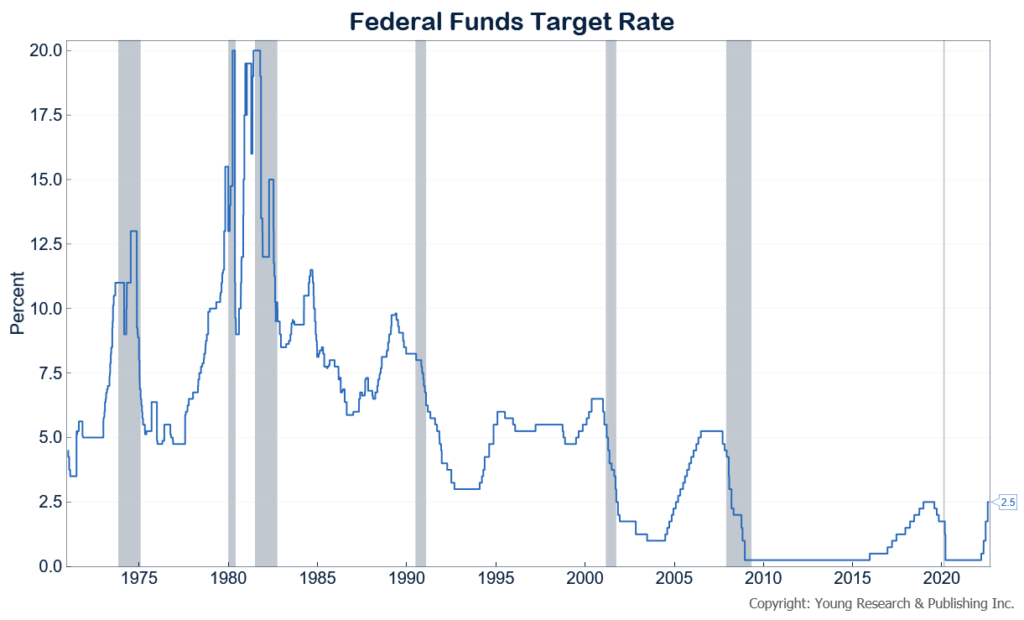

UPDATE 2.12.24: As they were in June, stocks are rallying, and Wall St. is betting on Federal Reserve rate cuts this year to boost the market. But today, Federal Reserve Board Governor Michelle Bowman became the latest in a series of Fed personnel to tamp down on the idea of imminent cuts. She told a meeting of the American Bankers Association in San Antonio this morning that it’s “too soon to predict” when the Fed might cut rates and that she doesn’t think cuts are appropriate in the “immediate future.”

UPDATE 6.7.23: Stocks have been rallying, and Wall St. has been betting on Federal Reserve rate cuts this year. But, reports Matt Grossman in The Wall Street Journal, investors are having second thoughts about big rate cuts in 2023 after the economy has proven more resilient than predicted. Grossman writes:

Persistent strength in the economy has wrong-footed bets that the Federal Reserve will make large interest-rate cuts this year, potentially undermining a key element of support for the 2023 stock rally.

Previous expectations that rates would fall before December helped boost markets this year, particularly shares of large technology companies. Apple, Amazon.com and Facebook parent Meta Platforms—battered in 2022 as rates rose—have all climbed more than 35% so far this year. The Nasdaq Composite has gained 26%.

Some say a second half featuring higher interest rates would likely drag on stocks, despite persistent strength in the economy and corporate profits. Many note that most U.S. stock sectors have been weak this year even as major indexes rise.

UPDATE 5.23.23: Economists polled by the National Association for Business Economics believe that prices will remain high, and that the Fed will keep interest rates higher in response. The Hill’s Lauren Sforza reports:

The group forecasts inflation to average 4.2 percent this year, which is up from 3.9 percent in the group’s February survey, The Associated Press reported.

