Originally posted on August 17, 2011.

Here’s my true story. A few years back, Sydney and Rhonda Goldman sold the family deli in Brooklyn and headed south, looking forward to their long retirement in a high-rise condo in sunny Boca. For decades, they had worked from 5:00 a.m. to late in the afternoon and were now worn out and ready to hit the beach. The net proceeds from the sale of their deli provided Sid and Rhonda with a million dollar nest egg that, with their Social Security checks, figured to hold them well. Their plan was to draw a modest 4% from an ultra-low-risk, fixed-income portfolio. The proposed $40,000 annual draw covered, if just barely, Sid and Rhonda Goldman’s basic needs. They are frugal people.

So how are things going? Thanks to Ben Bernanke, not so well. You see, the Fed Chairman has decided that the way to artificially pump up the economy is to clamp the lid on the interest rates for two more years. The target rate on Fed funds is now basically zero. Such historically low borrowing costs are just dandy for Washington’s favorite New York trading crowd at Goldman Sachs, but far from fine for the savaged Boca Goldmans, Sid and Rhonda. You see, their 33/33/33/ mix of safe and secure 90-day T-bills/money market funds/1-year CDs is pulling in just $4800 mini-dollars for the retired and now tragically underfunded couple. This is but a tiny fraction of the $40,000 annual draw the prudent Boca couple had planned on. The last shopping trip to the local Winn Dixie was so expensive and Rhonda’s wallet so thin that she had to take most of the groceries out of her basket at the checkout counter. Rhonda stood there aghast at the hit her food-buying mission was taking from her decimated budget and from brutal cost inflation. Had not Mr. Bernanke assured Americans that inflation was under control? Well, what Rhonda was forgetting is that the food that she and her retired husband survive on and the gas she burns up on her trek to Winn Dixie do not count on Mr. Bernanke’s inflation meter.

Meanwhile, everything is hunky-dory back on Goldman’s New York trading floor, giggles all around. Imagine the largesse of Mr. Bernanke in allowing Goldman, for the next two years; to ride the free money truck up and down Wall Street? A child could make a fortune borrowing at basically zero. Isn’t America great, and isn’t Ben Bernanke a sweetheart? Well, that’s the story: one dream of a retired couple that had worked hard for a lifetime shattered and truckloads of free money for the Wall Street speculators.

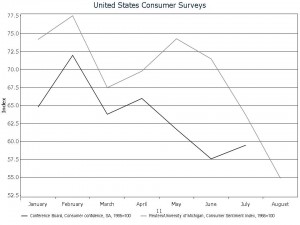

The U.S. economy is in the tank after two-and-one-half brutal years of mismanagement from the Obama administration. As the Ames, Iowa Straw Poll has just shown, American’s are honked off and ready to do battle. You may be shocked at the level of discontent in America, and my consumer sentiment chart will make you feel no better. Americans will not spend in this environment, and America’s small business owners will not hire. A nice one-two punch, don’t you think? Have a good week.

Warm Regards,

Dick

P.S. For more, read Inflation Rise Puts Fed in a Bind by Sudeep Reddy at The WSJ.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.