President Barack Obama and Vice President Joe Biden in the Oval Office during the President’s Daily Economic Briefing on July 30, 2009. (Official White House Photo by Pete Souza)

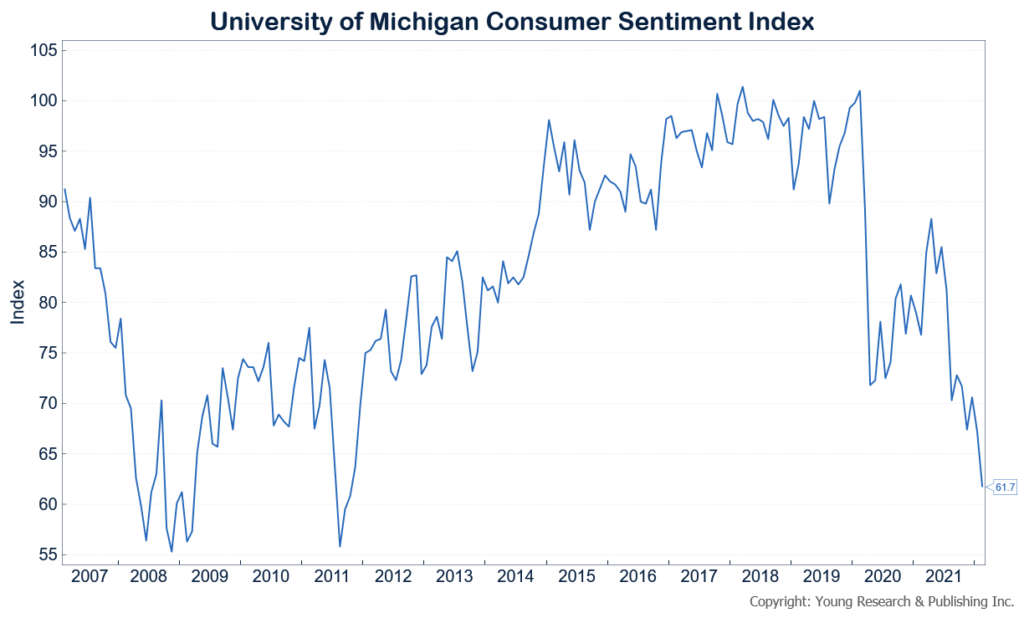

As Barack Obama entered office, he faced some of the worst consumer sentiment in history, but after the initial onset of the financial crisis subsided, sentiment bounced back into normal territory for a couple of years. Then, by the third year of his administration, Obama drove it right back to some of the lowest levels ever in 2011. In only one year in office for Biden, consumer sentiment levels are already nearing Obama-era lows. Chris Matthews reports at MarketWatch:

The numbers: The University of Michigan’s gauge of consumer sentiment fell to an initial February reading of 61.7, from January’s level of 67.2, the lowest reading since October of 2011.

Economists were expecting a reading of 67, according to a Wall Street Journal survey.

Key details: Expectations for inflation over the next year rose to 5% from January’s expectation of 4.9%, the highest level since July of 2008, while inflation expectations over five years held steady at 3.1%.

A gauge of consumer’s views of current conditions fell to 68.5 in February from 72 in January, while an indicator of expectations fell to 57.4 from 64.1 in the previous month.

Big picture: With consumer prices rising 7.5% since last January, the fastest pace in 40 years, Americans remain pessimistic about their buying power, meaning healthy wage gains have not kept pace with the rise in the cost of living.

What UMich said: Richard Curtin, chief economist of the survey, called February’s decline “stunning,” adding that “the recent declines have been driven by weakening personal financial prospects, largely due to rising inflation, less confidence in the government’s economic policies, and the least favorable long term economic outlook in a decade.”

“The impact of higher inflation on personal finances was spontaneously cited by one-third of all consumers, with nearly half of all consumers expecting declines in their inflation adjusted incomes during the year ahead,” he added. “In addition, fewer households cited rising net household wealth since the pandemic low in May 2020, largely due to the falling likelihood of stock price increases in 2022.”

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.