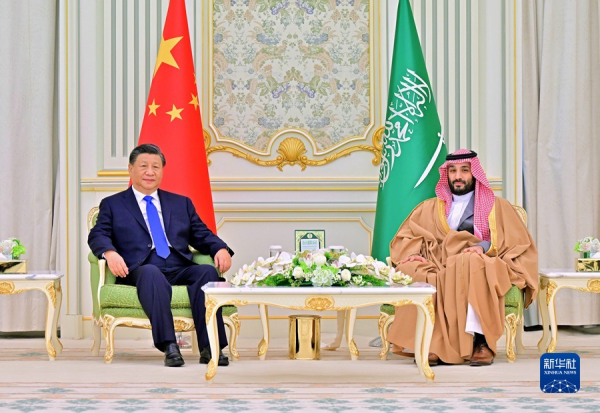

President Xi Jinping holds talks with Crown Prince and Prime Minister Mohammed bin Salman of Saudi Arabia. 12/9/2022. Photo courtesy of the Ministry of Foreign Affairs of the People’s Republic of China.

At the Ron Paul Institute, former congressman and presidential candidate, Dr. Ron Paul explains the arrangement between Richard Nixon and the Saudis that became part of the bedrock of the dollar’s reserve currency status in the 1970s. Now, that arrangement is being threatened by a split in Saudi/U.S. ties brought about in large part by Joe Biden’s relentless insulting of the Kingdom and misuse of sanctions. Paul writes that a breakdown in the petrodollar could cause immeasurable problems for the United States:

Future historians may say that the most significant event of 2023 had nothing to do with Donald Trump, other 2024 presidential candidates, or even the war in Ukraine. Instead, the event with the most long-term significance may be one that received little attention in the mainstream media — Saudi Arabia’s movement toward accepting currencies other than the US dollar for oil payments.

After President Nixon severed the last link between the dollar and gold, his administration negotiated a deal with the Saudi government. The US would support the Saudi regime, including by providing weapons. In exchange, the Saudis would conduct all oil transactions in dollars. The Saudis also agreed to use surplus dollars they accumulated to purchase US Treasury bonds. The resulting “petrodollar” is a major reason why the dollar has maintained its world reserve currency status.

Also this year, China and Brazil made an agreement to conduct future trade between the countries using the countries’ own currencies rather than dollars. Brazilian President Lula da Silva has called on more nations to abandon the dollar.

This de-dolarization movement is driven in part by resentment of America’s foreign policy, including, in particular, the US government’s increasing use of economic sanctions. Dethroning the dollar from its world reserve currency status makes it easier for countries to ignore these sanctions.

De-dolarization will negatively impact the US government’s ability to manage its over 30 trillion dollars debt. With a few exceptions, there is still no real support in Congress for spending cuts. Republican leadership members may say they will not support a debt ceiling increase unless it is tied to spending cuts. However, after the Biden administration accused the Republicans of wanting to cut Social Security and Medicare, House Speaker Kevin McCarthy declared a reduction in spending on Social Security and Medicare — big drivers of the federal deficit — “off the table.” Similarly, despite the growing skepticism of foreign interventionism among Republicans, the military-industrial complex maintains a viselike grip on congressional leadership and the White House. Therefore, do not expect any reduction in military spending. Instead, the Pentagon’s budget will likely increase.

The Federal Reserve will face continuing pressure to monetize ever-increasing federal debt and keep interest rates (and thus the federal government’s borrowing costs) low. The resulting inflation will lead to more support for ending the dollar’s world reserve currency status. As more countries abandon the dollar, the Fed will become less able to monetize the federal government’s debt without creating hyperinflation. This will result in a dollar crisis and an economic meltdown worse than the Great Depression.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.