America’s job-creation engine is its small businesses, and Joe Biden’s policies are strangling them. Carl J. Schramm reports in Specator World:

As a recession looms, policymakers have predictably turned to entrepreneurs to start new businesses and jumpstart the economy. While this may be a good political talking point, the fact is that new business formation has never shortened a recession or reduced its impact.

Some economists have looked to Covid to explain the unprecedented number of new businesses that sought IRS tax IDs during the pandemic. Washington’s touted “surge in entrepreneurship” is proving evanescent, however. Many individuals, facing economic lockdowns and the prospect of extended unemployment, decided to create businesses, often from home. Few of these companies will ever employ anyone except their founders — and rates of new business formation are already falling back to pre-pandemic levels.

Worse, the twenty-year trend of declining new firm foundation, year over year, continues to accelerate. Why? Because the administration’s economic policy has made starting a new business, always a challenge, even more difficult now.

The unprecedented government transfer payments — both stimulus dollars and unemployment — that buoyed the economy are running out. But the public debt incurred to fund these stopgap programs will burden the economy, slowing growth for decades to come.

The White House is working feverishly to control the political fallout in the midterm elections. Reductions in social spending are unlikely — the administration still talks of Build Back Better — and the Federal Reserve continues to be too timid in raising rates to dampen rising prices. The specter of long-term inflation has triggered a stock market sell-off that has destroyed trillions in household savings. Consumer sentiment has just hit a new low, and housing starts have fallen 14 percent this year as construction dries up.

Young businesses are in a worse spot than even during the Great Recession of 2007 and 2008. Global supply chains have delayed and raised prices on everything from computer chips to washing machines. As our ratio of public debt to GDP worsens, the cost of overseas production will grow as the dollar weakens.

Access to startup capital is also in decline. Bank loans to startups are practically non-existent — and venture capital investments in new companies were down 19 percent in the first quarter of 2022.

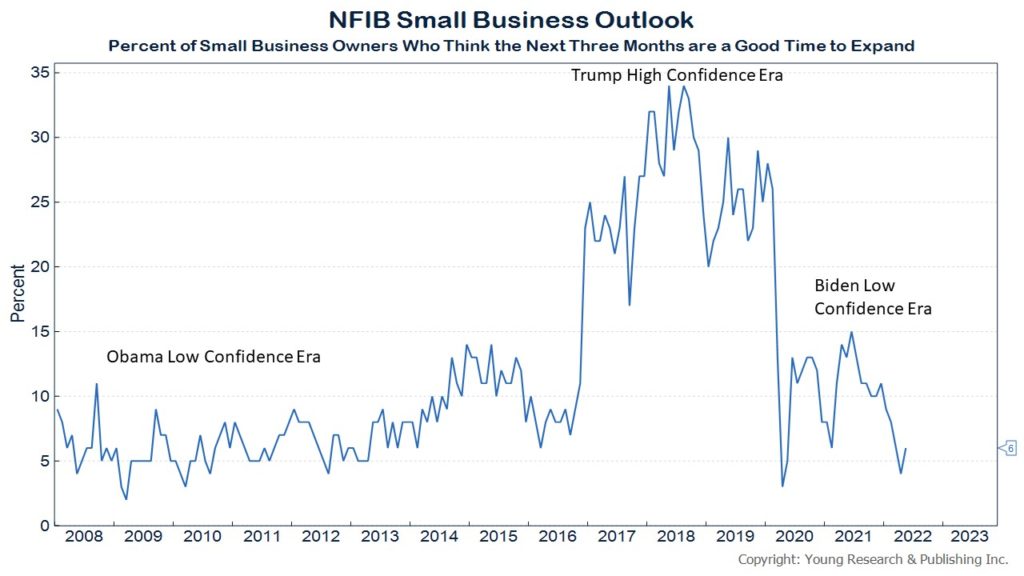

None of this is news to entrepreneurs and small business owners. In March, 88 percent of small business respondents to a Goldman Sachs survey said that inflation has worsened its bottom-line impact since January. Similarly, the National Federation of Independent Businesses reported that its Business Optimism Index among smaller firms had declined in May for the fifth consecutive month, reaching the lowest level in the Index’s forty-eight-year history.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.