Americans are flooding into movie theatres to see Inside Job, a movie co-financed and executive produced by Philadelphia Eagles owner Jeffrey Lurie and his wife Christina. The red-hot movie, about the 2008 financial markets collapse, was financed through the Lurie’s charitable foundation. The foundation’s goal is to fund movies that examine tough global issues in an illuminating and evenhanded manner.

OK then, a noble goal has been put forward by the Luries. And to say that Inside Job deals with a tough global issue and is fascinating is a gross understatement. Masterful, insightful and thoroughly credible are words that come quickly to mind after my two recent back-to-back viewings. I saw the Luries’ fabulous documentary twice in forty-eight hours because, after the first viewing, I knew I wanted to write about this shocking, terrifying documentary of greed and expropriation.

After five decades in the investment industry, I have never felt more disgusted with all the major players from Wall Street to Washington. What a massive breach of the public trust. What immense greed and dishonesty. And talk about hubris! Fogettaboutit, as the Providence gang on Federal Hill is want to say. Most of what I saw in the movie I already knew to be basically factual. Over the past several years, I have written about a lot of stuff that the documentary covers. As you know, I have pulled no punches in blaming the multi-term politicians, the Fed, Wall Street’s moneychangers, and the Nobel Prize winning academic economists. Director Charles Ferguson isn’t selective in the lashing he gives to this unpleasant group of exploiters, and he does a superb job of Q&A-ing a crowd he clearly regards as having committed broad-scale criminal fraud.

We all got a preview of the 2008 financial markets debacle back in 1998 when the Russian government defaulted on their government bonds (GKOs). I am referring here to the implosion of Long-Term Capital Management, founded by Goldman Sach’s long-time competitor, John Meriwether of Salomon Brothers. Mr. Meriweather was joined in the founding by, yup, two Nobel Prize winning economists, Myron Scholes and Robert C. Merton. This crowd specialized in developing complex mathematical models to take advantage of fixed-income arbitrage deals (termed convergence trades). As 1998 got rolling, these Nobelists had equity of about $5 billion, had borrowed over $120 billion (neat, huh!), and had off-balance-sheet assets of perhaps $1.25 TRILLION, most of which was in interest rate derivatives such as interest rate swaps. Kind of takes your breath away, doesn’t it? Does mine. My dad worked for A.J. Weatherhead in Cleveland in the early 50s. At Weatherhead management meetings, a crusty old non-college guy named Harry Adams sat next to A.J. and frequently answered a tactical question from A.J. with a “it don’t make no sense.” A perfect response that patently applies to both the LTCM and the 2008 financial debacle.

On what path did the Nobelists lead Mr. Meriwether? Why that of financial obliteration. LTCM folded in 1998, losing $4.6 billion in less than four months. So lesson learned, right? Not at all. Same old song in 2008, but with gargantuan numbers, many more players, and unbridled incompetence at the Fed. Eternal hubris allowed academic economists Frederic Mishkin, Glen Hubbard, Martin Feldstein, and the head of Harvard’s economics department to agree to be Q&A-ed, with cameras rolling, by a well-informed and prepared Charles Ferguson. After the fact, economist Mishkin penned off his recollection of events of his sit down. “In 2009, I agreed to be interviewed on camera for a film that was presented to me as a thoughtful examination of the factors leading up to the global economic collapse. About five minutes after the microphone was clipped to my lapel, however, it became clear to me that my role in the film was predetermined—and I would not be wearing a white hat.”

No, indeed not, Mr. Mishkin. You, a Fed board member, quit right in the middle of the meltdown to “revise” your textbook. And your fingerprints were all over the Icelandic collapse. In fairness to you, you were bagged here. You were caught like a dear in headlights. And yes, indeed, you penned off an artful and humorous defense of yourself in your letter. You are clearly a splendid personal strategist and letter writer and no doubt a brilliant, pleasant gentleman. But, but, but, unless a whole lot of folk were telling a whole lot of whoppers, you are guilty as charged here. You did not man-up when a manning-up was in need. Nope, economist Mishkin, you were not up to the task when Americans were in bad need of some leadership and wisdom from an economist as intelligent as you obviously are. Quite honestly, I feel bad for you, as you will now be savaged for having been a sucker and for having been duped by the Wall Street crooks and bullied by the Lifers in Congress. Not so hot for your rep at Columbia, is it? But you will have to live in perpetuity with the fact that when times got really tough, economist Frederick Mishkin got really gone. Quite sad. At least that is what I took away from Inside Job.

And Mr. Glen Hubbard, how to see your sterling reputation go down the rat hole almost like magic? You looked bad, man, and I mean real bad. Charles Ferguson made you the playground joke. Not the end you had in mind no doubt, but I for one couldn’t help but wonder what you had in mind and how you, like economist Mishkin, had apparently been on mental vacation during much of the crash. And I know that Mr. Ferguson blindsided you all, but Mr. Ferguson was looking for the truth. You and Mr. Mishkin were quite pleasant and helpful in indicting, well, yourselves. Now I guess that Mr. & Mrs. Lurie and documentary director Charles may be mean spirited and simply out to roast you all. But naw, I don’t like that possibility. The Wall Street moneychangers? Sure. The Fed? Oh yes, with impunity. The tenured politicians? One would hope so. But you academic economists? I don’t think so. You all came up for review because you were each an integral part of the debacle. That’s the long and short of it. Pathetic to a tee is my conclusion!

