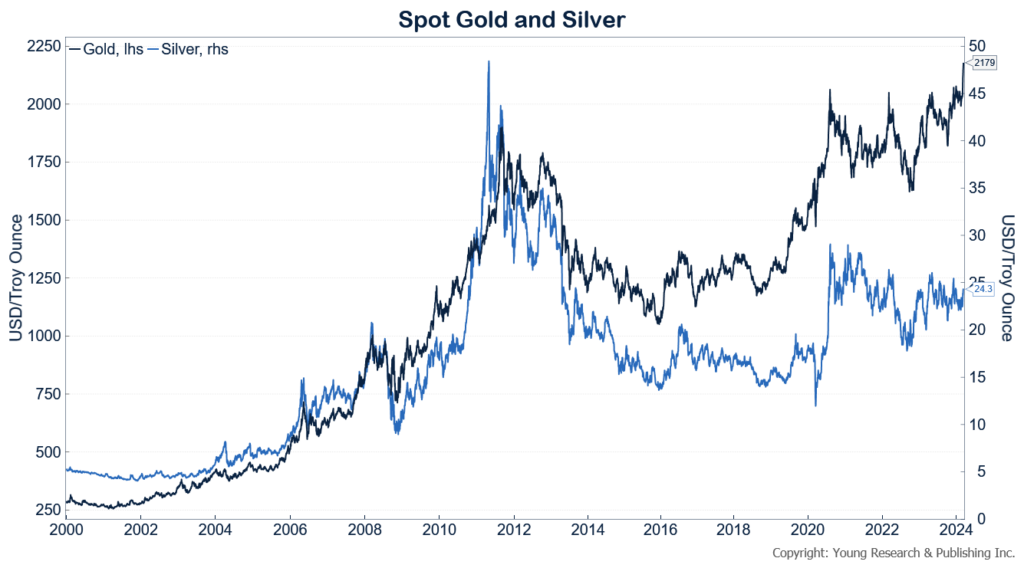

On his Substack, Alasdair Macleod discusses the surge in gold and silver prices. He writes:

Gold and silver surged this week on a sudden increase in demand. In European trade this morning, gold was $2167, a new record and up $85 from last Friday’s close, while silver at $24.49 was up $1.18. Comex volumes in both contracts were heavy, but the startling increase was in gold’s Open Interest, which has surged by 100,000 contracts since 20 February:

Comex deliveries have also soared. In the four days of this week so far, 1,056 gold contracts have stood for delivery, making the total this year 28,159 contracts (87.58 tonnes). But the more remarkable increase has been in silver contracts: 1,628 this week so far representing 8,140,000 ounces or 253 tonnes. The total for this year to date is 1,122 tonnes.

Admittedly, this would take fleets of security vans working 24/7 to handle these quantities if on being stood for delivery this bullion was actually delivered out of the vaults. Instead, it represents change of ownership rather than actual deliveries, but it is an indication of the stress on bullion bank liquidity which must be being badly squeezed, not just on Comex but in London as well.

The bullion establishment in western capital markets has been caught badly short. The squeeze is global, which is why when the charts say “buy gold” as they now do the effect has been dramatic. After a 43-month consolidation, breaking into new high ground was bound to be a major event. The next chart shows the technical position.

Read more here.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.