When I was a child, my father would take me out into the forests, the fields and the swamps to check his trapline. We’d catch foxes, beaver, mink, and other fur-bearing animals. While I don’t trap anymore, I remember that the key to trapping is putting the trap between the animal and something it wants. America has been trapped. Here’s how it happened.

The trap for the U.S. was set with policies in Washington. The bait was the idea that Americans could have something for nothing. Homes for everyone, health care for everyone “for free,” and hundreds of other lures from the government. To delay the pain of all the entitlements politicians had promised their constituents, they borrowed instead of taxing. When the U.S. can no longer borrow to fund itself, the trap will be sprung, and America will be caught in it.

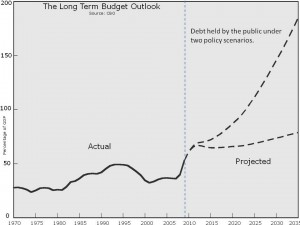

In my chart, you can see that new forecasts from the CBO show that America is hurtling toward debt loads that represent multiples of its annual GDP. In other words, America’s debt principal is nearing equal with all the money the country makes in a year. The interest on that debt is massive. When a country can no longer pay the interest on its debts, it falls into a debt trap.

There are only three ways out of a debt trap: hard work and sacrifice, inflation and monetization, and default. The preferred choice for the American people is hard work and sacrifice. It may hurt you and me, but America’s future generations will be better for it. Inflation will ruin life for seniors on fixed incomes and savers. Default would surely mean the end of U.S. world domination.

There are only three ways out of a debt trap: hard work and sacrifice, inflation and monetization, and default. The preferred choice for the American people is hard work and sacrifice. It may hurt you and me, but America’s future generations will be better for it. Inflation will ruin life for seniors on fixed incomes and savers. Default would surely mean the end of U.S. world domination.

The U.S. needn’t chew its arm off to get out of the debt trap, but it must start electing congressman and senators that will cut spending to reduce the debt and eliminate (not reduce, eliminate) the deficit. Rand Paul of Kentucky has promised to show up to the Senate with a plan to balance the budget in his first year in Washington. I urge Kentuckians to send him to Washington to do so, and I urge all Americans to ask their senators to support him.