Originally posted on December 14, 2021.

“There was a time when I would point investors to low-cost index funds, but as you can see, that ship has sailed.” — Dick Young

In an excellent review of a festering problem in the market today, Randall Smith of The Wall Street Journal, outlines the $1.3 trillion Vanguard Total Stock Market Index Fund (VTI), and the growing importance of the CRSP U.S. Total Market Index to the future of markets.

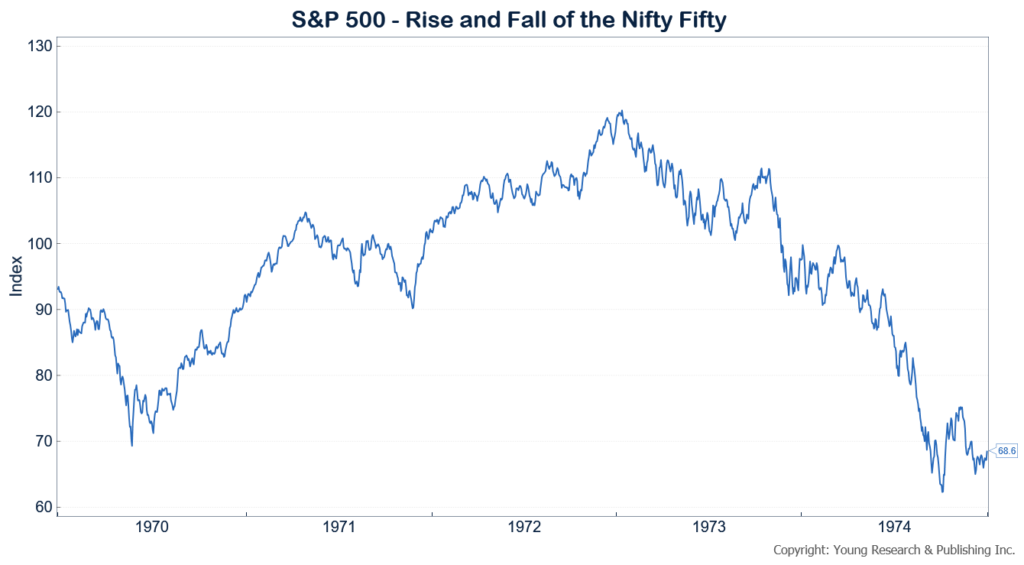

What’s concerning to Your Survival Guy is that the top 10 companies of the CRSP U.S. Total Market Index comprise a quarter of its value. Does anyone remember the plight of the Nifty 50 in the 70s? When people fell out of love with the Fifty, the S&P crashed 48.2% from early January 1973 to early October 1974.

The problem with indices or lists is they’re always evolving. Names come and go. Do you really want to hitch your life’s savings to a Total Stock Market Index that’s so top heavy?

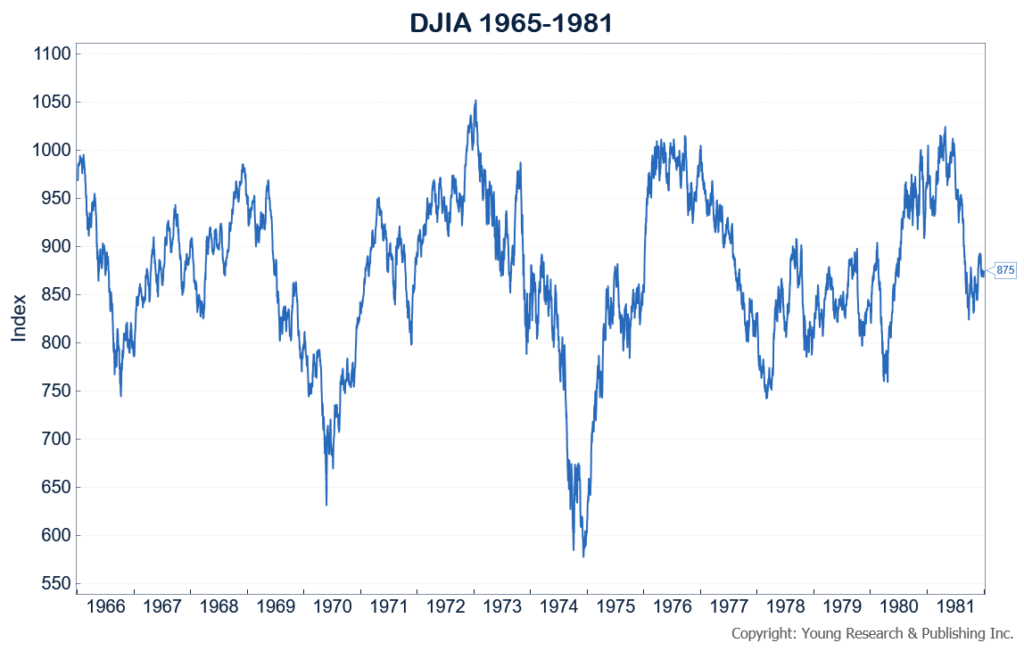

Action Line: This is a stock picker’s market. I want you to get paid no matter what in the form of dividends, regardless of what prices do. Stocks have a history of doing nothing for longer than you care to remember. If you need help building an investment plan that’s right for you, I would love to talk with you.

Not only do they have a history of doing nothing for long stretches of time, but names are also replaced with more frequency than one cares to remember.

Smith explains here how oblivious the public is to the massive movements of the VTI, and the CRSP U.S. Total Market Index, writing:

Everyone knows the New York Stock Exchange. And its rival, Nasdaq.

But there is a mutual fund that invests in stocks based on a relatively unknown market index that has grown so large it might be considered a third stock market unto itself.

That fund is the $1.3 trillion (yes, trillion, including all share classes) Vanguard Total Stock Market Index Fund (VTSAX) and its exchange-traded-fund shares. The fund, from Vanguard Group, now accounts for 10% of all assets in U.S. stock mutual funds and ETFs in the market, according to Morningstar Inc. No other mutual fund or ETF comes close to it in asset size. The next largest is an $821 billion Vanguard S&P 500 index fund.

The paradox is that this biggest beast among funds is tied to the most unassuming of stock indexes—the CRSP U.S. Total Market Index, developed at the University of Chicago’s Booth School of Business.

While many investors may not be familiar with CRSP, the influence of the index and the Vanguard fund is felt minute to minute on Wall Street. Traders say they sometimes check the Vanguard fund’s ETF version, with the symbol VTI, to get a better idea of what is happening in the market overall, since it effectively covers more stocks than any of the three major indexes—the Dow Jones Industrial Average, S&P 500 index and Nasdaq Composite.

“When the stock market is open, VTI gives you a better picture of what it’s doing than anything else,” says Rick Ferri, an investment adviser in Georgetown, Texas. The CRSP, he adds, “drives this gigantic mutual fund, and most of the general public doesn’t even know that CRSP exists.”

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.