This is why last year I posted the warning below.

In my 1987 book The Financial Armadillo Strategy, I focused on my long-term fear of (1) inflation, (2) printing money to balance the books, and (3) the highly leveraged position of the US Banking system.

I offered a multi-layered platform for investing during the expected financial blow-off I feared was emerging. Featured planks in my portfolio platform were U.S. government securities, gold and silver (thanks Ron Paul, Dan Rosenthal, Jim Blanchard, the Messrs. Harry Browne & Schultz, and Dr. Franz Pick) Vanguard’s low-cost, no-load funds, Benham Capital Management Company, and the Swiss banking system.

Now, in 2020, I am writing more about gold and silver and the Swiss Way than ever. Here we are in August 2020, and 100% of my personal investing centers, for the month, on Switzerland. Back in March and April, I loaded up on large positions in gold and Swiss francs – the most I have ever purchased over a similar period.

In 2009, Ron Paul wrote in End the Fed:

“Ending the Fed need not be in one bold stroke. We could transition towards the goal. There are many small steps we could take toward sound money. The power of the Fed to increase the money supply could be curtailed. The Fed could be restricted in its open market operations. We could, by legislation, deny authority to the Fed to monetize any debt. We could prohibit the Fed from participating in central economic planning.”

Dr. Paul warned, “The future looks bleak. The power elites are hunkering down, and there is no sign in Washington that anyone cares, listens, or understands the issue of money and the power of the Fed. There’s a rumbling in the heartland and anger is building.”

Ron Paul concluded back in 2009: “Freedom and central banking are incompatible.”

To help conservative investors organize themselves around the principles outlined in The Financial Armadillo Strategy, in 1987 I founded investment counseling firm Richard C. Young & Co.

Twenty-five years ago, our son Matt took on the day-to-day management responsibilities. Our daughter Becky joined the company back in the mid-nineties. Becky is today our Chief Financial Officer. Our son-in-law E.J. Smith (Your Survival Guy) is managing director and head of client contact.

Every client of our family investment counsel firm has daily access to family members. And every client has access to me every business day of the year. I respond to all client inquiries through either Matt or E.J.

In 2019 CNBC ranked our team in the top 10 of all U.S. financial advisory firms. (Richard C. Young & Co., Ltd. has never paid a fee to be considered for any rankings, but does pay a license fee to utilize them. Please click on the attached link to read the full disclosure).

Last year I suggested, a series of balanced debates is necessary between President Trump and Joe Biden. Were I the debates organizer, the first question I would ask Joe Biden is to explain the function of Fed open market operations and America’s need for a sound money policy. If those debates had taken place, I can’t imagine Biden would have been elected. His installation of Janet Yellen as his Treasury Secretary shows that he has little understanding of just how bad she did as Chairwoman of the Fed.

After having officially lost the election (Can you really believe 80 million people voted for Joe Biden, despite its statistical unlikelihood?), Donald Trump has decamped to Florida, and will now lead the GOP from there, for the time being. As perhaps his first official act as opposition leader, Trump will headline the CPAC annual conference. This could go one of two ways. If the version of Trump who showed up for the 2020 State of the Union gives the speech, the GOP will be propelled into a strong election cycle, with many victories to follow in 2022. If instead the rambling version of Trump who directed the late spring 2020 COVID-19 press conferences shows up, the party will require a retooling.

Whether Trump or some other patriotic American challenges Biden and the Democrats in 2024, the candidate must recognize the damage the Fed has done to the American economy. That candidate should put the administration on notice that the role of the Fed will be an issue at the 2024 debates, and make Biden publicly defend the Fed’s actions.

