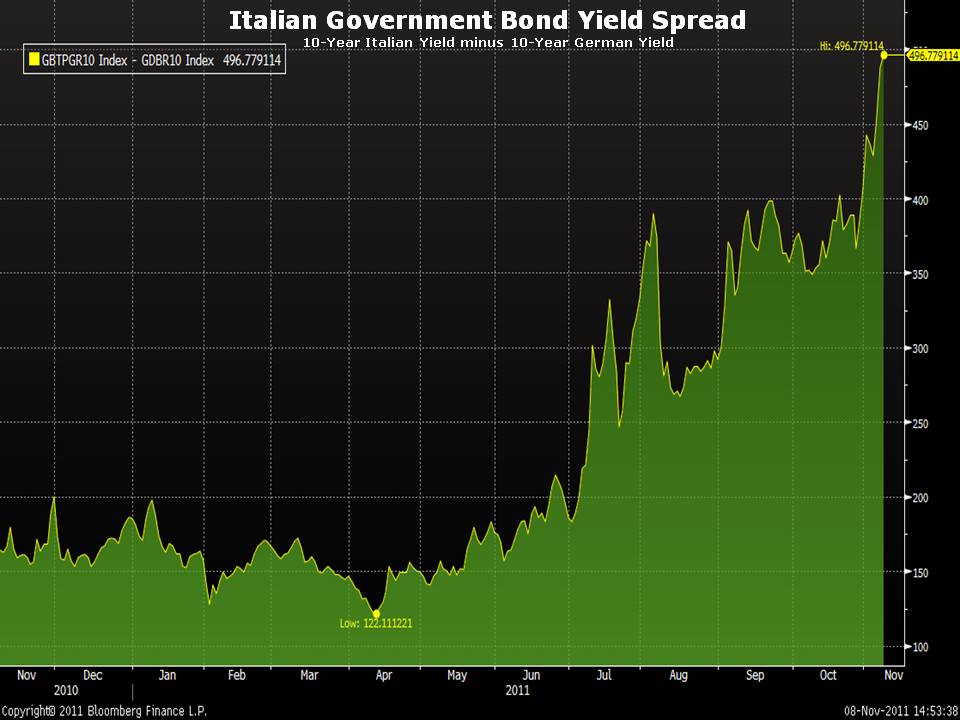

While global equity markets continue to cheer every positive headline out of Europe, the Italian government bond market implodes. Even with the European Central Bank intervening in the market, the spread between Italian and German government bonds hit a new high yesterday. Italy has lost the confidence of private market investors. Italy’s 10-year government bonds now yield 6.76%. Borrowing costs of more than 6% are unsustainable in a country with a debt to GDP ratio of 120% and economic growth of less than 1%. The euro-area debt crisis is far from over and still poses the single greatest risk to the global economy.

Latest posts by The Editors (see all)

- Trump Announces Vietnam Trade Deal - July 2, 2025

- Naturalized Criminals Set to Lose American Citizenship - July 1, 2025

- NYC’s Mamdani: The More You Know, the Worse It Gets - June 30, 2025