Your Survival Guy wants your grandchildren to be as rich as Croesus. How can you help them do that? Get them on the path to riches by putting time on their side. It’s time that’s the key ingredient to compound interest. As Dick Young wrote to you back in July 2016:

How $10,000 Grows to $28 Million

I’m assuming each of my grandchildren invests $10,000 at age 25 with a goal of compounding that investment for either 30 or 50 years. Each will purchase 500 shares of a stock (at $20/share) with a long history of paying dividends and offering an initial 4% dividend yield. Using an early retirement age of 55 means 30 years of compounding. With all dividends reinvested, the end value would be $410,114, with a 30th annual dividend of $6,345.

But here’s the miracle of compounding. If allowed to compound for another 20 years, until age 75, the end value of the original $10,000 investment rounds off to … well, about $28,000,000. Yes, million.

I am assuming 10% long-term dividend growth (seven of this month’s Top 10 meet or beat 10%), and long-term capital appreciation of 6% (just a simple historical norm for stocks, nothing special). The annual dividend on the original 500 shares compounds to about $47,000 after 50 years. Not a bad increase from the first year’s $400-per-year dividend.

I made it a point to see that our children understood this math years before they began investing. And I am doing the same for my grandchildren. Regardless of the profession they choose, I have a high degree of confidence that each will achieve millionaire status. And I obviously do not think the job is terribly difficult.

Action Line: And for those children and grandchildren about to graduate from college, there’s no more important time to teach them the value of saving. You can help by giving them a free copy of my Special Report: How To Invest After Graduating College.

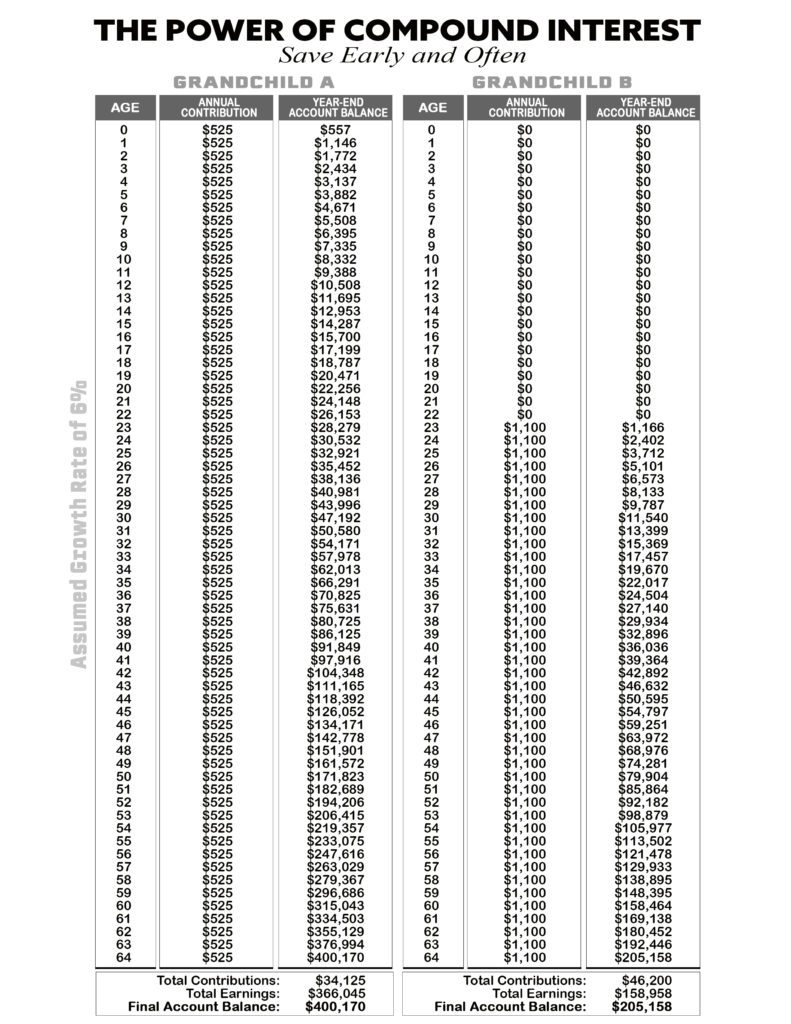

P.S. Look at my table below to compare her success to someone who begins his investment savings at age 22 at double the savings rate of your granddaughter, saving $1,100 each year. Even though he’s saving twice as much each year, when he turns 64 he’ll have half as much as your granddaughter simply because you helped put time on her side with your early generosity (I’ve used a long-term expectation for stocks of 6% growth per year).

So, how do you save money for your grandchild? Easy, put time on their side.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.