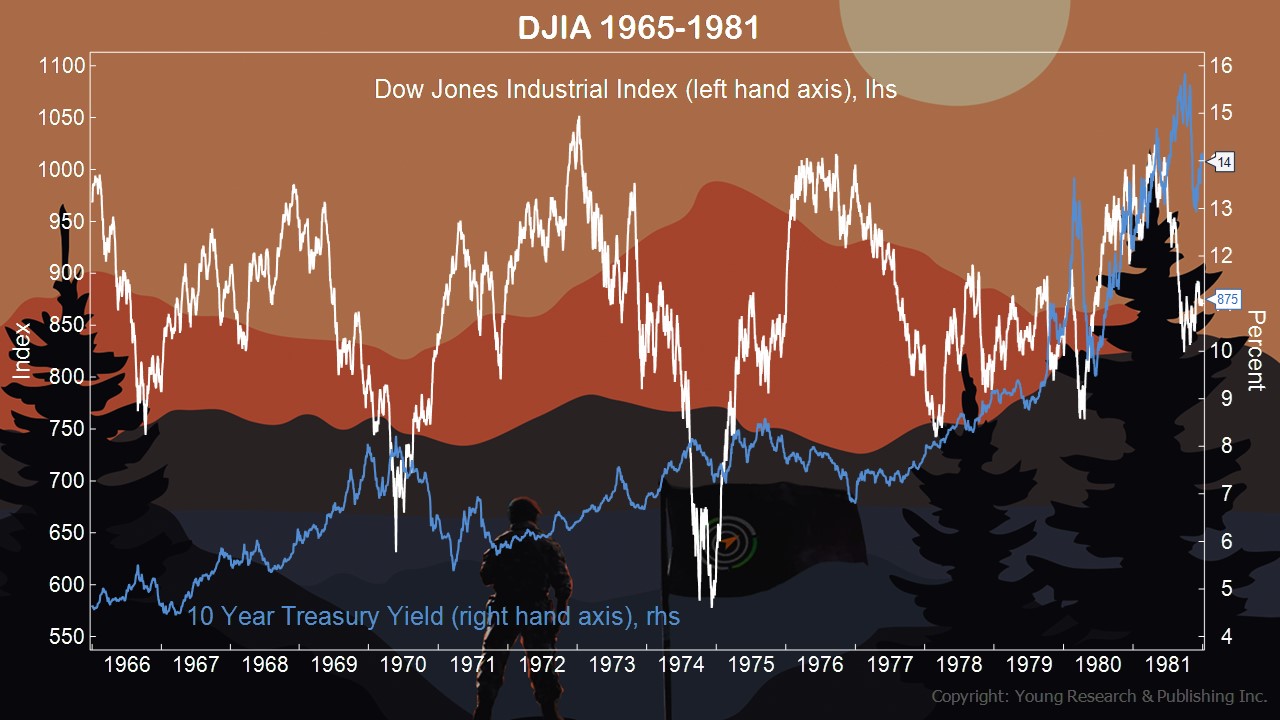

You want a forward-looking indicator? Look at the stock market or 10-year Treasury bond—both flashing warning signs this week. But how about years from now? What will the decades ahead—your retirement life—look like? What if we’re going back in time?

You and I, we’re in the business of patience. With so much attention paid to what the market did this week or who won last night’s game, it can be difficult to remember that investing is an endeavor in b-o-r-i-n-g. At least until you have enough to retire on, and then it’s fun.

Saving money takes time. Every day you’re taking baby steps toward your goals. Looking at the scoreboard, like checking social media, is short-term. It’s price checking. Emotional.

The question you asked me the most this week is, “Survival Guy, where are interest rates headed?” Good question. I know the thinking is higher. Because with all this debt and inflation, how could they not go higher? But what if, for example, the Fed gets its wish and cuts rates? And what if it stops issuing 10-year treasuries like it stopped issuing the 30-year back in 2001?

What if the government only issues debt with maturities around a couple of years so they can have more control? Wouldn’t that make existing treasuries maturing beyond a couple of years more valuable?

Look at the real estate market. America’s pastime. If mortgage rates reflect the 10-year Treasury, why keep it? Why not intervene (not that word again) and create a new mortgage rate based on some federal invention? A new acronym like the horrible twins Fannie and Freddie? Guaranteed low rates.

We just don’t know. And because of that, if your goal is to be able to live off the interest and dividends from your savings, don’t be too cute and think the yield curve is predictable. It’s not. Wouldn’t it be a shame if you didn’t lock in pretty good rates today by being greedy with too much in short-term holdings?

Action Line: Beat inertia. Save ‘til it hurts. Work with an advisor who’s a fiduciary. You got this. When you want help, I’m here.

But here’s the time travel lesson for today. Remember this?

NEW YORK (CNNmoney) – The U.S. government said Wednesday it no longer will issue 30-year Treasury bonds because they don’t meet the government’s cash needs and discontinuing them will save U.S. taxpayers money.

“We do not need the 30-year bond to meet the government’s current financing needs, nor those that we expect to face in coming years,” Peter Fisher, the Treasury Department’s Under Secretary for Domestic Finance, said in prepared remarks.

Fisher said the decision would cut borrowing costs, since the government currently pays a higher interest rate for long-term bonds than for short-term bonds.

“They’ve been moving in this direction for a couple of years, reducing the size and frequency of 30-year auctions,” said Bill Hornbarger, bond analyst at A.G. Edwards. “The big surprise is the timing, not the act itself. It happens in front of a couple of years where it looks like we’ll be running deficits.”

The price of the 30-year bond soared 5-10/32 points to 107-28/32 after the announcement, pushing its yield, which moves inversely to the price, down to 4.87 percent, the lowest in nearly three years, from 5.21 percent late Tuesday.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.