President Barack Obama meets with Warren Buffett in the Oval Office, July 14, 2010. (Official White House Photo by Pete Souza)

Your Survival Guy loves dividends, as does Mr. Buffett. The key divergence from Warren Buffett’s Berkshire Hathaway stock is that Your Survival Guy likes getting paid on a regular basis with a tax-favored dividend payout. Berkshire, though, doesn’t pay out a dividend to shareholders.

Akane Otani writes in The Wall Street Journal:

What has made Warren Buffett’s stock portfolio so successful over time?

One answer is an uncanny knack for picking good businesses. Another, according to Mr. Buffett, is something more understated: an appreciation of dividend-paying stocks.

Dividend stocks are shares of companies that regularly return a portion of their earnings to shareholders, typically in the form of cash.

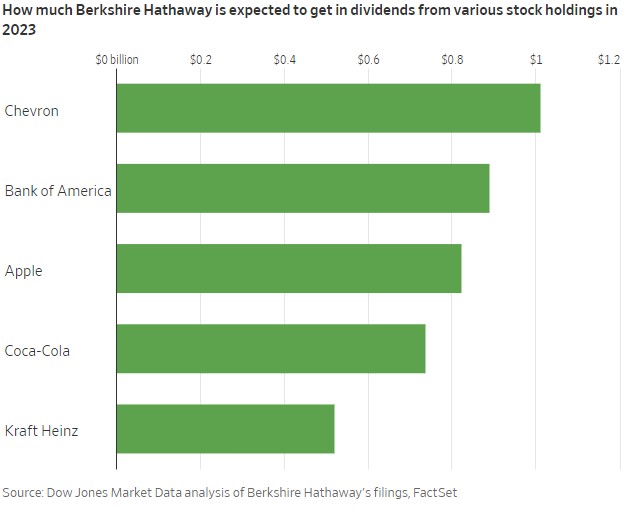

The majority of companies that Mr. Buffett invests in pay out dividends. In fact, this year Mr. Buffett’s Berkshire Hathaway is expected to rake in about $5.7 billion in cash from its stock portfolio, according to an analysis of company filings conducted by Dow Jones Market Data.

Nearly a fifth of that money will come from Chevron, which last year became one of Berkshire’s biggest stockholdings. The oil producer has increased its dividends for 36 consecutive years. Berkshire is also poised to collect more than $700 million apiece from Coca-Cola, Apple and Bank of America, more than half a billion dollars from Kraft Heinz and roughly $363 million from American Express, according to Dow Jones Market Data.

“That’s what he loves: dividends and buybacks,” said Todd Finkle, a professor of entrepreneurship at Gonzaga University and author of a book about Mr. Buffett’s career.

Where Mr. Buffett has excelled, Mr. Finkle said, is in choosing businesses that have been able to stand the test of time through many economic cycles—and raise their dividends, too. That has both increased the value of Berkshire’s stock portfolio over time and added to the ample cash pile Berkshire is able to put to use in its own businesses, as well as in acquisitions and share repurchases.

The company had $128.6 billion in cash and cash equivalents at the end of 2022, according to its last earnings report.

Action Line: If you’re seeking an income stream in retirement, then let’s talk about getting you some dividend religion.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.