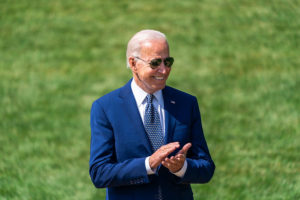

President Joe Biden claps during a clean car event Thursday, August 5, 2021 on the South Lawn of the White House. (Official White House Photo by Cameron Smith)

In 2011, Pat Buchanan wrote his book, Suicide of a Superpower. There is probably no faster way to kill a superpower nation than to hamstring its fastest-growing industries with new taxes, but that’s exactly what Joe Biden wants to do. Chris Edwards, director of tax policy studies at Cato Institute, explains how Biden’s tax plan will cut deep into America’s world-leading technology industry, and its job-creating Main Street entrepreneurial businesses. He writes (abridged):

President Biden and congressional Democrats are pushing to raise capital gains taxes. The Democratic proposals are radical and out of step with the treatment of capital gains in other high‐income nations. I argue here, here, and here that higher capital gains taxes would damage America’s technology industries and entrepreneurial economy.

Let’s look at capital gains tax rates in the high‐income OECD nations. In the chart below, the red bar in the middle is the current U.S. top rate of 29.2 percent, which is much higher than the OECD average of 19.1 percent. These rates, compiled by the Tax Foundation, include both federal and state taxes.

Biden has proposed doubling the top federal capital gains tax rate. With state taxes on top, that would push the U.S. rate up to the highest in the OECD at 48.4 percent. The House Democratic plan would push the U.S. rate up to 37 percent, or the third highest in the OECD.

Pundits and politicians on the left talk about equalizing the top tax rates on capital gains and ordinary income, but virtually all OECD nations have substantially lower rates on gains than on ordinary income for good reasons. By pushing to raise capital gains tax rates, the Democrats are ignoring the best practices of our trading partners, and also ignoring the bipartisan consensus over the past century to keep capital gains tax rates at a moderate level.

By Chris Edwards Cato Institute

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.