Jerome Powell and the Federal Reserve Open Market Committee (FOMC) have slowed the pace of interest rate increases to 25 basis points. Nick Timiraos reports in The Wall Street Journal:

The Federal Reserve nudged up short-term interest rates by a quarter-percentage point and signaled it was on track to do so again at its meeting next month while officials consider whether and when to pause increases late this spring.

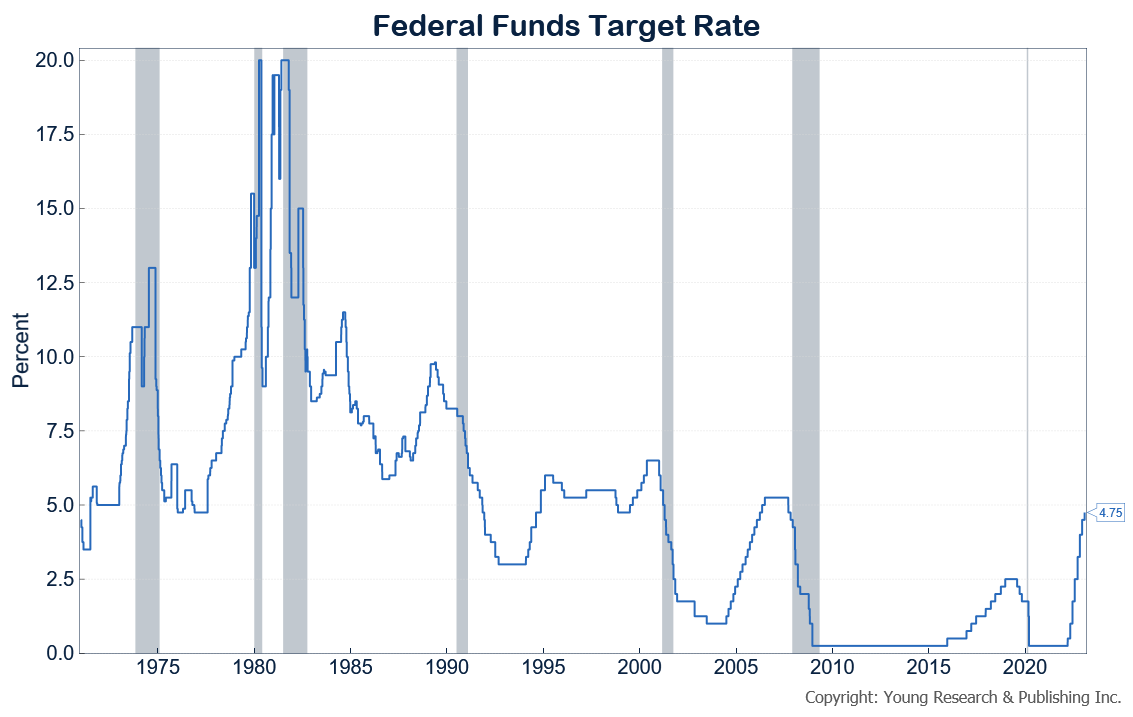

The decision Wednesday to raise the Fed’s benchmark federal-funds rate followed six larger, consecutive increases to combat inflation, which hit a 40-year high last year. Officials raised rates by a half point in December and by 0.75 point in November.

Officials agreed to slow rate rises to gain more time to study the effects of their moves. “We’re talking about a couple of more rate hikes to get to that level we think is appropriately restrictive,” Fed Chair Jerome Powell said at a news conference after the central bank’s policy meeting.

Despite signs that wage and price growth might have peaked several months ago, “We’re going to be cautious about declaring victory and sending signals that we think that the game is won,” he said.

Investors welcomed the decision, with the S&P 500 closing up about 1%, to 4119.21, while the Nasdaq Composite advanced by 2% to 11816.32. The Dow Jones Industrial Average rose 6.92 points to 34092.96. The yield on the benchmark 10-year U.S. Treasury note declined to 3.398% from 3.527% the previous day. Yields fall when prices rise.

The latest increase caps a year in which the Fed lifted the fed-funds rate from near zero to a range between 4.5% and 4.75%, a level last reached in 2007, extending the central bank’s most rapid interval of rate increases since the early 1980s.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.