Although not official by any standards, a benchmark definition of a middle-class income is approximately $25,000 to $75,000 a year. Why the $50,000 gap? To take into account the cost of living between, say, San Fran and Des Moines, Iowa. So if you earn a middle-class income and a live in a state with high taxes, you probably face a total tax burden of nearly one-quarter of your income.

In a recent piece in NRO, the Cato Institute’s Michael Tanner writes about why the November mid-term elections turned out as they did: “American voters are clearly fed up with a government that demands ever more and more of their money.” In example after example, in red states and blue, voters have clearly said enough is enough, but, as Mr. Tanner asks, “Is anyone listening?” Read more here.

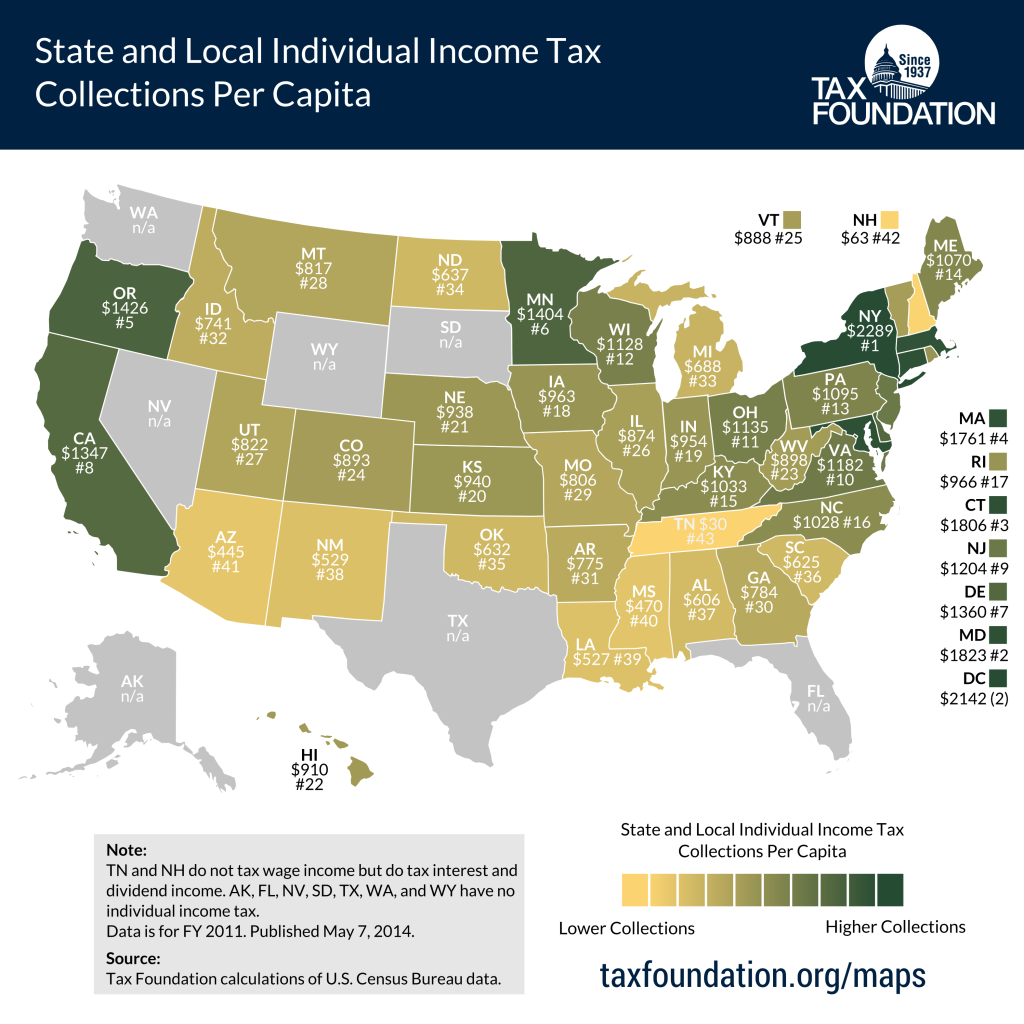

Related map:

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.