When Americans have a chance to take a steel-cold look at the part Goldman Sachs, Merrill Lynch, Citigroup, B of A, Morgan Stanley, Lehman Brothers, Bear Stearns, AIG, Countrywide, Moody’s, S&P, Fitch, and Freddie and Fannie played in the debacle, I doubt few will be amused. The leadership of all the preceding come across as pathetic, soaked in greed, thoroughly and morally dishonest, and covered in hubris. And each and every board member of the group should find it hard to look at himself in a mirror, such is the magnitude of the lack of oversight. After your viewing of Inside Job, I suggest you read the March 2009 Wired article, “A Formula For Disaster.” You will read about David X. Li’s Gaussian copula formula as a primary instrument in causing financial collapse. Find out how “the correlation number” could theoretically help gauge the safety and potential risk in just about any bundle of assets and allow packaging into triple-A-rated securities. Wired tells us that, at the end of 2001, there was $920 billion in credit default swaps outstanding. By the end of 2007, that number had rocketed to more than $62 trillion. Sound dangerous to you?

And what were Alan Greenspan and Ben Bernanke up to along the way? According to Inside Job, they were throwing more gas on the fire with easy money. If you have not read Ron Paul’s book End The Fed, you are missing the boat. The Fed is a real problem and has been since its founding. Wired concludes with some insightful commentary from The Black Swan author Nassim Nicholas Taleb. Looking at the Gaussian copula and co-association between securities, NNT concludes, “Anything that relies on correlation is charlatanism.”

Coming out of the theatre, it occurred to me that it was Warren Buffett who bailed out Goldman Sachs in a $5 billion deal. And it was Mr. Buffett who supposedly, at one point along the crash way, owned about 20% of Moody’s. I doubt that Mr. B. would have appreciated or benefitted from a Ferguson Q&A. How about you? Well that’s it, sort of. I say sort of in that I have recently completed my monthly strategy report with some unpleasant conclusions regarding the future. I conclude that The Great Money Flood rolls on and that Bernanke’s Free Money Truck rumbles forth with adequate high-powered money fuel (see the monetary base) to keep the good times rolling, right? Absolutely! What this tells me is that D-Day is coming, and I do not want to be caught unprepared, nor do I want you exposed.

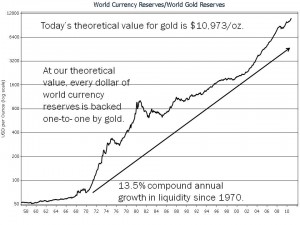

My report goes into detail, and the picture painted is, to be kind, unpleasant. With each report, I now include a 32-chart package that helps in gauging where we are in the investment and business cycles. One chart indicates a theoretical price for gold. My theoretical price tells you what the price of gold would be if every dollar of world currency reserves were backed one-for-one by gold. Central bankers and politicians abhor my chart because it exposes the 13.5% compound annual growth in liquidity since 1970. When a government borrows like the Bush and Obama administrations have borrowed and continue to borrow, the only way out is inflation and dollar debasement. And yes, a deflationary collapse could indeed precede an inflationary blow off. But remember, in a deflation, the government’s debt burden becomes greater in real terms—a most unpleasant and impossible condition.

Well then, with my theoretical price for gold at nearly $ 11,000/oz, do I really project such a price for gold? No. In fact, I continue to buy gold and pray its price drops to zero. Most of my assets are not in gold, and my assets would soar in price if my counterweight position in gold went to zero. I am what you might call an observational investor. I look at my charts each day and determine what is cheap and what is expensive. I then look to add the cheap and to eschew the expensive. What is cheap today? I provide the answers in my monthly strategy reports, but, in short, damn little! My chart shows that back in the late 1970s, my theoretical price for gold was in the $400/oz range. It was then still possible to buy gold in a reasonable price range. Today, one pauses before shelling out nearly $1400/oz for gold. Quite a leap of faith is required. But should my monetary price for gold continue to compound at a 13.5% rate of growth, you will know two things: (1) Inflation and much higher interest rates lie ahead. (2) My theoretical price for gold will soar to over $20,000/oz in just five years (the rule of 72).

In conclusion, Inside Job is well done and packed with insight. Although I cannot document every event in the movie as fact, events and actions in Inside Job are largely as I understand them to be. The individuals cited as contributors to the worst financial crisis in my lifetime have been presented in a reasonable fashion. It is my understanding that Mr. Ferguson is surprised that the subject of criminal fraud is not on the table. One need not be an academic economist to agree. And if you conclude, as I have, that one Elliot Spitzer has gained, what should I say here, an inside perspective, he could shake enough fruit out of the trees to get some convictions. And by the way, in the future, I’d think twice before agreeing to a Q&A-ing from one Charles Ferguson. What do you think, economist Mishkin?

Revisiting this video explanation of the Federal Reserve’s quantitative easing is evidence enough that this storm isn’t over:

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.