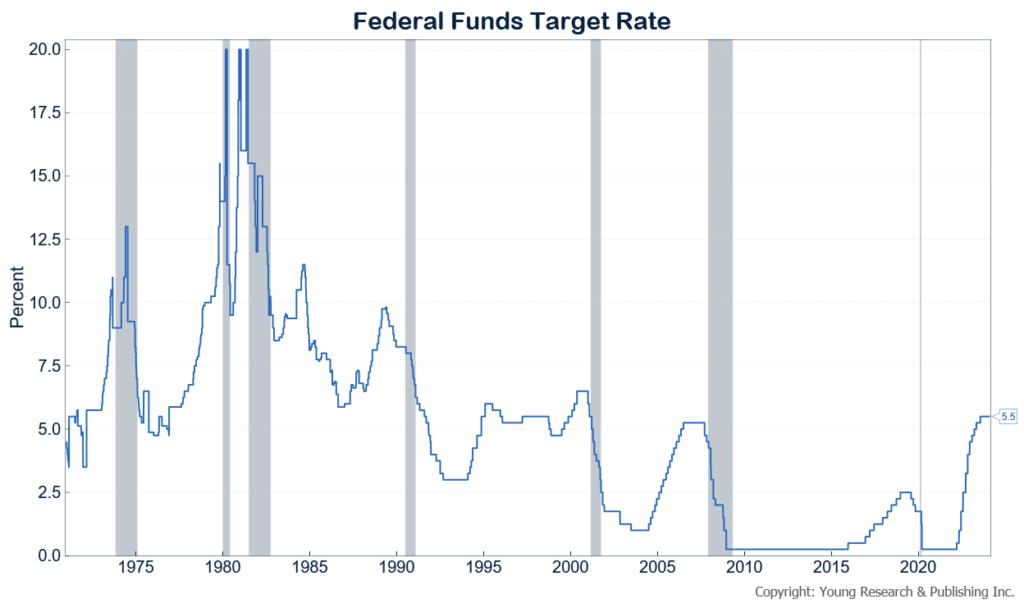

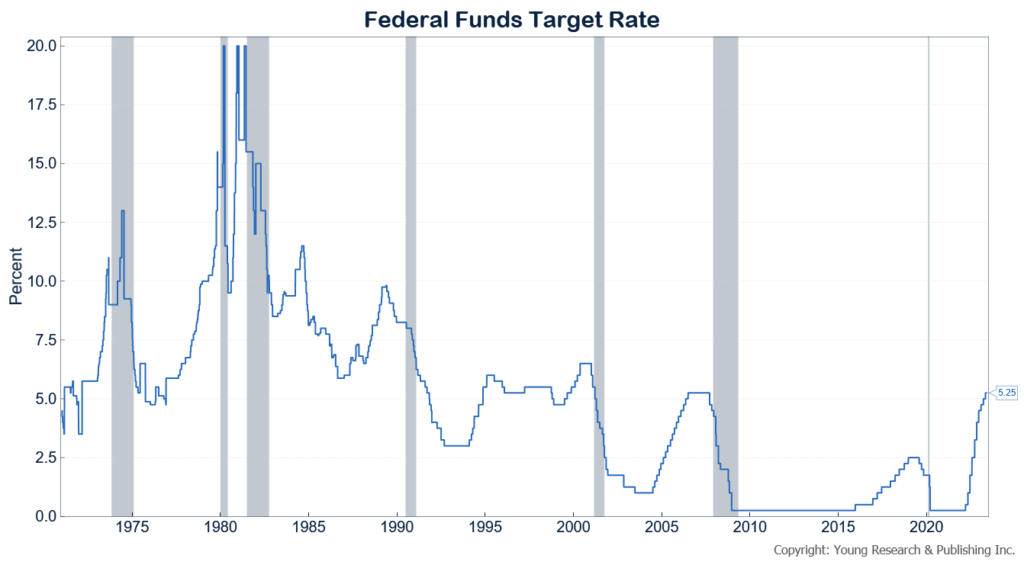

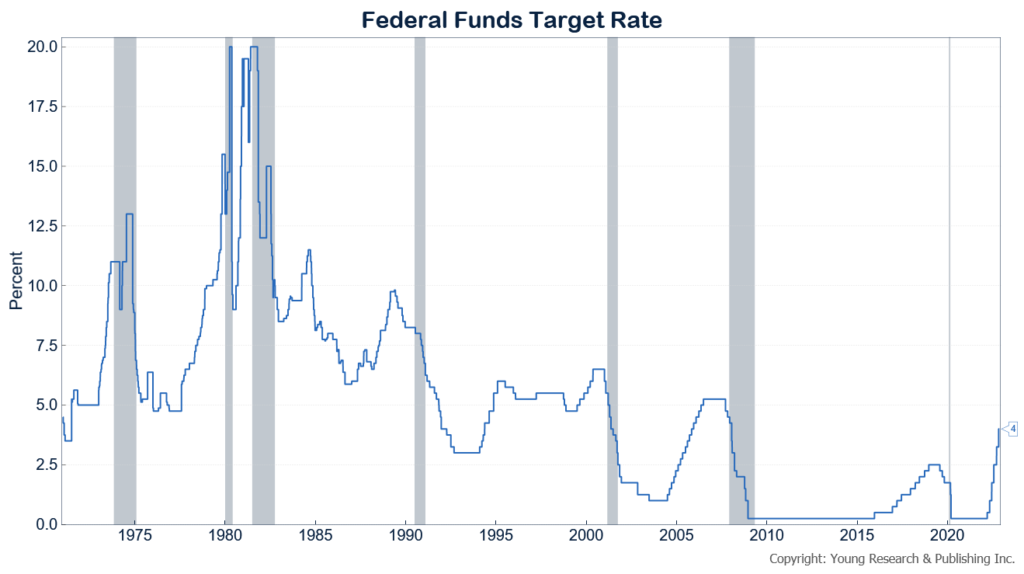

The new survey also found the economists believe the Federal Reserve will keep its benchmark interest rate around 5.1 percent this year, which is the highest it has been in 16 years.

“Respondents to the latest NABE Outlook Survey are divided as to whether a recession in the U.S. is likely in the next year,” said NABE President Julia Coronado in a statement. “However, the median forecast calls for economic growth through 2024 to be modest.”

Savers trying to generate compound interest in their portfolios finally have some interest to compound.

UPDATE 11.18.22: After recent inflation index reports, markets have rallied under the assumption that perhaps Federal Reserve rate hikes may decelerate. Federal Reserve Presidents James Bullard (St. Louis) and Neel Kashkari (Minneapolis) have come out to pour cold water on those assumptions. Bullard suggested the Fed funds rate “has not yet reached a level that could be justified as sufficiently restrictive. To attain a sufficiently restrictive level, the policy rate will need to be increased further.” Kashkari later told the Minneapolis Chamber of Commerce that “I need to be convinced that inflation has at least stopped climbing, that we’re not falling further behind the curve, before I would advocate stopping the progression of future rate hikes. We’re not there yet.”

UPDATE 8.25.22: As the Fed raises rates at speeds not seen for quite some time, the information below on duration becomes even more important to understand.

Originally posted on March 31, 2021.

- COMPOUNDING

- INTEREST

- DIVIDENDS

- DURATION

While no one can predict the future direction of interest rates, examining the “duration” of each bond, bond fund, or bond ETF you own provides a good estimate of how sensitive your fixed income holdings are to a potential change in interest rates. Investment professionals rely on duration because it rolls up several bond characteristics (such as maturity date, coupon payments, etc.) into a single number that gives a good indication of how sensitive a bond’s price is to interest rate changes. For example, if rates were to rise 1%, a bond or bond fund with a 5-year average duration would likely lose approximately 5% of its value.

BY FIDELITY LEARNING CENTER

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.