In the November issue of Richard C. Young’s Intelligence Report, Dick Young writes:

The Fed has sat on its hands throughout the duration of the current business cycle recovery from the financial crisis. In my five decades in the investment industry, there has not been a period where the Fed has refused to increase rates during an extended economic rebound. As I have been writing, we are now in the winter stage of the economic cycle. Gauges of employment momentum indicate that the cyclical upturn now has nowhere to go but down. Yet the Fed and the White House Council of Economic Advisors appear to be taken aback by September’s monthly rotten jobs report–the second in a row. Look, in any cyclical business recovery, manufacturing average weekly hours improves only to a level a little above 42 hours. I have been staring at these numbers for a long time. Since I first started tracking the data in 1971 at the institutional research and trading firm of Model, Roland & Co. in Boston, this has been the record. And the same can be said about data pertaining to weekly initial unemployment claims. The upside limit for any cyclical business advance most often flashes when initial weekly claims fall decisively below the 300,000 level. In my four and a half decades of analyzing this data, only once during the period (early 70s) have claims readings fallen this low.

An Embarrassed White House?

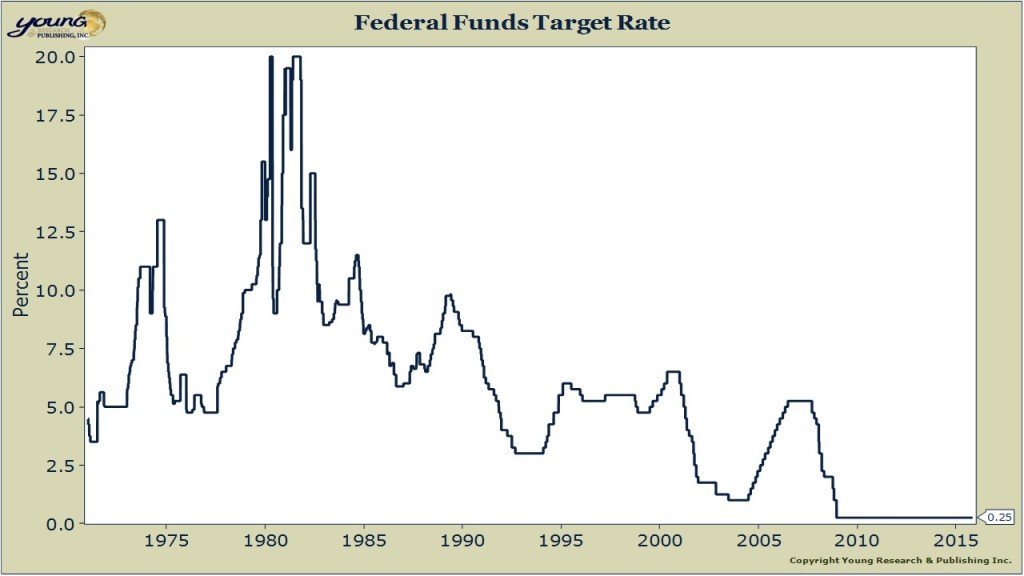

Are we to believe that the Obama administration and its cousin the Fed have been caught off guard? You sure hope that’s not the embarrassing case. But why was Fed Chair Janet Yellen jawboning about a Fed Funds rate increase in September? You tell me. The truth is, the Fed Funds rate should have been nudged up gradually to a more normalized 4% years ago. But nope, no Fed action. Now, with two consecutive months of microscopic 0.1% increases in nonfarm payrolls, along with plunging industrial commodity prices and sinking production momentum (see charts below), palms must be a little sweaty at the White House and at the Fed. And the Fed has zero leeway today to cut interest rates to stave off any impending business downturn. The monetary quiver is, if you will, arrowless!

Here you can see the Fed Funds target rate since 1971. Look at the unprecedented low rates the Fed has maintained since 2009.