You may have read the recent WSJ article on the perils of the 60/40 portfolio model, where 60% is stocks and 40% is bonds. Don’t believe it. Because what the article fails to mention is the arithmetic of losses and the emotionalism of investing. But first, let’s get into your spending habits.

Spending is one of the more difficult tasks an investor faces, and if interest rates decline, it doesn’t make it any easier to do. One exercise you want to do is to keep track of your spending. Understand your monthly, yearly, and three-to-five-year costs. This is not rocket science; it just gives you a better feel of what you spend money on, and yet it can also be a moving target.

Back to the WSJ article for a minute. What the article doesn’t get into is how long-term investors like Warren Buffett can hold 90% of their assets in stocks. News flash: WB’s 10% in cash or bonds is larger than the entire portfolio of the one percent of the one percent. He’s got some wiggle room. But for Main Street investors, it’s the anchor to windward of bonds that helps them get through disastrous stock corrections.

As Ben Graham advised, investors should have a 70-30 mix of stocks-bonds or somewhere in between, but not less. Because when stocks fall, someone is selling and putting downward pressure on prices. But if you have income coming in from dividends and interest, you may be able to ride out the storm better than the investor who owns 90% in stocks.

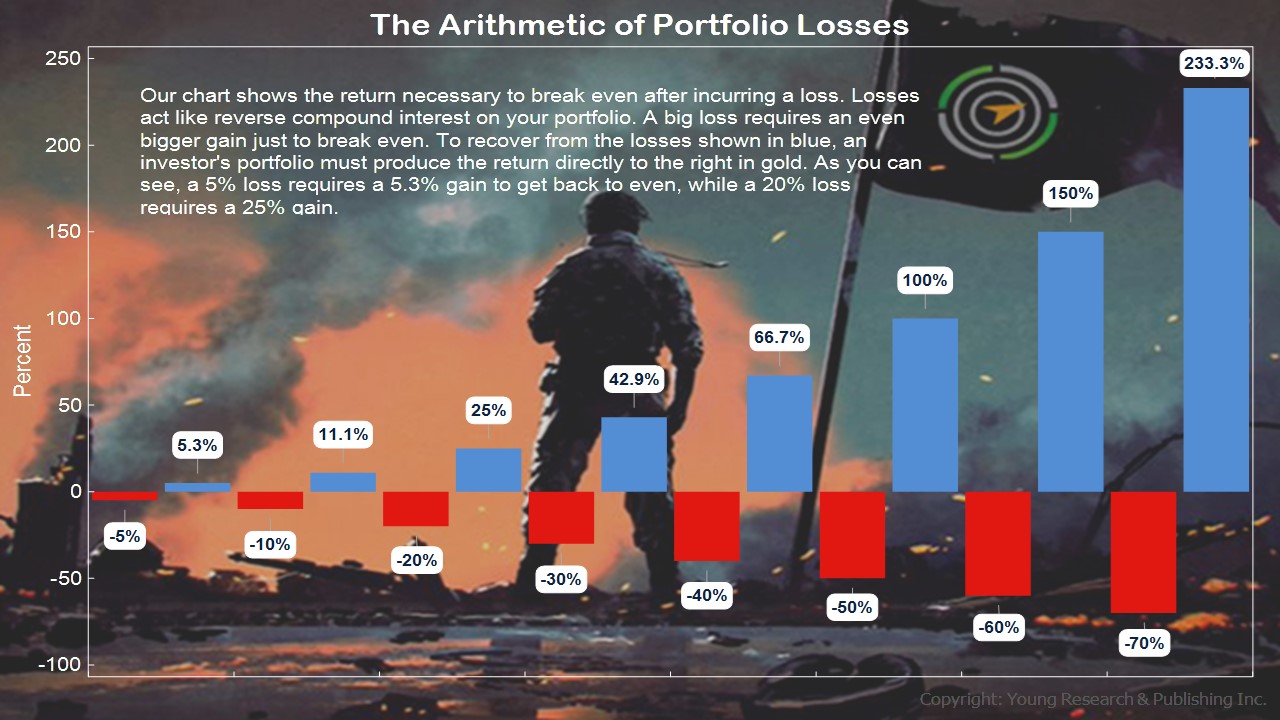

Action Line: Remember the emotional side of price declines in stocks can make investors uneasy and create momentum in the wrong direction. A balanced portfolio can help weather the ups and downs of stocks. When you want help building a balanced portfolio, I’m here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.