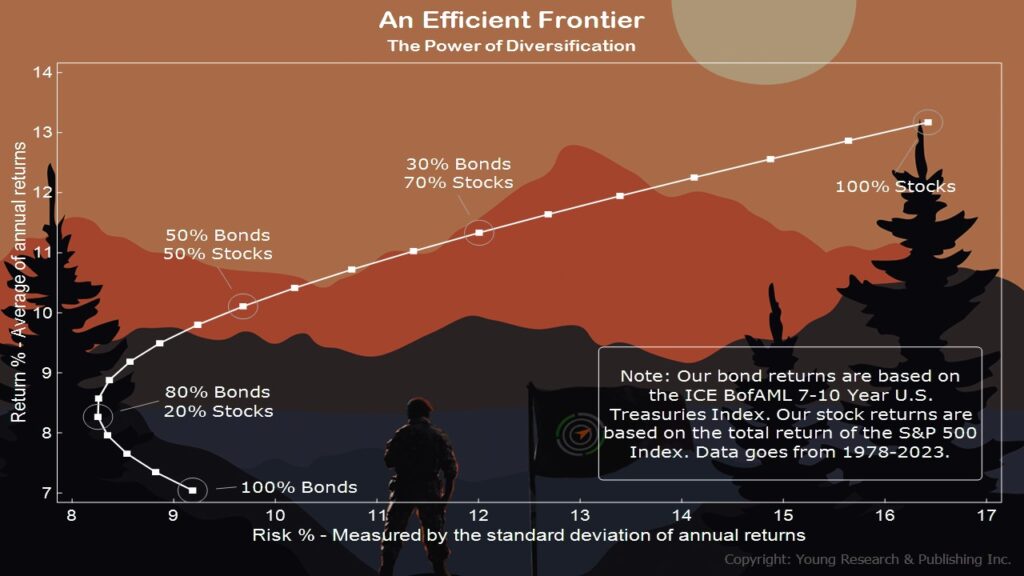

How you invest in stocks and bonds, in other words, your asset allocation can mean more to your investment success than what you invest in. Let me explain.

When you look at risk/reward as measured by my efficient frontier, you can see by the fish hook how having your eggs in one basket can mean more risk. Obviously, 100% in stocks will be riskier as measured by a portfolio’s ups and downs or standard deviation. But what’s not always clear is that having 100% in bonds can be riskier than a mix of, say, 20% stocks/80% bonds.

As you see above, this efficient frontier is a combination of bond returns based on the ICE BofAML 7-10 Year U.S. Treasuries Index and stock returns based on the total return of the S&P 500 Index from 1978 to 2023.

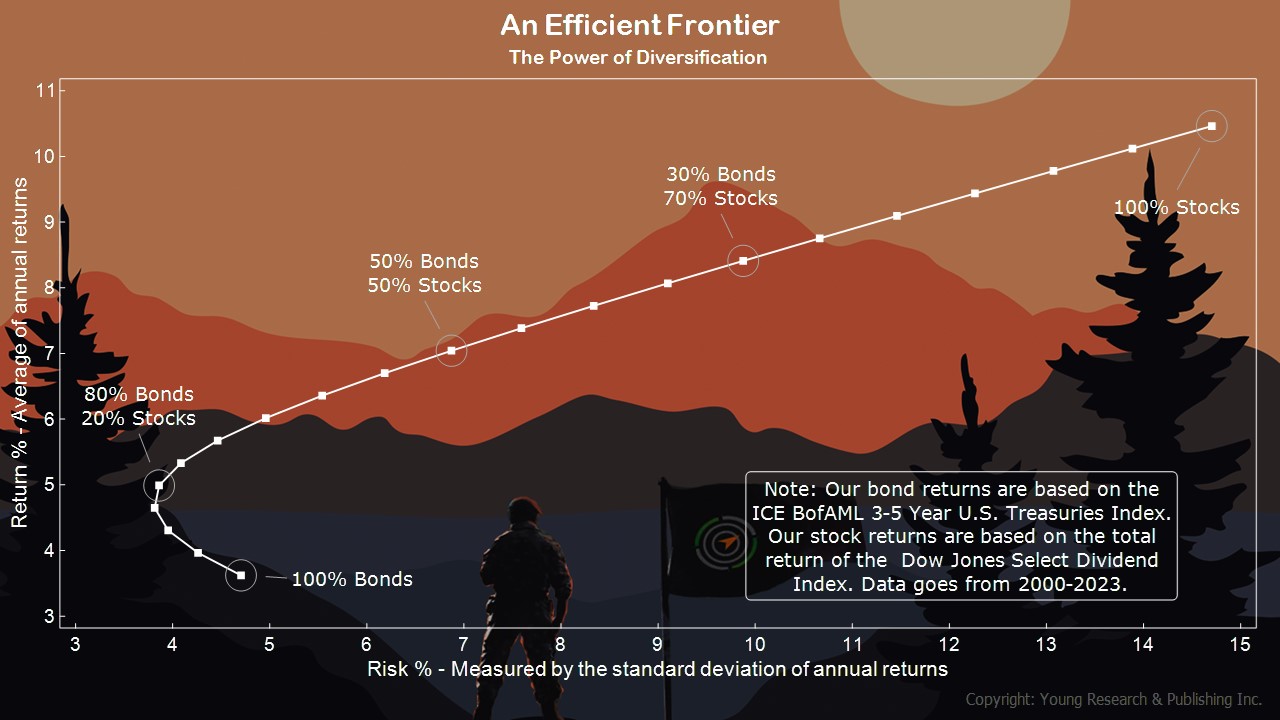

What you can see above is the efficient frontier for this century marked by three debilitating declines in stocks: tech bust, financial crisis, and Covid. This one contains bond returns based on the ICE BofAML 3-5 Year U.S. Treasuries Index and stock returns based on the total return of the Dow Jones Select Dividend Index from 2000 until 2023.

Comparing the two, lower interest rates provided a tailwind to both stocks and bonds. And with loose monetary policy and zero percent rates, stocks did the heavy lifting so far this century. But how about in the future?

With the T-bill at around five percent, how in the world can one explain, beyond AI speculation, the huge advance in stocks? Nasdaq is up 37.34% over the last 52-weeks.

This is the time to get your fixed income mix in order. We’ve seen this house of cards in stocks before. Does that mean you don’t invest in stocks? No. It means you figure out your risk tolerance, then run your finger along the efficient frontier and see what has happened in the past.

Action Line: Past performance is no indicator of future returns. But it helps to understand where we’ve been to figure out how you want to move forward. When you’re ready to talk, let’s talk.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.