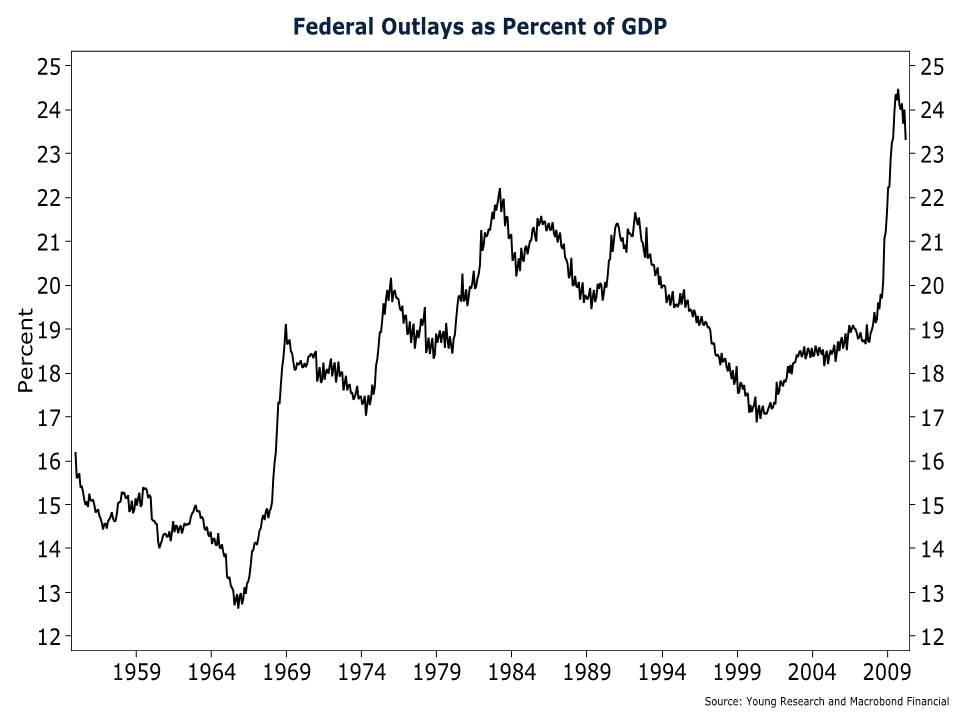

A quick look at my chart of federal spending as a percentage of GDP shows that the free market in the United States is ailing. The percent of our economic activity by government has risen above 24%. The rapid increase shows no signs of ebbing. What does this mean for capitalism?

Rather than competing for the dollars of consumers like you and me, companies are increasingly competing for government money. That money is levied from taxpayers and controlled by politicians.

Merriam-Webster defines capitalism as “an economic system characterized by private […] ownership of capital goods, by investments that are determined by private decision, and by prices, production, and the distribution of goods that are determined mainly by competition in a free market,” and defines a command economy as “an economic system in which activity is controlled by a central authority and the means of production are publicly owned” (my emphasis added).

Twenty-four percent of our economic activity is controlled by the central government. Increasingly, America’s “means of production” are publicly owned. The United States now owns 61% of General Motors. To ensure GM’s success, Uncle Sam is taking money out of your pocket to fund the “cash for clunkers,” program. The government is determining not only what products are made in the U.S., but also which ones are purchased.

The problem is that command economies never work. The fall of the Soviet Union and the recent American economic crisis, triggered by government intervention in the housing market, are two prime examples of command economics gone awry. Government has no way of knowing what everyone needs, or wants. Countries will ration out alcohol to new mothers, and baby formula to drunks.

The effect of rapid government expansion into the economy is that major corporations spend an ever-increasing amount of money on lobbying. In 2008, the amount of money spent on lobbying increased 15.4% to a record $3.3 billion. In contrast, companies decreased their advertising budgets by 3.8%, or $6.6 billion.

From day to day, this system may look like capitalism. Companies competing for government contracts are, by definition, in a competitive system. However, a competitive system with the government as the only customer isn’t capitalism at all. The government doesn’t play by the same rules that normal consumers do. The government can set prices (think agricultural subsidies, tobacco taxes, and health care). No other customer can do that. The government’s guaranteed income stream (your tax dollars) gives it no incentive to shop for the best deal. That’s why no-bid government contracts are proliferating and bringing with them bribery and corruption. This is crony capitalism at its worst.

Americans must oppose increased government spending. Not only does it create distortions in the market, it loads future generations with a debt burden far beyond their capacity to pay. Even if spending cuts hurt now, they must be implemented to prevent future catastrophe.