The economy looks like it may be floundering again. What has all the stimulus bought for Americans? All the debt that has been piled on ($1.3 trillion in deficit spending this year alone, according to new CBO figures) has served to make future generations poorer, but done nothing to alleviate the problems of the here and now.

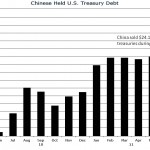

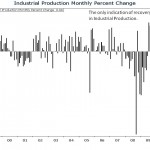

This week, the number of Americans seeking unemployment benefits jumped up to 500,000 (after seasonal adjustments). That’s the highest number in eight months. The jobless claims aren’t the only bad information coming from the market. The number of new housing starts was lower than expected, prices for producers grew, homebuilders are depressed in their outlook, the Chinese are selling American debt, and manufacturing index reports from New York and Philadelphia were poor (and that’s putting it gently for the Philly index). Only one major indicator of economic strength was a positive sign this week: the industrial production report was up 1%. That was better than most economists expected it to be.

- Chinese Treasury Holdings

- Homebuilder Confidence

- Housing Starts

- Industrial Production

- Jobless Claims

- New York Business Index

- Philly Business Index

- Producer Prices

It would seem that the administration’s continuous mantra, “recovery is upon us,” was just so much more politi-speak. The Democrats, including the president, are doing anything they can to simply make it through November. A wave of bills designed to be gifts to special interests is about to crash on Capitol Hill as soon as the August recess ends. Congress is writing bills to bail out private union pensions and to gift $30 billion of your tax money to banks.

The problem with the bailout mentality is that it doesn’t allow the market to correct itself, further extending the amount of time it will take to come out of the recession. Congressman Ron Paul outlines in his excellent book End the Fed that the more the government tries to dilute the symptoms of a market downturn, the longer and more painful that downturn will end up being. He says that AIG and Goldman Sachs should have been allowed to follow Lehman Brothers into bankruptcy if they were insolvent on their own, and that the bankruptcies would have had less effect on the general public than the taxes and inflation that will be needed to make up for the bailouts that kept these companies alive.

As much as Democrats would like Americans to think that bailouts are a gift Congress is giving to them, it’s really the other way around. Bailouts are money taken from Americans and given to special interests to buy votes and campaign contributions. Money that is borrowed from China today is stolen from the next generation of Americans. Someone will have to pay for the largesse of the past two decades; Americans have to choose whether it will be them or their children.