You may have noticed the food and beverage industry needs workers. Like, right now. You can expand that out to most businesses in the service industry. Your Survival Guy will place the blame on big government unemployment checks and on the lockdowns freaking people out.

Case in point, we escaped to the city this weekend to meet friends, and when the sun went down, it turned into a ghost town. No taxis, no Uber, which is basically operating with on-and-off strikes. Why? Because the governor isn’t allowing them to charge higher prices when demand surges. According to him, the city’s still in a state of emergency. So what is everybody doing? Trading stocks.

According to JP Morgan Chase & Co., and the Federal Reserve, as reported in the WSJ, stockholdings among U.S. households increased to 41% of their total financial assets in April, the highest on record—that’s going back to 1952—and includes 401(k) retirement accounts. Think about that, especially when the largest financial asset tends to be one’s home—another untethered “asset.”

Investor enthusiasm is sky-high with low volatility as the S&P 500 has hit 25 records so far this year. Stimulus checks and a speedy economic recovery are fueling investors to make “bets” on the market. These “long-term” investors are buying the dips and hanging on for a ride that can get pretty wild and change direction on a dime. What do the experts think?

How about this comment: “In order to achieve our clients’ goals, we need to take on more risk,” says he. “We intend to continue to reallocate into risk assets while interest rates stay this low.” What does that tell you about the steward for your money?

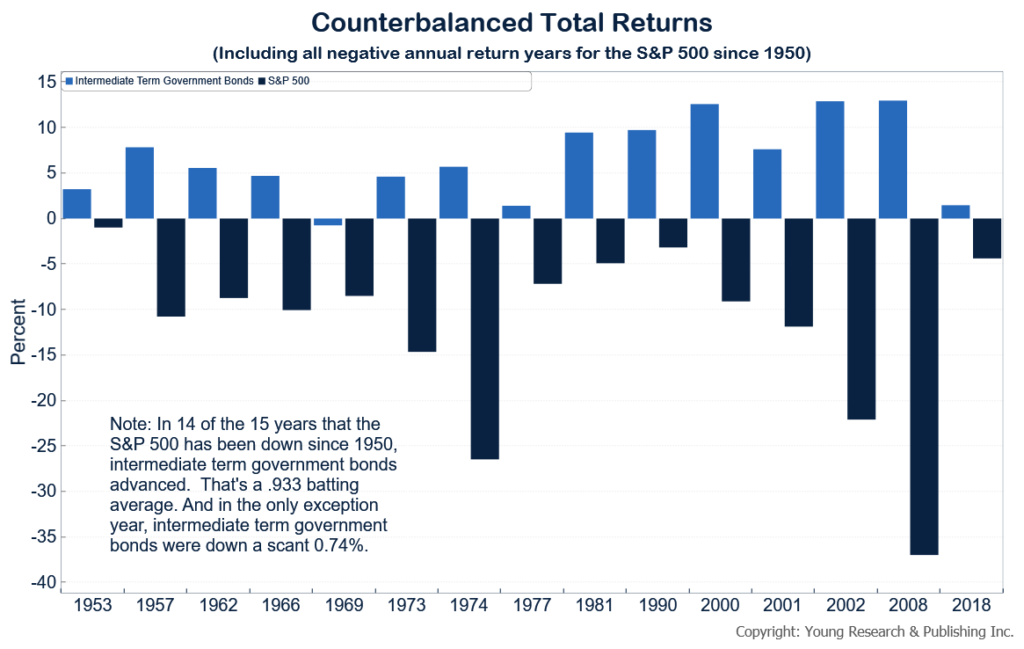

From the same WSJ article: “A survey by the American Association of Individual Investors showed that investors’ allocations to the stock market hit around a three-year high of 70% in March. And margin debt—or money that investors borrow to buy securities—stood at a record as of March, Financial Industry Regulatory Authority figures show.” In other words, investors are eschewing a properly balanced portfolio at their own peril. Look at the chart above for why counterbalancing NEVER goes out of style.

Action Line: Records are meant to be broken. Don’t forget they can cut both ways as this market continues to float away. You need to get serious in times like these. Inertia is your biggest enemy, and you need regular prompting to defeat it. Click here to sign up for my free monthly Survive and Thrive newsletter, and I’ll help you beat inertia and achieve your goals. But only if you’re serious.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.