Here’s why I don’t follow the meaningless price or market capitalization stock market averages, especially the likes of the Dow and S&P 500.

- The S&P 500 Index: only 50 of the biggest cap names account for more than 50% of the total S&P500 Index.

- The Dow 30: only 10 of the highest priced stocks account for more than 50% of the total Dow Jones Industrial Average.

No thanks to index investing in either the Dow or the S&P.

Dick Young’s Investment Rules

Why savvy investors saving for a long and comfortable retirement should always follow RCY’s guide in crafting balanced portfolios:

- RCY: I rarely invest in stocks that (1) pay no dividend or (2) have not increased shareholder payout for years.

- RCY: I don’t like companies with high P/E ratios. In fact, stocks with single-digit P/Es are most appealing.

- RCY: Consumer expenditures account for $7 out of every $10 of real GDP, so I use Vanguard’s broad Consumer Staples ETF portfolio as a handy shopping list for many of my individual stock purchases. This allows me to craft portfolios with an average yield of nearly 3%

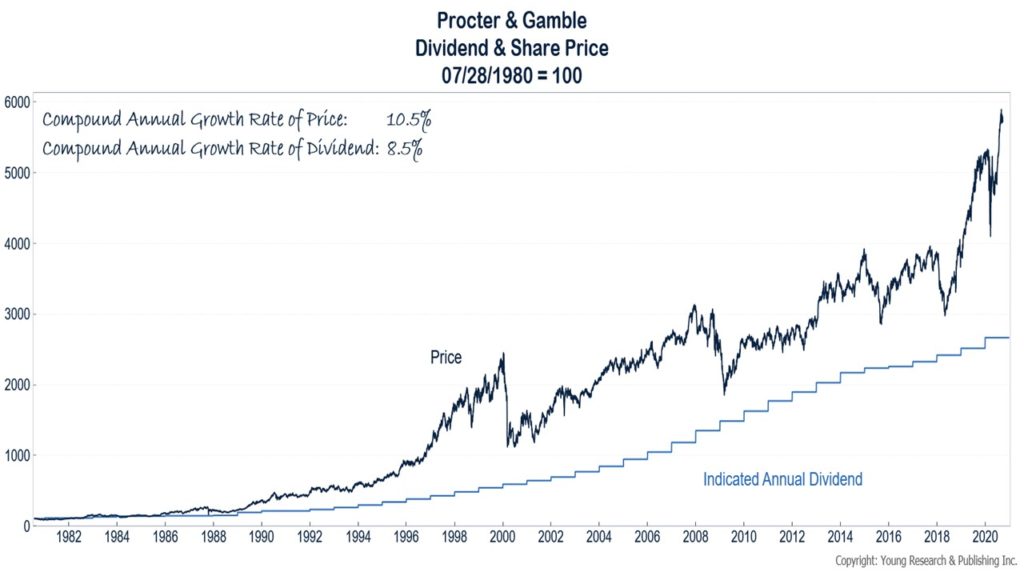

- RCY: I also insist on long-term annual dividend growth.

Over the long term, stock prices most often follow dividend increases upward.

Once you construct a conservative portfolio in a low interest rate environment like the one we face today, cash flow can be readily enhanced with a modest, replaceable draw from principal. By example, a client wanting a 4% annual portfolio draw can withdraw temporarily an additional 1% from principal annually.

Don’t forget, each year your portfolio receives more cash from increasing dividends, your yield on initial investment goes up. Talk about a winning hand.

Originally posted on Young’s World Money Forecast.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.