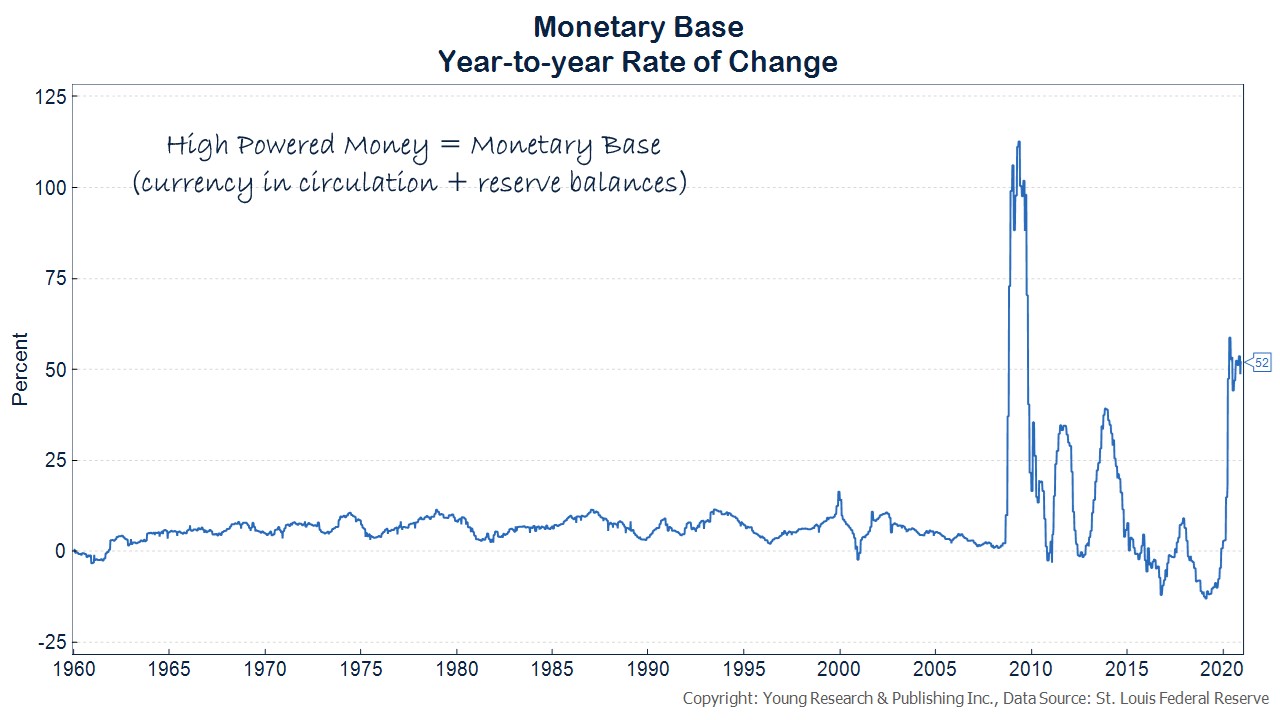

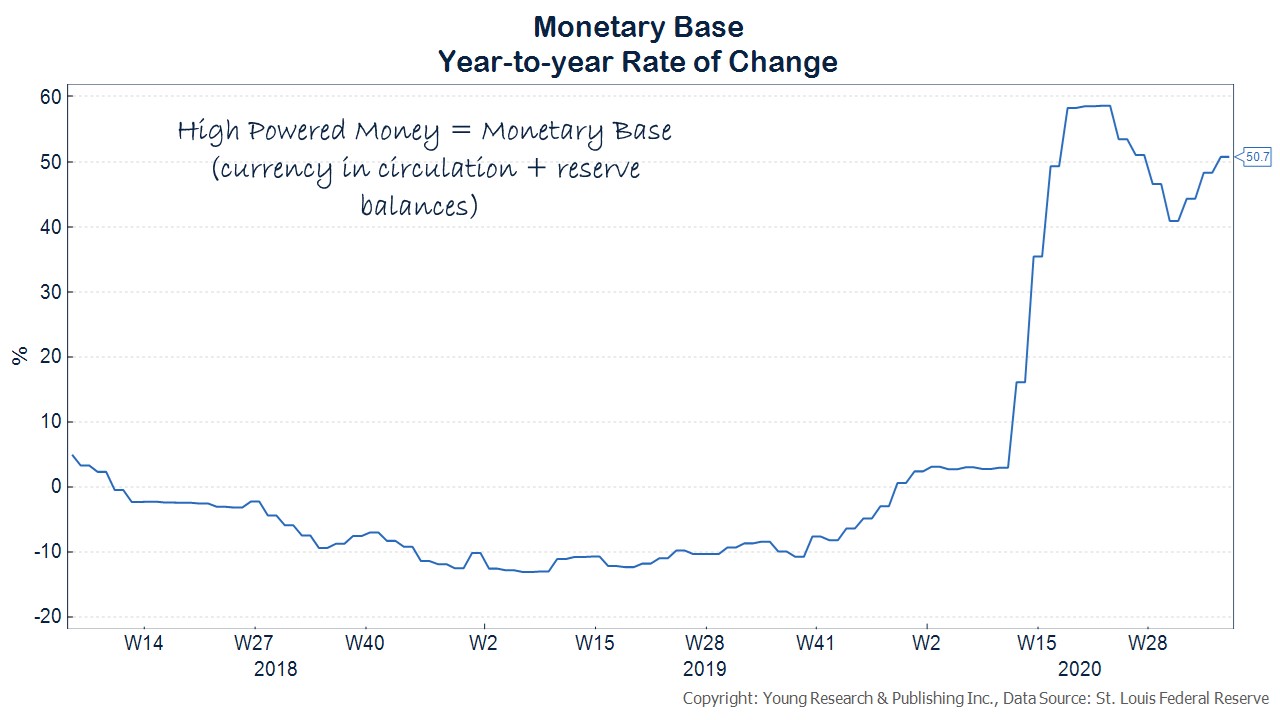

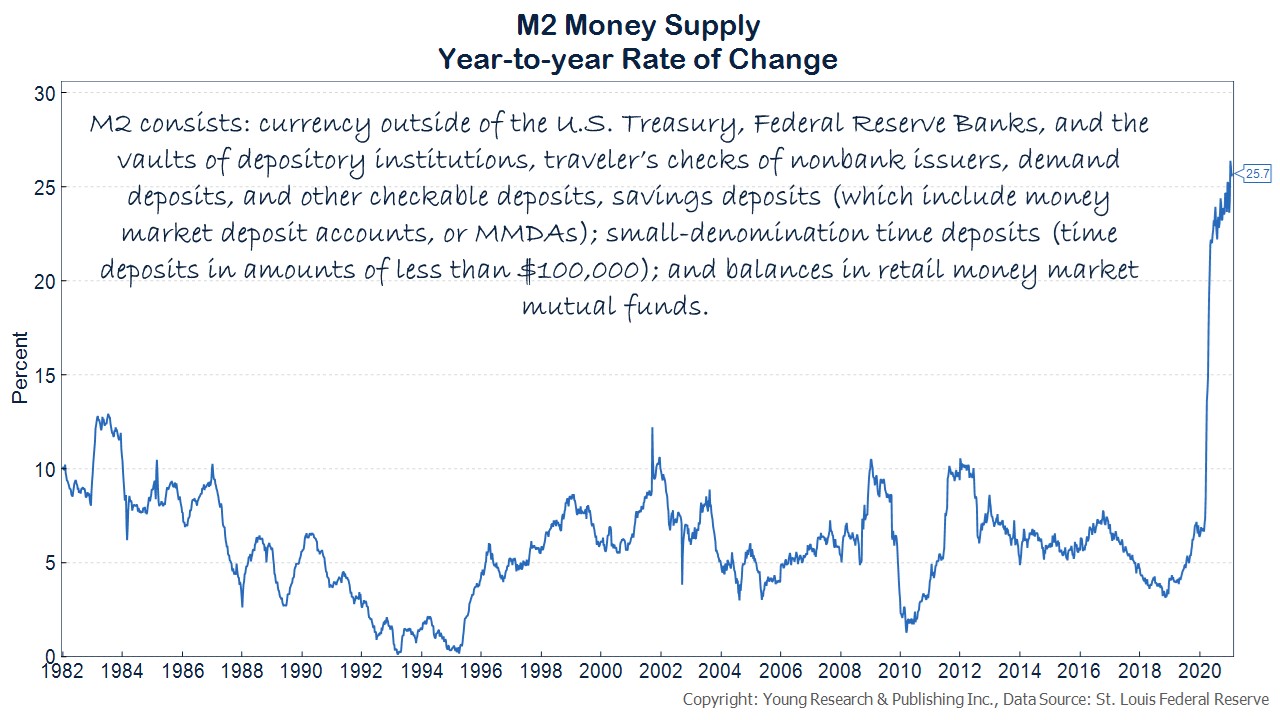

