Earlier in the week, I posted on how Donald Trump legally avoided paying taxes. According to Mr. Trump’s biggest, unbiased fan, The New York Times, President Trump did nothing illegal or inappropriate.

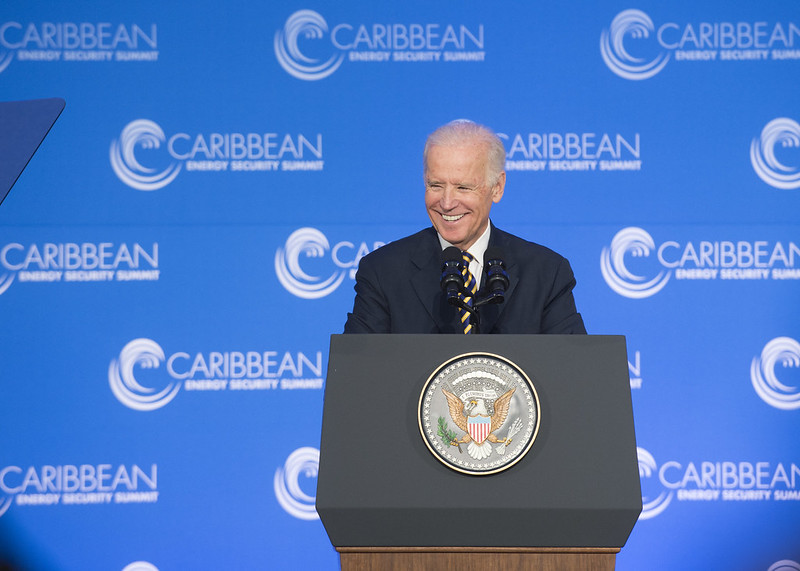

President Trump is not the only presidential candidate to have taken advantage of the tax code to avoid paying taxes. Here’s how Mr. Biden and his wife dodged paying taxes that fund ObamaCare:

Joe and Jill Biden, who did pay federal income taxes on all their earnings, avoided “payroll taxes on the portion of income characterized as corporate profits—$228,703 in 2019, and a total of more than $13.5 million since. Mr. Biden left office in 2017. All told, the Bidens have avoided paying more than $513,000 in payroll taxes,” reports Chris Jacobs in the WSJ.

I (Jacobs) reported in August that in 2017 and 2018 Mr. Biden and his wife, Jill, characterized large amounts of book and speaking income as corporate profits rather than taxable wages, allowing them to circumvent Medicare and ObamaCare payroll taxes, of 2.9% and 0.9% respectively, on that income. The Bidens released their 2019 tax return before the debate, and again they use this dodge.

Center for American Progress 2019 report:

“The current tax code allows many high-income individuals to avoid Medicare taxes on their business income (including, in some cases, labor income that is mischaracterized as business profits).”

Another CAP report said that closing such “loopholes” would “raise close to $300 billion over 10 years.”

In attributing Mr. Trump’s tax maneuvers to the Tax Cuts and Jobs Act, Mr. Biden stretched the truth, continues Mr. Jacobs.

It didn’t take effect until 2018, and the Trump tax returns covered in recent press reports go up only to 2017. But the act did repeal ObamaCare’s individual-mandate penalty, a regressive tax on the uninsured.

In the past three years, meanwhile, the Bidens avoided paying $121,000 in ObamaCare payroll taxes alone.

Joe Biden vigorously defends the Affordable Care Act, promising to “expand ObamaCare. He also faults the President for supporting a legal challenge to it, declaring in a campaign ad: “ObamaCare is personal to me.”