The recent Republican debates and the Obama’s Spruce Goose jobs bill seem to have taken all the oxygen out of the air. Parade syndrome can kick in and throw you off track as you make business and investment plans through the end of the year. Parade syndrome? That’s when you try to watch all the action on the street rather than from several floors above the action. The annual New York Macy’s Thanksgiving Day Parade offers a real life example. Just think of how little of the action you would be able to catch jostling with curbside throngs. No thanks.

So using my parade syndrome analogy, how do you see the economy as we move into fall? Isn’t economic momentum going to be a pivotal factor during the 2012 election process? I doubt that anything could be more important.

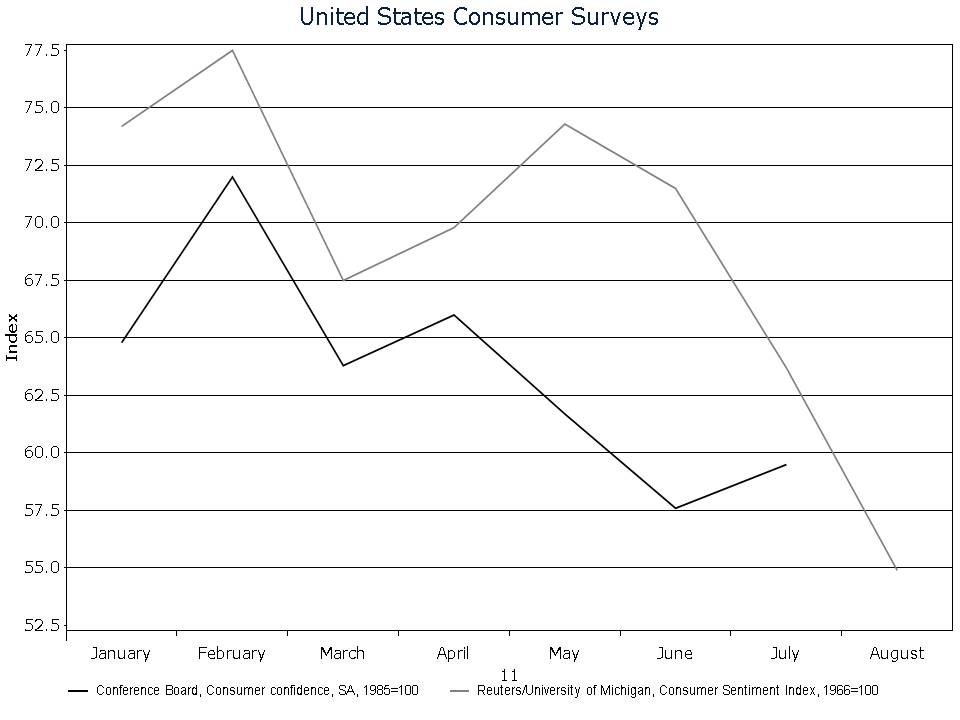

Here are two charts that allow you to climb above the fray. They lay bare for you sentiment of consumers and momentum in the all-vital housing sector.

So, how would you like to run for reelection using these charts as your raison d’etre? Talk about disaster. The consumer’s mood continues to be come fouler as the year progresses. And after a monster 2007/2008 crash in new home sales, the 2009/2011 market has simply gone stone cold. Is there any other way to interpret this information? Unfortunately, there is not. This is why the tea party movement is gaining such momentum and why the stock market is in shambles. I will continue to update you with this information as we move into full-scale 2012 election season mode. You will be able to place your bets accordingly.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.