Your Survival Guy isn’t looking to turn over your apple cart. But with today’s yields, it would be a shame to miss the boat. Sometimes, the grass is greener. Let me explain.

Imagine you’re getting ready for a weekend. Your family is coming to visit. It’s peaceful outside. You have a few things to finish up, but all in all, you’re in good shape. Then it hits you. Like a solar storm without warning, you see it. The Friday email from Your Survival Guy. “Don’t open it,” you say to yourself.

Too late.

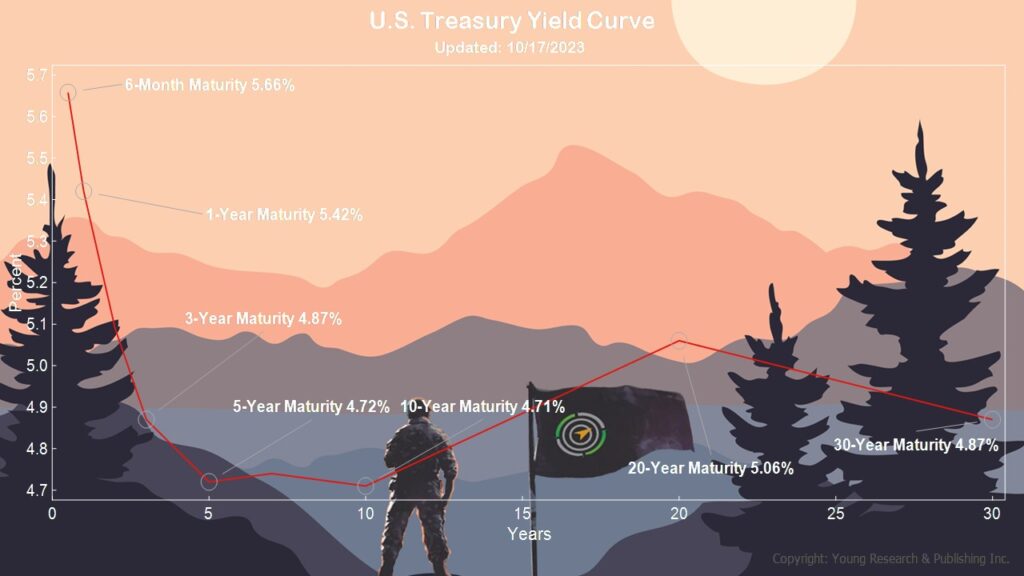

At dinner, you can’t stop thinking about it. Why did you open it? You didn’t want “yields you can sink your teeth into” dancing in your head while there’s so much food on the table and the family is laughing. You want to listen to their stories. You try to focus, but darn it, that short end of the yield curve and perhaps a longer stake sound great.

And maybe they are.

But that should not be your focus.

“Pass the apple pie,” they say as you come out of a trance.

Look, I’m Your Survival Guy, not some street vendor looking to upset your apple cart.

I want you to enjoy life not disrupt a good Friday night.

But we are seeing a tectonic shift in bond markets. If you own bonds, you should know exactly what and why. I hope you’re getting the attention you so desperately deserve.

You know I’m not a big fan of trading. I’m not just a buy-and-hold guy either. Markets are dynamic. I don’t want to be a stodgy investor. I don’t sell just to sell. I’m not a fan, for example, of selling a bond for pennies to buy another for a buck with a higher yield. That’s more like spinning your wheels.

Action Line: If you have lazy cash wandering aimlessly through the harvest fair, then maybe it’s time to see what’s out there. But don’t ruin a Friday night. I’m Your Survival Guy. Family first. Don’t get me in trouble. Let’s talk after the weekend.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.