Wellesley Fund: Balanced Investing is Dead (Please Stop)

Happy Friday, Your Survival Guy needs to clear the air. Over the last couple of months, a major publication has done a disservice to balanced investors. You know, the investor I cater to who likes to sleep well at night, has saved ‘til it hurt, and is fairly wealthy.

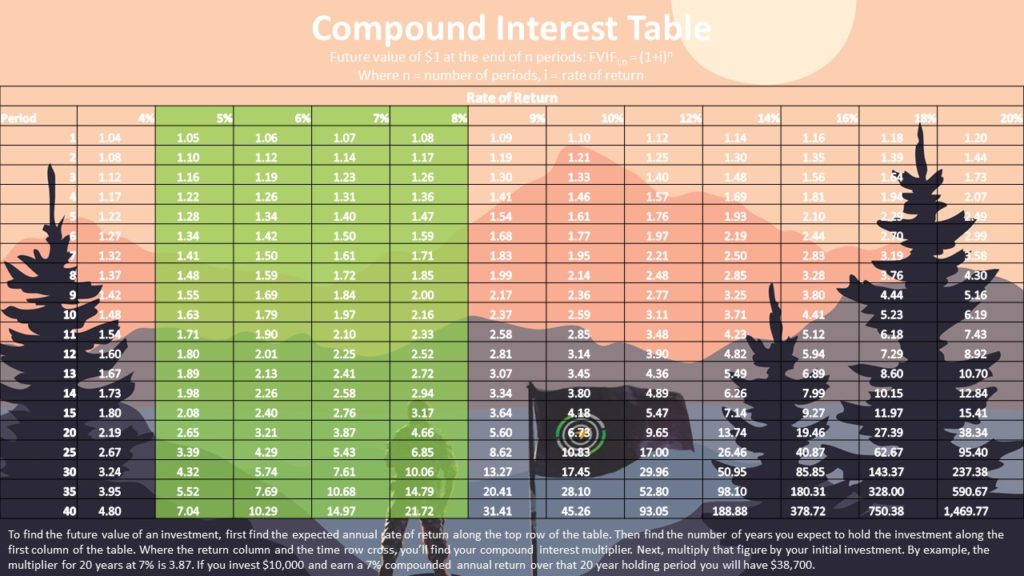

One of my favorite proxies for such a manner of investing is the Vanguard Wellesley fund. When I think balanced investing, this fund comes to mind, as does its brother, the Vanguard Wellington fund. Over the last ten years, Wellesley averaged 5.04% per year. And Wellington 7.63% per year.

Plug those numbers into my compound interest table below, and you quickly realize you don’t need to hit a home run every year to stay in the game. Balanced investing, like a balanced life, can take you a long way.

And what sells newspapers is not the same as what’s good for you, the investor. Because today’s newspaper is old by tomorrow, whereas balance never goes out of style.

Newspapers are focused on prices. What sells. It’s an emotional endeavor with headlines making you want to stay in bed all day. Prices are qualitative.

In contrast, balance investing is about steady income you can set your clock to. It’s quantitative. You can see the money coming into your account. You can spend it if you need to. That’s why you have it. The money, that is. Eventually, you’re going to need it.

I use Wellesley as a proxy, but there’s more than one way to be a balanced investor. Owning dividend-paying stocks and individual bonds is another. Yes, there can be some years when prices are down, but I can’t think of a better way for the long-term investor to sleep well(esley) at night.

Action Line: If you’re up in the middle of the night, count on Wellesley to put you back to sleep. Let’s talk.

P.S. Just beware of buying mutual funds, especially when you could buy a distribution you’ll owe taxes on. The best way to avoid the tax hit is to own in a tax-deferred IRA or retirement plan, or better yet, work with an advisor who can help you build a portfolio of individual stocks and bonds you own directly.

Click to enlarge.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.