. But dig a little deeper, and we have an important lesson playing out in real-time. I’m talking about the arithmetic of losses. Lose 50%, and you need a 100% gain to get back to where you started.

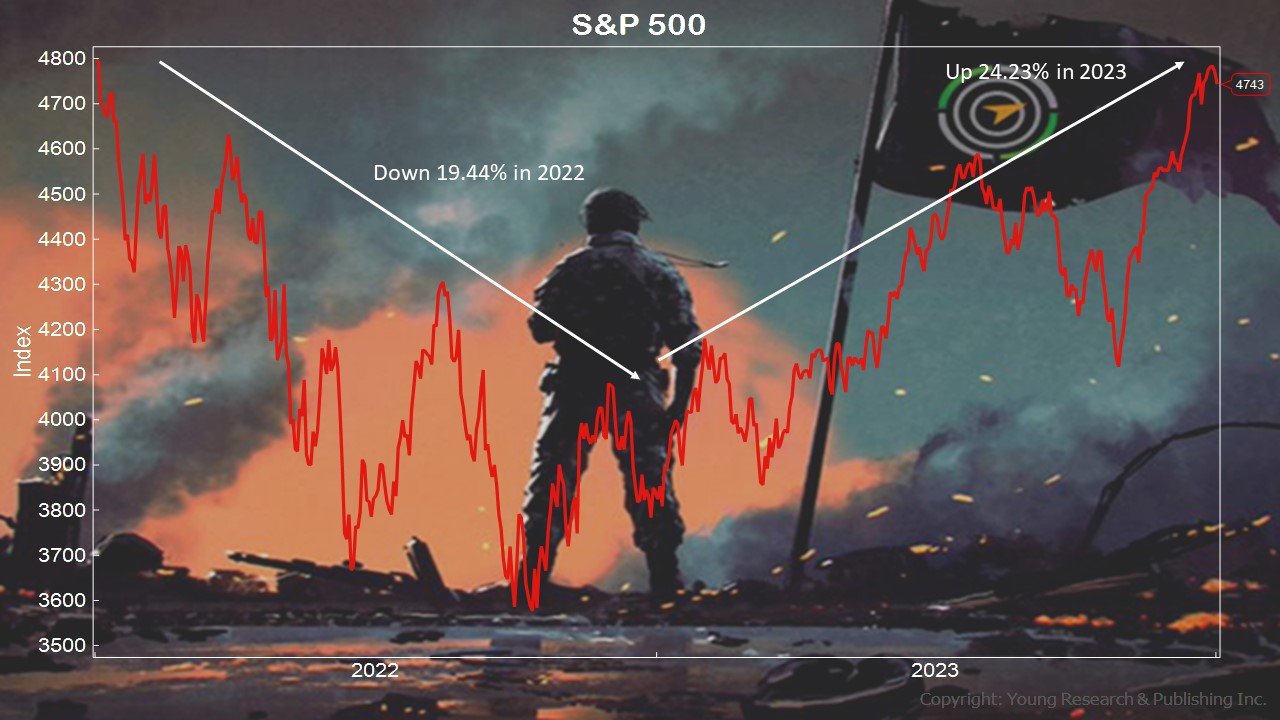

If you look at the past two years in the S&P 500, you’ll note this recent year was simply making up for lost ground from two years ago.

Yes, over long periods of time, stocks have historically done well. Note the key word historically. My interest isn’t predicting what’s going to happen this year or next year with stocks. No, my focus is on you and your retirement years. They’re golden. But they go by fast, and when the tide goes out, the lost money isn’t as easy to get back as it once was. Without a job, it gets scary. How many investors bailed out when the going got tough in 2022 and missed the boat on the rebound? It happens all the time.

Investors tend to look at how much they “need” to retire comfortably and push it too far. They plug in numbers to models and programs and calculate how much they’ll be “worth.”

It has been my experience that investors do not know how much they can handle “losing” (perhaps temporarily; perhaps not). Risk tolerance soon becomes intolerance in times of trouble, and plans are destroyed. Happy New Year? We’ll see.

Action Line: Make sure you focus on return of assets first. I’m here when you’re ready to get serious.

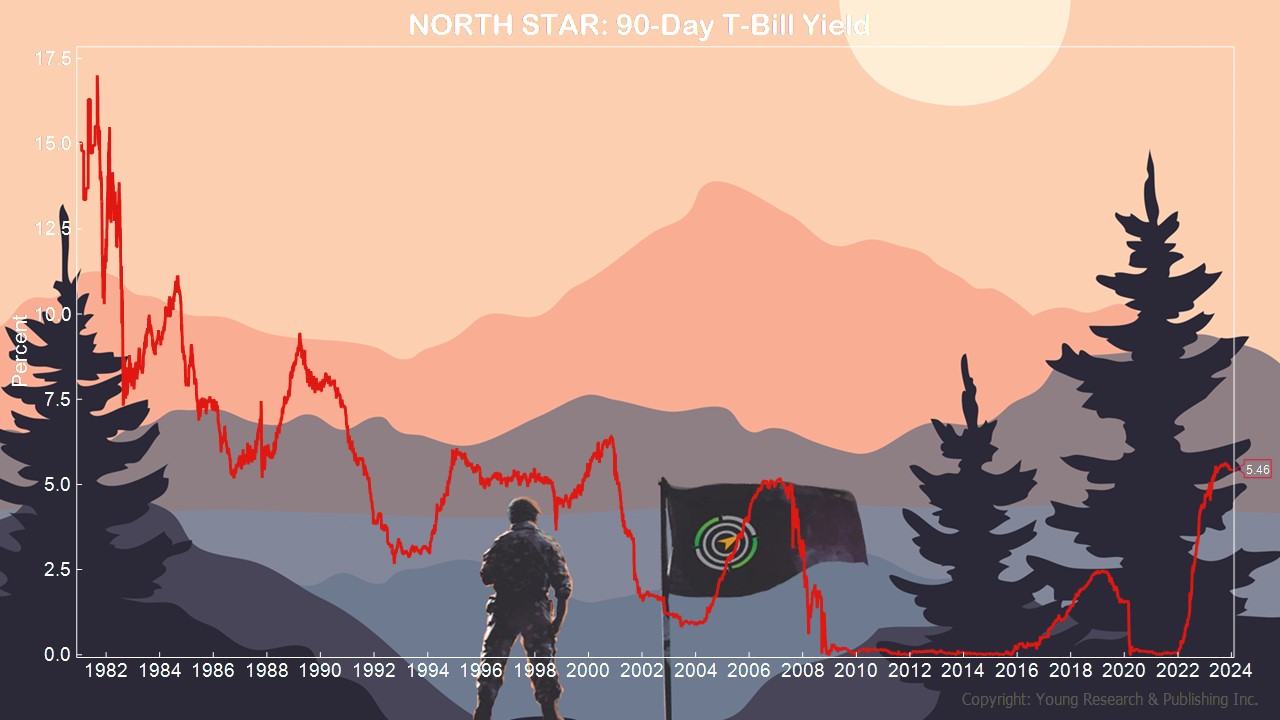

P.S. You can sink your teeth into these risk-free yields.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.