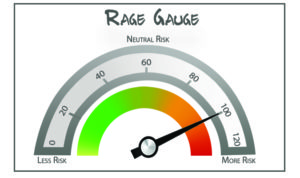

Throughout July, Americans signaled that they’re feeling more risk. Gold prices pushed higher, people bought more guns, and most frighteningly, dissatisfaction with the country jumped from 69% to 82%. It’s obvious the current political campaign is having an effect on people’s moods, and rightly so. No matter who you’re voting for, no one can deny this has been one of the most divisive, scandal filled, and partisan elections in memory. The RAGE Gauge remains at High Risk.

Throughout July, Americans signaled that they’re feeling more risk. Gold prices pushed higher, people bought more guns, and most frighteningly, dissatisfaction with the country jumped from 69% to 82%. It’s obvious the current political campaign is having an effect on people’s moods, and rightly so. No matter who you’re voting for, no one can deny this has been one of the most divisive, scandal filled, and partisan elections in memory. The RAGE Gauge remains at High Risk.

But politics isn’t the only thing creating risk. Deutsche Bank reported recently that the U.S. has a 60% chance of entering recession in the next 12 months. The yield curve has been flattening, and as analysts from DB point out, that’s traditionally a sign that recession is imminent. Fortune reports on DB’s announcement here:

“This relentless flattening of the curve is worrisome,” the team of analysts led by Dominic Konstam wrote, referring to the graph that plots bonds of different maturities against their yields. “Given the historical tendency of a very flat or inverted yield curve to precede a U.S. recession, the odds of the next economic downturn are rising,”

The difference between long-term and short-term interest rates are also likely to get even tighter. Following the U.K.’s decision to leave the EU, investors have flocked to “safe havens” such as gold and sovereign bonds. The 10-year treasury note hit a record low of 1.375% on Tuesday, while the 30-year closed at 2.155%, another record low.