U.S. Army Soldiers with the National Guard secure an area near the U.S. Capitol in Washington, D.C., Jan. 20, 2021. National Guard Soldiers and Airmen from several states have traveled to Washington to provide support to federal and district authorities leading up to the 59th Presidential Inauguration. (U.S. Air National Guard photo by Master Sgt. Matt Hecht)

How much information do you want big tech to have on you? With big data forming a virtual Panopticon, how much of your life is for sale? Probably not any of it as far as you’re concerned. Isn’t the foundation of our Republic all about keeping big government and others out of our lives? Of course, it is. Leave us alone.

But, when you see the steel walls surrounding the Capitol building in D.C., you realize your elected officials are protecting themselves from you. They’re scared of you. They want to control you to protect their power.

And it’s not getting any better. There has to be a way forward. How do we take back what is ours? Is repealing Sec. 230 the answer? An army of lawyers will fight tooth and nail to protect it. How about antitrust suits where the big guys simply end up becoming an army of lots of powerful little guys? Same result.

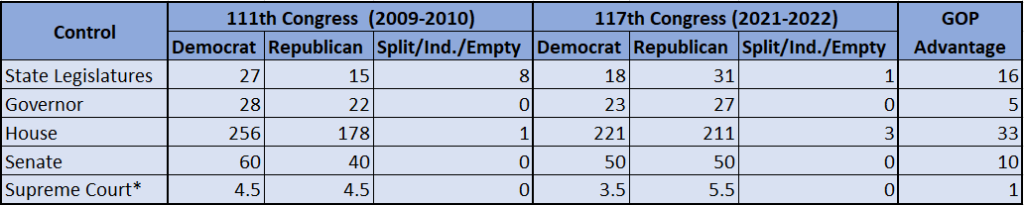

The clearest way forward is from the ground up. It starts with you, and it ends in the state in which you live. I want you to be in control of your life. Do your elected officials wish the same for you? Consider your state rights, because clearly, we’re gaining some ground here.

And now we have New Hampshire, the live free or die state, leading the charge against Massachusetts. The WSJ Editorial Board writes:

Can a state collect income tax from nonresidents working remotely for in-state businesses? Massachusetts, New York and some other states claim they can, and now New Hampshire is asking the Supreme Court to protect its citizens from this tax grab.

Tens of millions of Americans have been working from home during the pandemic, including an estimated 2.1 million who used to commute to the office across state lines. Enter Massachusetts, which in April adopted an emergency regulation declaring that nonresidents employed in the state before the pandemic must still pay its 5% income tax even if they are working remotely.

Most states tax only income earned—proportional to their employment activities—within their borders. So a hedge-fund manager who splits his time equally between offices in Fairfield, Conn., and Miami only has to pay Connecticut income tax on half his salary. The same rule applies for athletes, consultants and other professionals.

However, five states besides Massachusetts (New York, Pennsylvania, Delaware, Arkansas, Nebraska) tax nonresidents working at home. New York requires nonresidents who telecommute for an in-state employer to pay its income tax unless “necessity, as distinguished from convenience, obligate the employee to out-of-state duties.”

If an employee of a New York-based firm chooses to work most days from home in another state, New York still taxes him as if he worked the entire day in Manhattan. In October state tax regulators said there would be no pandemic exception for nonresident telecommuters unless their employer “established a bona fide employer office at [the] telecommuting location.”

So unless Goldman Sachs sets up a satellite office in its bankers’ vacation homes, they will still have to pay New York taxes as long as they work remotely. Welcome to Hotel New York—you can check out but never leave.

New Hampshire, which imposes no income tax on wages, last fall sued Massachusetts and is asking the Supreme Court to hear its case (N.H. v. Mass.). “Massachusetts has unilaterally imposed an income tax within New Hampshire that New Hampshire, in its sovereign discretion, has deliberately chosen not to impose,” says the Granite State.

What right does Massachusetts have to tax New Hampshire residents working from home? It doesn’t. The Supreme Court should absolutely take this up.

Now let’s consider secession. “It can’t happen,” you say? Too complicated? Why not? We need to get back to our roots

From Secession by Thomas H. Naylor:

Arguably Vermont is the most radical state in the Union in terms of its commitment to human solidarity, sustainability, direct democracy, egalitarianism, political independence, and nonviolence; and it’s been that way for a long time. Its famous town meetings make the Green Mountain State second only to Switzerland as an international showcase for direct democracy. Not unlike Switzerland, Vermont’s government works, and it works very well, for most of the people who live there.

Vermont’s radicalism goes back at least to 15 January 1777, when it became an independent republic. It remained independent until it joined the Union as the fourteenth state on 4 March 1791. Because it was never a territory or colony belonging to some other government (England), it was the only American state which truly invented itself, an event which has left an indelible mark on the character of its citizens over two hundred years later.

Secession represents the most radical form of peaceful rejection of the policies of the central government a state can choose.

“I love Vermont because her hills and valleys, her scenery and invigorating climate, but most of all, because of her indomitable people. They are a race of pioneers who have almost beggared themselves to serve others. If the spirit of liberty should vanish in other parts of the union and support of our institutions should languish, it could all be replenished from the generous store held by the people of this brave little state of Vermont.” — President Calvin Coolidge, 21 September 1928.

Action Line: America needs to get back to its roots, focused on the liberty and freedom of its people.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.