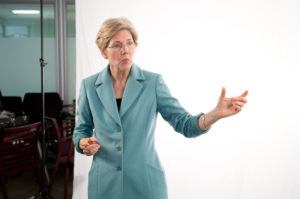

Elizabeth Warren films a video with the CFPB new media team announcing the CFPB “Open for Suggestions” project. Photo courtesy of the CFPB.

Sen. Elizabeth Warren has a plan for America. If she is elected president, she pledges to not accept the Constitution’s limits on federal power. James Freeman reports in the WSJ that the former Harvard law professor has unveiled a plan to extract wealth from the country’s wealthiest citizens.

Warren’s plan includes “a significant increase in the IRS enforcement budget” and “a 40% ‘exit tax’ on the net worth above $50 million of any U.S. citizen who renounces their citizenship.”

According to a press release from Sen. Warren’s office, Americans have reason to be particularly grateful in this campaign season that the U.S. Constitution forbids her plan to tax wealth.

Chris Edwards at the Cato Institute notes the many countries, especially in Europe, where citizens without such protections had to learn the hard way about the destructive power of such taxes. Among the many sad experiences cited by Mr. Edwards:

- France abolished its wealth tax in 2017 after many news articles noted that wealthy entrepreneurs and celebrities were fleeing the country. The government estimated that “some 10,000 people with 35 billion euros worth of assets left in the past 15 years.” A related reform was the 2015 repeal of France’s “supertax” on high incomes of 75 percent, which also raised little money and encouraged high-earners to leave…

- Germany repealed its wealth tax in 1997 after a constitutional court struck it down due to inequities in the treatment of different asset types. The tax repeal appears to have had a positive effect on savings…

- Sweden repealed its wealth tax in 2007 as it became clear that it was driving business people—such as the founder of Ikea, Ingvar Kamprad—out of the country.

Read more here.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.