Back in October of 2006, as the crest of the Housing Bubble was forming, I remained doggedly attached to my principled investment strategy of diversification and compound interest. That month I encouraged readers to build a “volatility barricade.” Here’s what I wrote (with updated numbers to reflect the intervening years):

Your Volatility Barricade

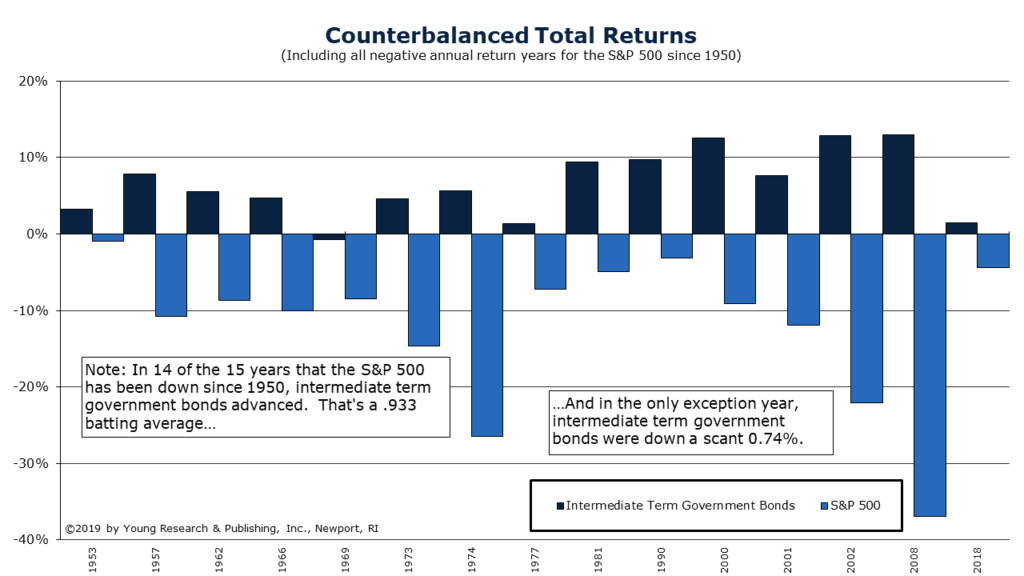

Your portfolio’s fixed-income position does two things for you. (1) It either throws off cash for you to spend at Ace or True Value (not Wal-Mart or Home Depot) in retirement or, instead, allows your interest to compound in an IRA. (2) Your fixed income holdings (short and medium term) will most often zig when stocks zag. You benefit with a counterbalancing teeter-totter. Please [refer to the chart below]. Here you will see that since 1950, in 14 of the 15 years that the S&P 500 has been down, intermediate-term government bonds advanced. That’s a .933 batting average. And in the only exception year, intermediate-term government bonds were down a scant 0.74%. Nice counterbalancing, wouldn’t you say?

If you had built yourself a volatility barricade in 2006, it is likely you managed the bursting of the housing bubble with fewer gut-wrenching swings in your portfolio’s value. I encourage every reader to incorporate fixed income into his portfolio, today.

Originally posted on Young’s World Money Forecast.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.