Coronavirus Infects Stock Market: Part XXVI

Before you dig into my latest RAGE Gauge™, let’s spend a few minutes defining the coronavirus pandemic:

It has been way harder for some than it needed to be.

I’m not talking about the poor. I’m not talking about those who are living paycheck to paycheck, either. Unfortunately, for a large swath of Americans, a $1,000 shock to monthly income is devastating. That may never change.

The group I’m talking about is, perhaps, the fifth of you who have savings: the wealthy, the upper-middle class, the middle-class, the doctors and lawyers and such. You’ve been able to create a nest egg and put some money aside for times like these.

You have come to yoursurvivalguy.com because you know how the good times don’t always roll and, in fact, can change into something you don’t exactly recognize.

It’s happened three times already this century (2000 tech bust, 2008 real estate crash, and the 2020 virus).

It will happen again.

You see the volatility. You see the rush for cash. It never ceases to amaze me how unprepared investors are, how short their memories are, and how hard this is for too many investors.

You’ve read in my father-in-law’s newsletter Richard C. Young’s Intelligence Report how to protect your ass-ets. In 2012 Dick wrote:

I have mentioned devoting 1% of your liquid net worth to personal security. This is but a starting point. After a detailed and realistic risk analysis, most investors, and certainly the wealthy, will be looking at a much bigger number. I look at financial security and personal security through the same analytical lens, which I advise for you and your family. Evaluate risk and downside, and take all defensive action possible. Let good news and upside take care of itself.

You can put this message on your fridge. Understand your risk tolerance, your emotions—like you know your family—and you’re on your way to understanding a lot about investing.

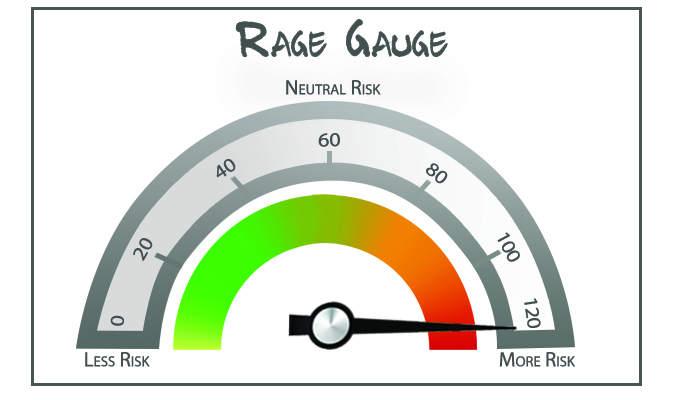

OK, on to my RAGE Gauge™. The purpose of my RAGE Gauge™ is to give you a back of the napkin gauge of what I’m seeing in terms of emotions in the markets and society, because emotions, as you know, are no friend of the prudent investor.

As Adam Smith wrote in “The Theory of Moral Sentiments” (1759):

The prudent man always studies seriously and earnestly to understand whatever he professes to understand, and not merely to persuade other people that he understands it; and though his talents may not always be very brilliant, they are always perfectly genuine. He neither endeavours to impose upon you by the cunning devices of an artful impostor, nor by the arrogant airs of an assuming pedant, nor by the confident assertions of a superficial and impudent pretender. He is not ostentatious even of the abilities which he really possesses. His conversation is simple and modest, and he is averse to all the quackish arts by which other people so frequently thrust themselves into public notice and reputation. For reputation in his profession he is naturally disposed to rely a good deal upon the solidity of his knowledge and abilities; and he does not always think of cultivating the favour of those little clubs and cabals, who, in the superior arts and sciences, so often erect themselves into the supreme judges of merit; and who make it their business to celebrate the talents and virtues of one another, and to decry whatever can come into competition with them. If he ever connects himself with any society of this kind, it is merely in self-defence, not with a view to impose upon the public, but to hinder the public from being imposed upon, to his disadvantage, by the clamours, the whispers, or the intrigues, either of that particular society, or of some others of the same kind.

Unlike the prudent investor, the emotional one has no direction, and wreaks havoc in the markets. He’s at the helm of this one and Americans are acting accordingly. Gun sales are up, rates are nailed to the floor, government malfeasance is at an all-time high, and the yellow-metal is glowing.

My Rage Gage™ reflects it all. Take that as a warning, or perhaps, a buying opportunity because you, my loyal reader, are in the catbird seat.

Read my entire series, Coronavirus Infects Stock Market here.

Originally posted on Your Survival Guy.