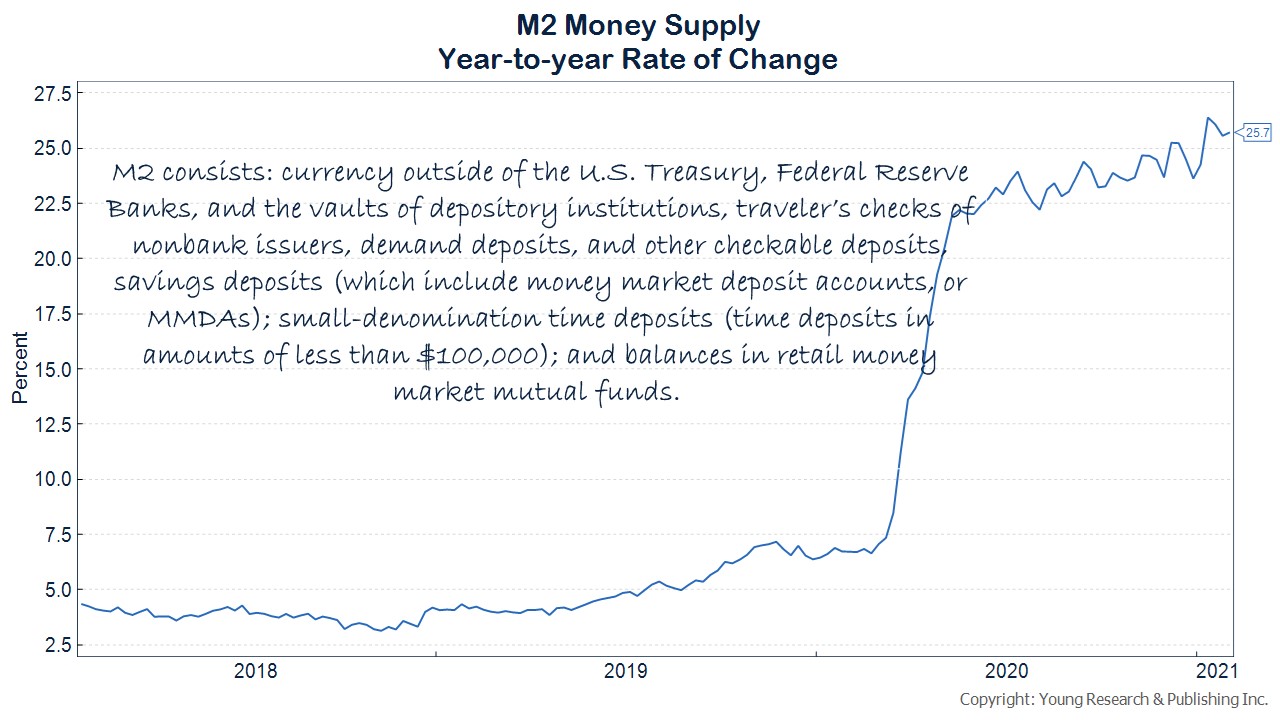

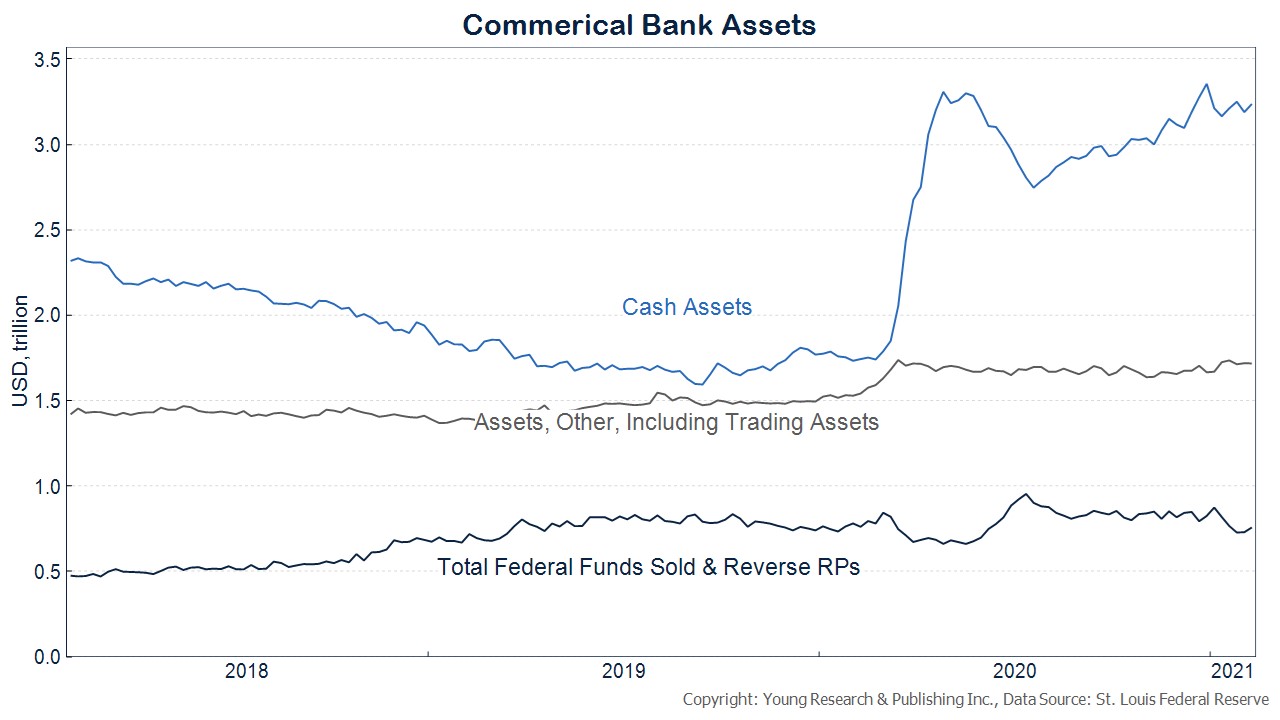

Anyone looking at the charts below can easily see how badly the Fed has mismanaged the economy.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.