Your investment success or failure may come from how you invest, not necessarily what you invest in. As you know, the pangs of pain from losing money far outweigh the euphoria of making it. We are human. We like to win. We hate to lose. Why, then, do we tend to invest in areas that are going up instead of areas that are going down and offer good “value?” FOMO or fear of missing the boat?

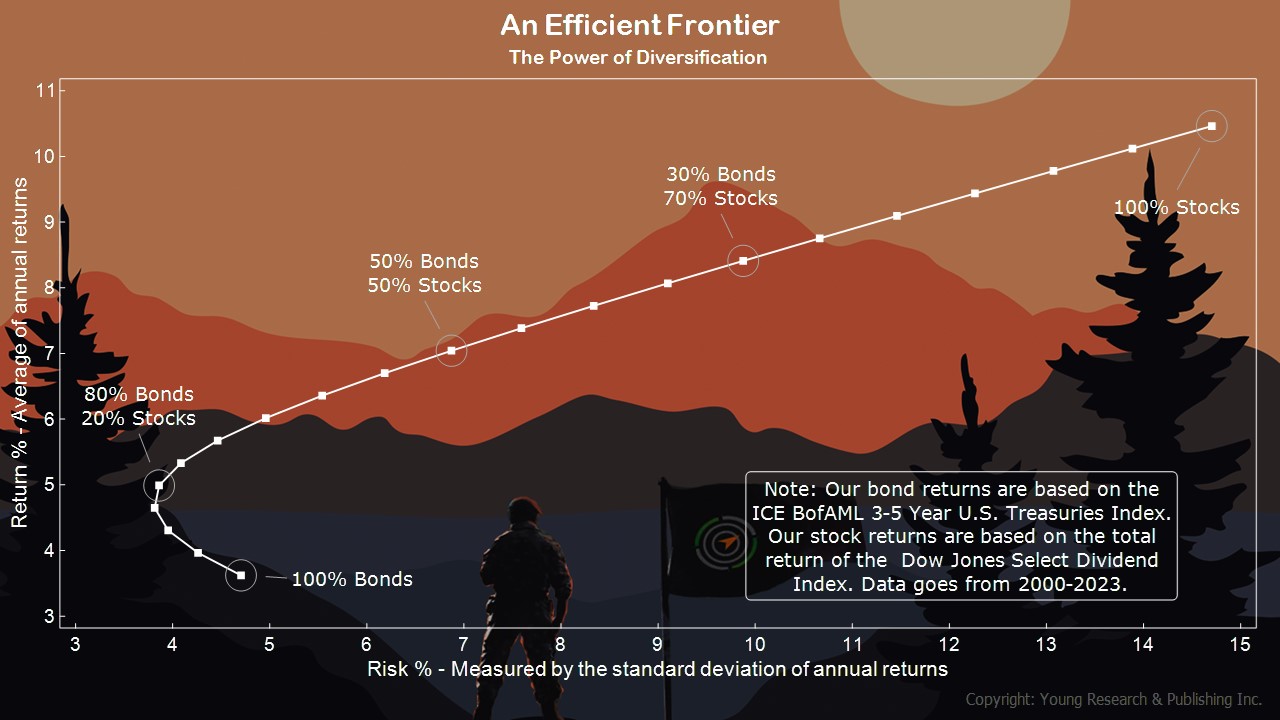

To understand risk and reward, I’ll point you to the efficient frontier. The Efficient Frontier, created by Harry Markowitz in 1952, measures the efficient diversification of investments that delivers the highest level of return at the lowest possible risk. Note that in my efficient frontier example above, I’m using a diversified, dividend-oriented stock index and a shorter-term bond index spanning 3-5 year maturities—one or two stocks are not diversified, nor are a bond or two. Also worth noting is that this comparison begins this century, one that has been manipulated by an interventionist Federal Reserve beginning with Mr. “Irrational Exuberance” Greenspan, then Mr. “Helicopter Ben” Bernanke and the others to follow.

In my conversations with you, we talk about asset allocation. We talk about bonds—an area that tends to be woefully underrepresented like a Main Street voter and equities that are represented in index funds controlled by the big three asset managers, Vanguard, BlackRock, and State Street, who vote your shares for their political gains. Once a passive way to invest, indexing is now like a powerful PAC for the 800-lbs. gorillas.

Action Line: Run your finger along my efficient frontier and see where you would have felt most comfortable. When you’re ready to talk, let’s talk.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.