How is it that President Obama can rumble around the heartland of America in his jet-black Obamabus touting his presidency when he has absolutely nothing to tout but failure, failure from A to Z? As you know, I have also lambasted the Bush administration almost as hard as I have the Obama crowd. But President Bush, to his endearing credit, nominated two outstanding, constitutionally sound Supreme Court justices.

Our country is spinning out of control for a wide array of reasons that the Obama administration has not only made worse, but has no will to make better. And in all fairness, the neocon-influenced Bush team would have done little better.

What America requires in 2012 is a Washington leadership team that is committed to the founding principals of our constitutional federal republic. I see 2012 as the year of the individual and the individual states, not the Republican or Democratic parties or central government. The central government in Washington has proven adept at one thing and one thing only: mass intrusion into the lives of America’s citizens. Next year is the first year in my lifetime where Americans have an actual chance to put constitutionally strong leaders into the Senate and House, as well as the White House.

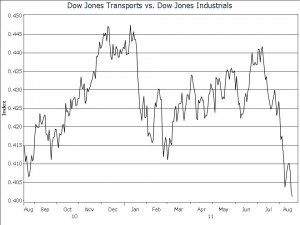

Meanwhile, as my group of five charts clearly illustrates, storm clouds are building and risk levels are rising. I cover this chart material monthly in my strategy reports and use my research as the cornerstone of our family investment advisory firm. A big part of America’s economic output travels by rail and truck. When conditions soften for the rails and for truckers, a warning sign flashes for the economy as a whole. I track the Dow Jones Transports (DJTA) daily versus the Dow Jones Industrials (DJIA). When the transports weaken versus the DJIA, it is a bad sign.

As you can see, Chart#1 shows that trouble is afoot.

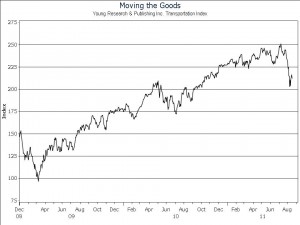

Chart #2 gives my revised DJTA, in which I have dumped the volatile airlines and added a name. I like the look and find momentum in my revised transportation average useful in gauging economic momentum. A breakdown is now clearly in place, and this is a bad sign.

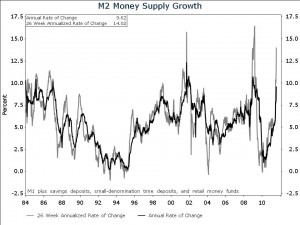

Chart #3 portrays M2 Money Supply growth momentum. Inflation is a monetary phenomenon pure and simple. When more liquidity is pumped into the system than structurally required, bubbles pop and bubbles burst. Americans have witnessed plenty of this over the past decade and are in for another dose of reality.

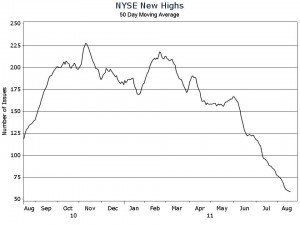

Chart #4 is simply a moving average of NYSE new highs. A sound underpinning for the stock market is reflected in a pattern of increasing new NYSE highs. As you can see, the exact opposite is the case.

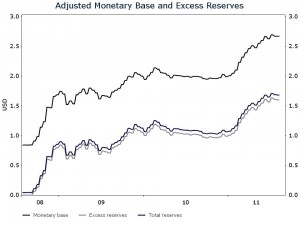

Chart #5 portrays growth in the adjusted monetary base and excess bank reserves. The base is simply high-powered money, or the fuel for growth in the broader monetary aggregates. When banks have more reserves than they can use, excess reserves build up. Both charts #3 and #5 indicate extreme levels of excess, the type of excess that ends in bubble popping.

OK then, five easy to understand graphic displays. Takes your breath away. If you were not concerned before, you should be now. Have a good weekend.

Warm Regards

Dick

P.S. In his morning comment Pat Buchanan expands on my theme, taking a different course. As usual Pat has a strong message to share with you.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.