In boxing, a one-two punch is usually a left jab followed by a right cross. It’s effective and can be dangerous if you’re on the receiving end. Add in an uppercut to the chin and the fight could be over.

In a new Congressional Budget Office (CBO) report[i], the CBO explains how the country was hit with a debt-one-two punch led by out of control spending in 2006–2008 by the Democratic Congress and the Bush administration. That was the left jab.

In a new Congressional Budget Office (CBO) report[i], the CBO explains how the country was hit with a debt-one-two punch led by out of control spending in 2006–2008 by the Democratic Congress and the Bush administration. That was the left jab.

Then America was hit by a big recession right-cross. The recession reduced government revenue to a fraction of what it was during the boom years, and without cuts in spending, the deficit widened, forcing Uncle Sam to borrow a ton of money to pay the bills. The country was on the ropes for sure.

Then, just like a dazed boxer, the country started flailing around throwing haymakers. In this concussed state, America left itself wide open to the knockout third punch in this punishing combo—the uppercut. The uppercut was the borrowing the government did to finance TARP and the stimulus. Those programs put America on the mat. The CBO is the referee in this match, and he’s quickly counting to 10.

The CBO stated in its report that “Unless policymakers restrain the growth of spending, increase revenues significantly as a share of GDP, or adopt some combination of those two approaches, growing budget deficits will cause debt to rise to unsupportable levels.” (My emphasis added.) In boxing terms, get off the mat, start fighting, and don’t stop until you’re partying with the ring-girls on the casino floor.

The CBO stated in its report that “Unless policymakers restrain the growth of spending, increase revenues significantly as a share of GDP, or adopt some combination of those two approaches, growing budget deficits will cause debt to rise to unsupportable levels.” (My emphasis added.) In boxing terms, get off the mat, start fighting, and don’t stop until you’re partying with the ring-girls on the casino floor.

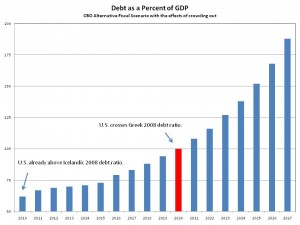

Debt as a percent of GDP has skyrocketed in the past few years to 62% in 2010. That’s up from just 36% at the end of 2007. The CBO projects (using some dreamy predictions of future events) that by 2035 government debt will equal 80% of GDP. Using more realistic assumptions, the CBO projects that debt will equal 180% of GDP by 2035. The CBO sums up this projected situation by saying, “the surge in debt relative to the country’s output would pose a clear threat of a fiscal crisis during the next two decades.”

According to the European statistical agency Eurostat[ii], Greek debt as a percent of GDP in 2008 was 99.2%. Iceland had a debt ratio of only 57.4% of GDP in 2008. That’s before both countries went into debt tailspins and needed major bailouts.

In its projections for the alternative fiscal scenario (the one using realistic projections of Congressional idiocy), CBO has the U.S. hitting a 100% debt to GDP ratio in 2023. In the most realistic scenario, when the effects of government crowding-out[iii] are factored in, a 100% ratio is hit in 2020. The U.S. needs to get off the mat and start fighting because no one is going to bail out the largest economy on the planet.

[i] The Long-Term Budget Outlook

[ii] Government deficit/surplus, debt and associated data, Eurostat

[iii] Crowding out happens when the government sucks up all the lending monies available, ruining any chance at financing for businesses trying to innovate or citizens trying to buy homes.