When the government sits at the head of the table it’s the end of the family as it was once known. Families learn how to rely on the government to run their households. That’s no way to live. Get government out of the dining room by balancing its budget because its appetite is insatiable. In The American Conservative, Tom McDonough explains the looming catastrophe of government debt that now hangs over the country. He writes:

If we balance the Federal budget today, and keep it balanced, it will take 100 years to pay off the National Debt.

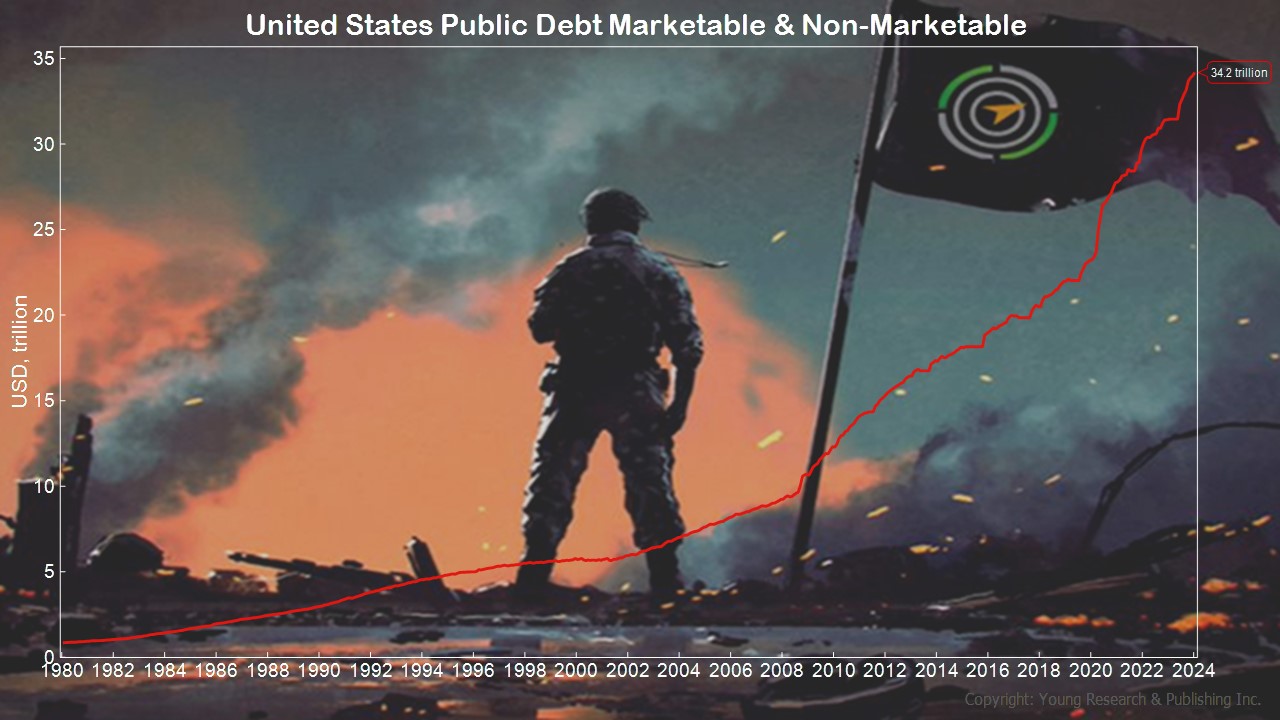

Each child born in the United States gets an ID bracelet and a pro-rata share of the National Debt, currently over $100,000 and growing. This is a terrible injustice inflicted on future generations due to the relentless expansion of the Federal government under Progressive policies of the past 150 years. Our perennial deficits have vaulted the national debt over $34 trillion and are increasing at a rate of $1.5 trillion per year.

These deficits and the debt they accrue are imprudent, dispiriting, unsustainable, and a national security risk, yet Congress lacks the resolve to do anything.

For years, commentators have been warning of the dangers of the deficit and the national debt. The hucksters hankering for a total economic collapse hoping to sell gold or Bitcoin have lately been joined by more respectable voices: Jamie Dimon, Brian Moynihan, and Jerome Powell.

It’s beyond time to take measures in line with the Constitution to balance the federal budget. Simple calculations conclude that balancing the budget without an increase in taxes will require a reduction in federal outlays (other than interest) of less than 20 percent. Only when the deficit is eliminated will it be possible to begin the burdensome chore of paying down the national debt.

My own preference is for a simple executive order requiring a 20 percent cut across every agency. Let the agency heads figure out how to accomplish that. Not spending every penny allocated and appropriated by Congress is entirely within the executive powers outlined in the Constitution.

Assuming that will not happen, the only alternative is for Congress to act. Unfortunately, our elected representatives have repeatedly demonstrated that, though they have the power of the purse, they simply can’t muster the willpower to make such a courageous move. Even now, when the Republicans have the House, they are floundering in their effort to achieve a mere 2 percent reduction in outlays.

Just look at the growth in America’s debt since 1980. It’s unsettling for any American who has to balance a family budget to watch this country’s “leaders” put the future in jeopardy. McDonough goes on to explain that balancing America’s budget would benefit America’s families by making them more confident in the future and by driving job growth in the United States, which would better support family budgeting, allowing families to step up and be families again. He concludes:

A balanced budget would be a true benefit for families: more wealth would be created by making stuff than by financial speculation and that new wealth would go to families rather than elites. With more confidence in the future, more families will be formed, and couples will be more inclined to have children.

To the argument that this will put holes in the safety net, I turn to Dorothy Day, whom no one ever accused of being calloused. As the New Deal was being rolled out, she observed that if the government takes care of people, people will stop taking care of people. The wisdom of her prediction is manifest throughout America. It’s time for families to step up and be family once again, taking care of family and community members without expecting much help from the federal government.

A balanced budget and its advantages for families depend on each American voter taking a more active role in the 2024 primaries and general elections, carefully selecting those they send to Washington to represent their interests, and holding them responsible.

Action Line: Can America recover from its debt addiction without a complete collapse? Every day the hard decisions are put off, the more difficult a soft landing on debt will become. Thanks to Tom McDonough, who is the Executive Director of the American Family Project, and others at The American Conservative for ringing the alarm bells on the national debt. Your Survival Guy is a proud supporter of The American Conservative. Click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.