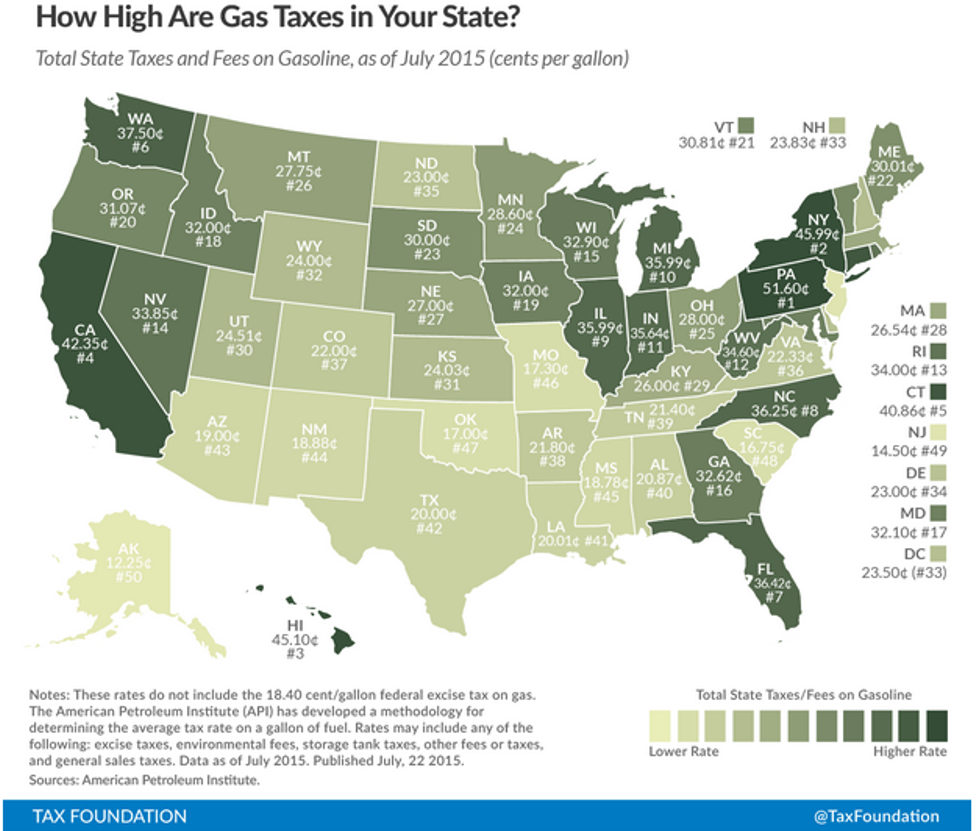

Richard Borean of the Tax Foundation recently updated the organization’s Gas Tax Map. Take a look at just how much per gallon you’re paying to your local governments. In some cases it’s a hefty proportion of the price.

Borean wrote:

Pennsylvania has the highest rate of 51.60 cents per gallon (cpg), and is followed closely by New York (45.99 cpg), Hawaii (45.10 cpg), and California (42.35 cpg). On the other end of the spectrum, Alaska has the lowest rate at 12.25 cpg, but New Jersey (14.50 cpg) and South Carolina (16.75 cpg) aren’t far behind. These rates do not include the additional 18.40 cent federal excise tax.

Gas taxes are generally used to fund transportation infrastructure maintenance and new projects. While gas taxes are not a perfect user fee like tolls, they are generally more favorable than other taxes because they better connect the users of roads with the costs of enjoying them. However, many states’ and the Federal government’s gas taxes are not adjusted for inflation and therefore do not respond to price changes. Over time, a nominal gas tax rate will decline in real terms, while the costs associated with funding roads will increase with inflation. This has been a contributing factor to the insolvency of the federal Highway Trust Fund, which runs out of funds at the end of this month.