In a recent interview on CNBC, Senator Elizabeth Warren provided an unlucky group of viewers with her take on the GOP tax plan. Warren’s unhinged analysis of the GOP tax plan (not perfect by any means), was a discordant reprise of her days storming backyards in Massachusetts and upbraiding entrepreneurs with, “You didn’t build that.”

Perhaps Warren’s biggest fairy tale is the accusation that the tax cut is a $2 trillion giveaway to the big corporations. Giveaway? There are no giveaways to big business in the GOP tax bill. Today’s effective tax rate of America’s 500 largest companies is only about 24%, not much higher than the 20% proposed in the GOP tax plan.

Big business loves high tax rates because it allows businesses to hire the teams of lobbyists, lawyers, and accountants needed to navigate the tax code, write loopholes, and pay the absolute minimum.

If Warren were not so busy throwing out red meat on the cable news networks, she would know this. Her own campaign website tells voters: “We all know the tax code is unfair and far too complicated. The statutory corporate tax rate is 35%, but it seems like every few months there’s a new report on big corporations working the system. One recent report showed that, of the big corporations in the S&P 500, 115 paid less than 20% in taxes. Another report claimed that, of 280 of the biggest corporations in the country, 78 paid nothing in taxes during one of the last three years. How is this possible? An army of lobbyists helps create tax loopholes, and an army of lawyers helps these companies take advantage of them – and it’s all perfectly legal. What does that mean for the rest of us? Small businesses are at a competitive disadvantage. We need serious tax reform to make the tax code fairer and simpler.”

Small businesses create 2 out of 3 jobs in America. Corporate tax cuts are about putting America’s job creators on a level playing field with big business and foreign competitors. Even a Marxist-influenced Harvard professor should be able connect the dots between corporate tax-cuts and economic prosperity.

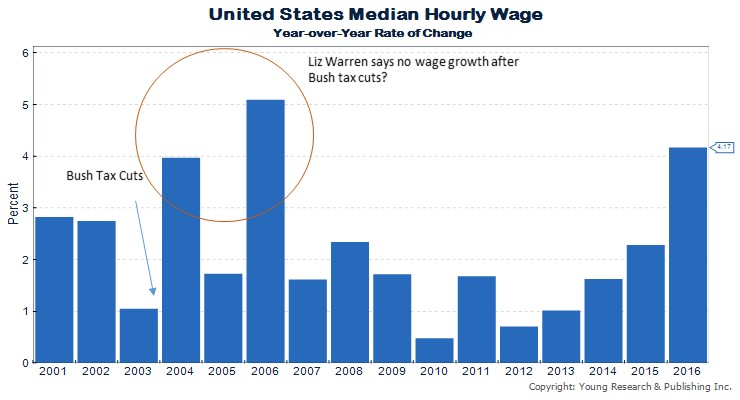

As she went on, Warren attacked the idea that corporate tax rate cuts would help the middle class. Wages had fallen, she claimed, after the Bush tax cuts and after corporate tax cuts in the U.K. Correlation may not be causation, but the chart below shows healthy pops in median hourly wages in the years following the 2003 Bush tax cuts. As for Warren’s assertion that corporate tax rate cuts held back wage growth in Britain? That notion has been best debunked here.

Despite her mistakes on the effects of corporate tax rates, Warren believes she has the answer. Rather than lower rates for millions of job creators, the senator would rather double-down on the income redistribution fantasy of the far-left. Warren proposes paying off all student loan debt or giving every family making less than $200k a $17,000 gift. You can predict the outcome there: bigger deficits, greater dependency on government, less economic vitality.

Hard to imagine how the people of Massachusetts, the most educated state, could elect such an economic illiterate to office.