A major publication is doing somewhat of an about-face on the virtues of balanced investing. As I mentioned, there have been a couple of foul balls lately in the form of articles with themes along the lines of “balanced investing is dead.” “Please stop,” I said to myself. “Is there a greater disservice to the long-term investor?”

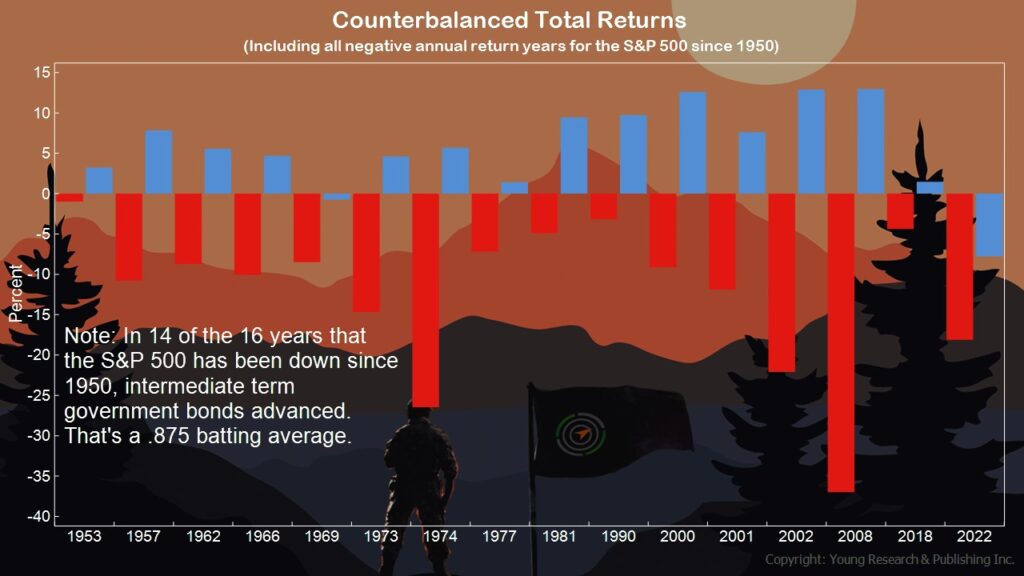

A wise man once wrote, in his strategy report, Richard C. Young’s Intelligence Report, about how savvy investors should invest within a framework of 70-30 of stocks and bonds, or vice versa. In my regular conversations with him, Dick Young, my father-in-law, he reminds me about that golden nugget of advice. “Survival Guy,” he says, “Allocation is the straw that stirs the drink.”

Whether you have a mix of Wellesley and Wellington or some other derivative of a balanced strategy, including Treasury Money Markets and a consumer stock fund, or individual securities and bonds, you’re a balanced investor.

What can be difficult is remaining balanced when prices are down. “How’s our money, honey?” can be a tough question to answer. Thankfully, you have Your Survival Guy to help explain.

Action Line: To all my balanced readers, sleep well(esley), be well(ington), and to all a good night. Let’s talk before the New Year, so you’re ready to go in 2024.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.