Do you live in a right-to-work state or a non-right-to-work state, where compulsory membership in a union can legally be a condition of employment? Is your state’s income-tax rate competitive with those of neighboring states—or the rest of the country, for that matter? Is your state adding residents or losing residents? And are you getting the best bang for your buck from the taxes you pay to your state?

Do you live in a right-to-work state or a non-right-to-work state, where compulsory membership in a union can legally be a condition of employment? Is your state’s income-tax rate competitive with those of neighboring states—or the rest of the country, for that matter? Is your state adding residents or losing residents? And are you getting the best bang for your buck from the taxes you pay to your state?

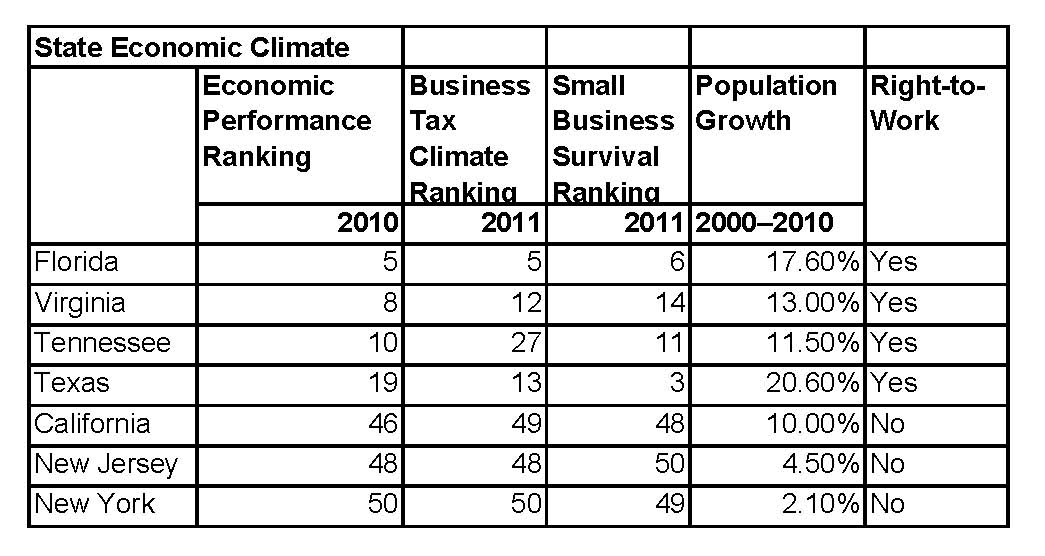

Richard Rahn, senior fellow at the Cato Institute and chairman of the Institute for Global Economic Growth, writes in The Washington Times, “The United States is a federal republic, wherein the Constitution gives most governing powers to the states, not Washington. The beauty of this system is that the states can experiment to determine which policies and government structures work and which don’t.” He shows the following table ranking seven of the major states based on information from various organizations, such as the Tax Foundation and the National Right to Work Legal Defense Foundation (see “sources” for table).

Sources: American Legislative Exchange Council, Tax Foundation, Small Business and Entrepreneurship Council, U.S. Census Bureau, National Right to Work Legal Defense Foundation.

In America you can choose the state in which you live and work. According to the census report for the last 10 years, Americans prefer to live and work in states that are open for business, like Florida, Virginia, Tennessee, and Texas. They avoid states that are unfriendly to business, like California, New Jersey, and New York, where living with the depressed results shown in the table above must be like living in another country.