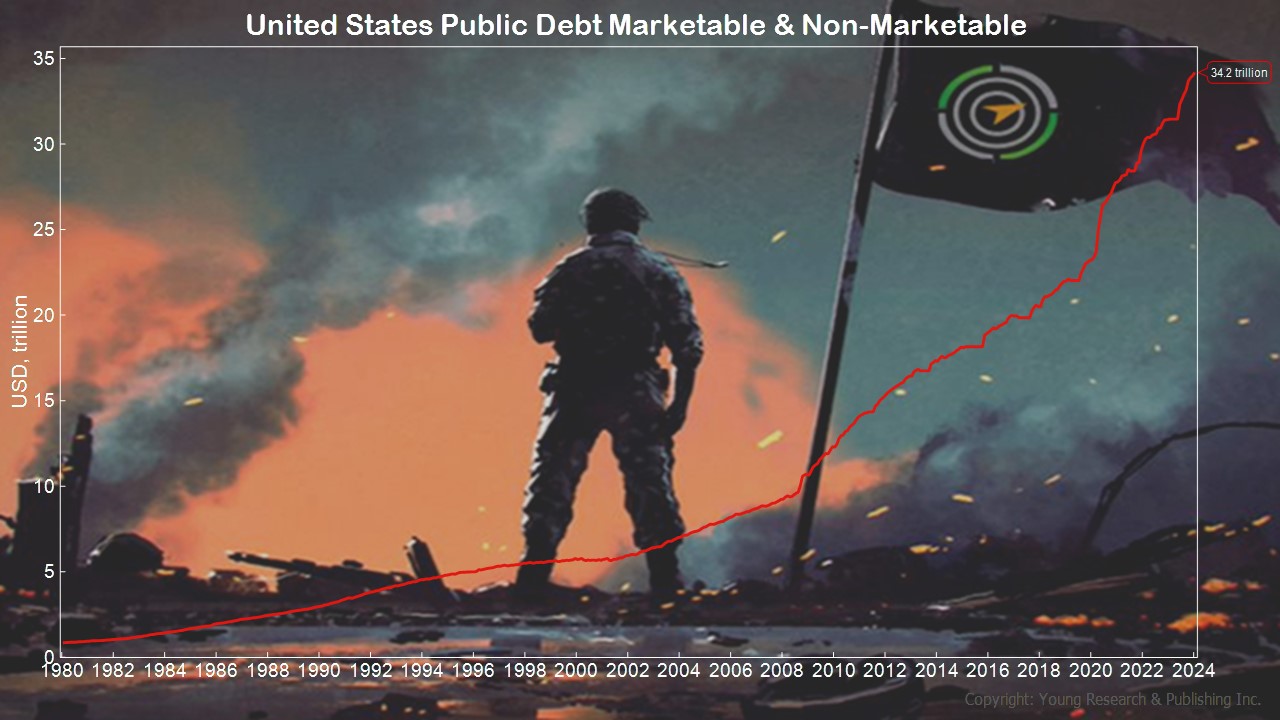

You’ve seen the debt load we’re gifting the grandkids. As I noted yesterday, one way to tackle it is by making cuts and buckling down, chipping away at it like one manages the family budget. The government? Since it can create its own money out of thin air, it chooses to inflate the debt away. With all that fiscal Covid money running dry, it looks like the Fed wants to come to the rescue with more easy money.

As an appointed official, not elected by you and me, Fed Chair Powell must be hearing the footsteps from Main Street voters looking for some monetary discipline. Just when we see interest rates at levels savers like you and I can sink our teeth into, the Fed wants to keep the sugar high going. As stocks surge, let’s not forget he’s human, too, and could be thinking about job security as November rolls around.

And here’s the kicker. Investments compete with each other, and as CDs roll over, investors see lower rates and think, “Hmmm, stocks have been doing well.” As more and more individuals load up on stocks, can you blame them for not wanting to miss the boat? Loose money encourages risk-taking.

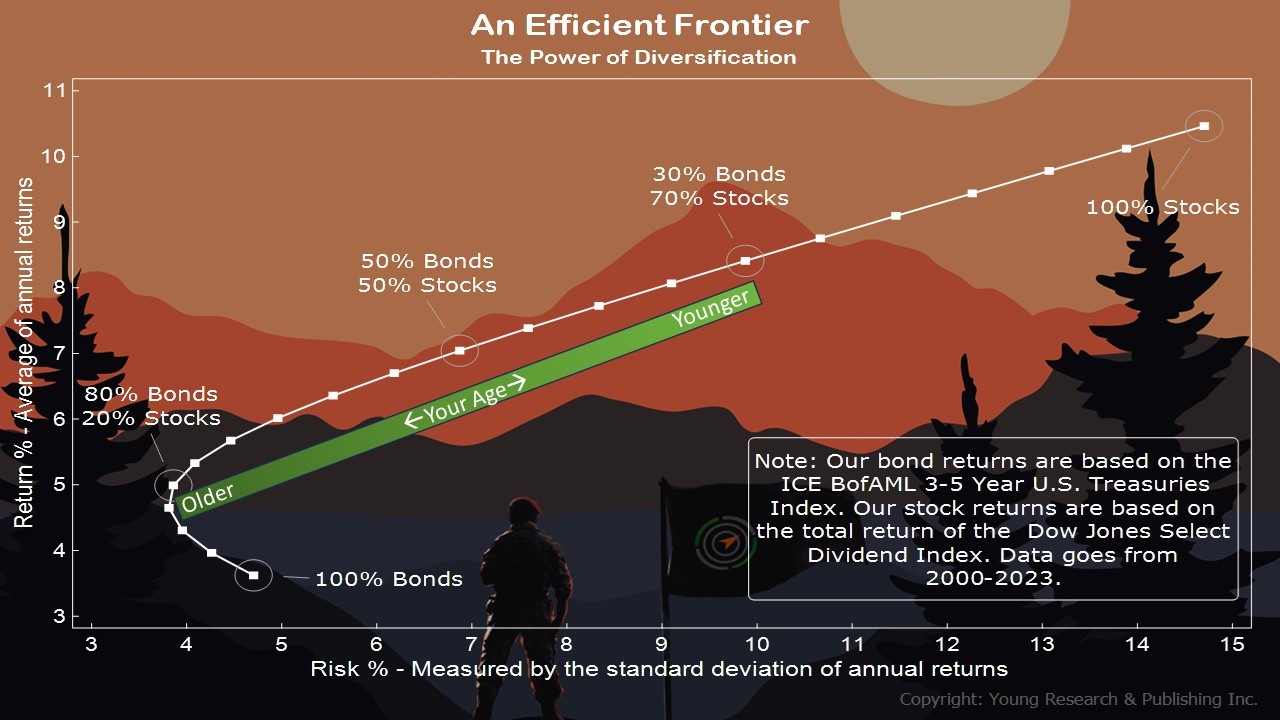

Action Line: Remember, it’s not what you buy or sell but how you invest that may determine your future. Don’t reach for yield. Don’t overweight in stocks if you can’t handle losing that weight. Markets may put one on a strict diet whether you like it or not. Roll your finger along my efficient frontier chart below and find a place where you and a loved one can live with the peace of mind and comfort you deserve. And when you’re ready, let’s talk. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.