A Not So Smooth Landing

The unfunded liability facing states across the country is much larger than is being reported, not only because investment-return expectations are too high, but also because of a simple accounting technique, called “smoothing,” that all but three states use to account for market performance. Simply put, states account for stock market gains or losses in their pensions by taking a five-year average. It’s a way to insulate expectations from volatility and can be helpful for long-term budgeting—but it’s also misleading.

In Rhode Island, at the end of June 2010, the actuarial value of the Employees’ Retirement System of Rhode Island (ERSRI) pension was 21% more than the real value, meaning that for state workers and teachers in the ERSRI, $1.125 billion in market losses had not yet been realized. The unrealized loss deficit will continue to grow. The spread of 5.22 percentage points between the official expected rate of return of 7.5% and the actual 10-year average return of 2.28% means that losses could be smoothed over five-year periods in perpetuity. And unlike in the private sector, where you realize the losses and move on, the taxpayer eventually has to make up the difference to fund someone else’s retirement.

Leave it to politicians to recklessly spend your money as the Rhode Island Retirement Board did by changing the smoothing rules in 1996–1997, at the peak of the technology bubble, when it worked in their favor. They “marked to market” the plan assets, when the real value was higher than the actuarial value—no doubt feathering their own nest, since in those days, the retirement board—like 7 of 15 members today—tended to vote in favor of the unions.

Hedge Funds Are Not the Answer

A lot of work needs to be done to make up for market losses that will be smoothed as far as the eye can see. The target allocation put in place by GRS, Rhode Island’s actuarial consultant for 2010, reduced the allocation to stocks and bonds (by 9% and 3%, respectively) and increased the allocation to hedge funds and cash (by 10% and 2%, respectively).

As painful as 2008 was, it’s shocking how few investors have learned their lesson, especially managers of public pensions who are diving headfirst back into hedge funds. Most taxpayers don’t know about the hedge fund two-and-twenty rule: they make 2% on assets under management and keep 20% of your profits. Public officials are OK with that. The director of finance for Danbury, Connecticut, calls hedge funds helpful from an actuarial standpoint because of the returns they project. That’s project, not return. In other words, pie-in-the-sky projections are eaten up by retirement boards. So I don’t see hedge funds being the savior for Rhode Island, and as for the 2% to cash—the T-Bill is at 0.05%

Rising Interest Rates Are Coming

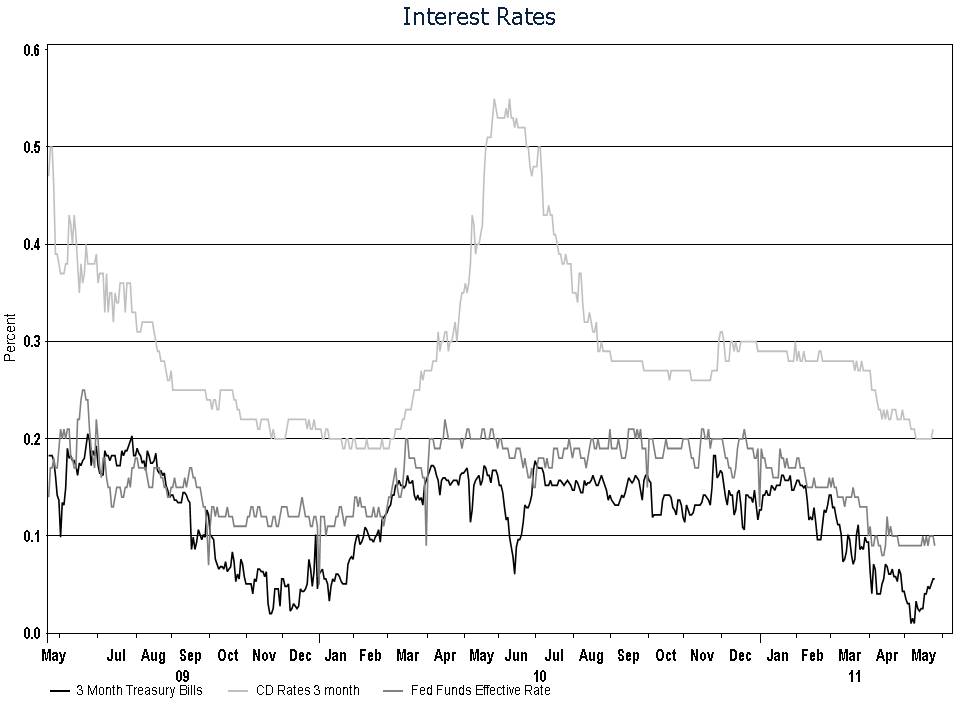

Just over 30 years ago, the three-month T-bill yielded 16.3%. As you can see in the chart above, at the beginning of May it yielded only 0.01%. That’s one basis point, or a difference of 16.29 percentage points. It can’t possibly go below zero in nominal terms—though the yield is already negative when accounting for inflation. Investors are essentially lining up to pay to lend the government money.

No Senior Leadership

Where’s the senior leadership? Legislators are punting a decision on pension reform until after Columbus Day, or 18 weeks from now. A lot can happen in 18 weeks, and politicians are happy to gamble that something will take voters’ minds off of the pension fiasco by then.

This is what Rhode Island’s leaders are saying. House Speaker and 20-year incumbent Gordon Fox (D-Providence) said recently, “I’ve been up here 20 years and I’ve never voted on any increase in pension benefits.” That’s not exactly getting out in front of the issue, Mr. Fox. Senate president and 20-year incumbent Teresa Paiva-Weed (D-Newport) isn’t much better, warning her colleagues that votes might come back to haunt them as they did when Democrats were defeated in the 2010 primaries. She said, “You’re going to be asked again to take another challenging vote.” Doing the right thing for Rhode Islanders shouldn’t be a challenge, Ms. Paiva-Weed.

The similarity in groups whose money flows to Mr. Fox’s and Ms. Paiva-Weed’s campaign coffers ties them together like two peas in a pod. Leading the list are lawyers and lobbyists, followed in no particular order by public-sector unions, and civil servants and public officials. And Governor Chafee is just as happy to go right along with them and push this “collaborative” effort down the road.

Unions Deeply Entrenched at the Local Level

Newport mayor Stephen Waluk successfully made a motion to eliminate 3% raises for non-union management personnel, calling it insensitive to lay off employees and “reward their supervisors” with 3% increases. Yet property taxes are going up by 4.13% and might have gone higher if there weren’t a 4.25% state cap. Let’s not forget, Mr. Waluk, overtime expenditures for the fire department for the current and past fiscal years have been in the $1.2-million range, and police officers already have raises as part of their negotiated contract. And $277,000 will go toward raises for the two unions representing municipal employees. A braver move would be to suggest more cuts period, not eliminating raises. But that’s what happens when politicians play with other people’s money.